- Cyclical Stocks Are Leading the Latest Leg of the Market’s Recovery (Wall Street Journal)

- Goldman Boosts S&P 500 Target by 20% as Strategists Catch Up (Bloomberg)

- Markets should be pricing in would-be Biden win already — they’re not (New York Post)

- Home Depot Braced for Covid Pain—Then Americans Remodeled (Wall Street Journal)

- Low Rates Push Homebuilder Optimism to Highest Since 1998 (Bloomberg)

- PBOC Adds Cash to Ease Liquidity Stress With Rate Unchanged (Yahoo! Finance)

- Oil Flows. The Energy Report (Price Group)

- 6 Stocks to Buy Now That Should Capitalize on the Economic Recovery (24/7 Wall Street)

- Stock Rally Gives Commodities New Shine (Wall Street Journal)

- Interior Secretary to Approve Oil Drilling Program in Alaska’s Arctic Refuge (Wall Street Journal)

Be in the know. 20 key reads for Sunday…

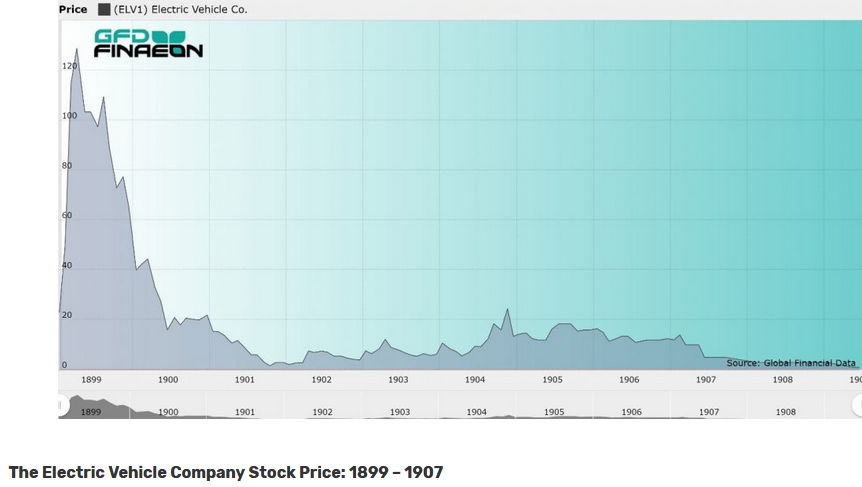

- Speculation & Innovation: The long history of electric cars (Investor Amnesia via The Big Picture)

- Top 10 Yachts Scheduled To Be At The Upcoming 2020 Cannes Yachting Festival (Forbes)

- The Master and the Prodigy (Project Syndicate)

- DOLLY PARTON Steers Her Empire Through the Pandemic — and Keeps It Growing (Billboard)

- Hedge Fund and Insider Trading News: John Thaler, Jim Simons, Jeffery Smith, Ray Dalio, Red Rock Resorts Inc (RRR), Zoom Video Communications Inc (ZM), and More (Insider Monkey)

- Another Roaring Twenties May Be Ahead (Yardeni)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- The 22 most expensive houses in the world (James Edition)

- The 2020 Ferrari F8 Spider Is a 710-Horsepower Smile Generator (Men’s Journal)

- Here’s How Well A 2021 Ford Bronco Sport Can Go Off-Road In The Toughest Terrain In America (Digg)

- Principles for Building Better Health Insurance (Manhattan Institute)

- The 1918 Flu Faded in Our Collective Memory: We Might ‘Forget’ the Coronavirus, Too (Scientific American)

- In coronavirus housing market, ‘better to be seller than buyer’ (Fox Business)

- The Economics of Gods and Mortals (NPR Planet Money)

- Think the Founding Fathers Were a Bunch of Old Men? Think Again (How Stuff Works)

- We Flattened the Curve. Our Kids Belong in School. (The Atlantic)

- Over 100 AMC Movie Theaters Reopen Aug. 20 (PC Mag)

- Yachting Vacations Are More Convenient and Affordable Than You Think (Just Luxe)

- Here’s One Way to Make Fusion Reactors Much Better (Popular Mechanics)

- “She Sticks Her Finger Right Into the Socket”: How ‘Ozark’ Star Julia Garner Became a Scene-Stealer and Emmy Favorite (Hollywood Reporter)

Be in the know. 20 key reads for Saturday…

- Warren Buffett Sold 26% of his Wells Fargo Position. Billionaire Hedge-Fund Manager David Tepper Was Buying It. (Barron’s)

- Retail Spending in July Topped Pre-Pandemic Levels (Wall Street Journal)

- The Bear Market Is Nearing an End. The Bubble Might Just Be Getting Started. (Barron’s)

- Merck, Big Pharma’s Quiet Giant, Looks Like a Buy (Barron’s)

- How the 2020 Election Could Affect Health-Care Stocks (Barron’s)

- Tailwinds for Small-Cap Stocks (Barron’s)

- How to Profit From the U.S.-China Cold War (Barron’s)

- U.S. Seizes Iranian Fuel Cargo for First Time (Wall Street Journal)

- Israel, U.A.E. Agree to Establish Formal Diplomatic Ties (Wall Street Journal)

- The Treatment That Could Crush Covid (Wall Street Journal)

- Goldman Sachs says the S&P 500 could climb another 7% from current levels if a ‘more optimistic US GDP forecast’ plays out (Business Insider)

- The Race to Build an American Rare Earths Industry (New York Times)

- Sia — The Alchemy of Blockbuster Songs, Billions of Views, and the Face You’ve Never Seen (#452) (Tim Ferriss)

- New York A-listers in $2bn bidding war to buy the Mets (Financial Times)

- Jeremy Siegel: I think we’re going to have a spending boom in 2021 (CNBC)

- Ariel Investments’ John Rogers Shares Insight About Stocks, Racial Relations (Investor’s Business Daily)

- Cyclical Recovery Coming? (upfina)

- Value Does Not Have To Mean Cheap (Boyar Value)

- Betting Against the Dollar Is More Popular Than Ever, BofA Says (Bloomberg)

- Credit investors go ‘all in’ rather than fight central banks (Financial Times)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 43

Article referenced in VideoCast above:

The Gordon Gekko, “Gridlock is Good” Stock Market (and Sentiment Results)…

Hedge Fund Tips with Tom Hayes – Podcast – Episode 33

Article referenced in podcast above:

The Gordon Gekko, “Gridlock is Good” Stock Market (and Sentiment Results)…

Where is money flowing today?

Be in the know. 15 key reads for Friday…

- Goldman Sees Room for S&P to Surpass 3,600 (Bloomberg)

- Interest Rates Are So Low, Buy Utility Stocks, Goldman Sachs Says (Barron’s)

- Harley-Davidson CEO Jochen Zeitz Scoops Up Stock (Barron’s)

- Bulls Still Like Lyft Stock After a Rotten Quarter and Negative Court Ruling (Barron’s)

- Las Vegas Sands Stock Can Rally 45%: Analyst (Barron’s)

- Intel Pushes Back on Concerns About Its Chip-Making Technology (Barron’s)

- A Field Guide to Covid-19 Vaccines and Antivirals (Barron’s)

- Yale Discriminated by Race in Undergraduate Admissions, Justice Department Says (Wall Street Journal)

- Bryant Park’s Piano Series Offers Hopeful Note to New Yorkers (Wall Street Journal)

- Electronics Spending Sends US Retail Sales Soaring (ZeroHedge)

- The U.S. has already invested billions on potential coronavirus vaccines. Here’s where the deals stand (CNBC)

- Locked Down and Loaded. The Energy Report (Price Group)

- An Analysis of “Testing Benjamin Graham’s net current asset value model” (Global Investing Insight)

- Cash Handouts Boost Bolsonaro’s Popularity Despite Virus Toll (Bloomberg)

- Brainard Says Fed Is Conducting E-Money Tests for Research (Bloomberg)

Tom Hayes – CGTN America Appearance – 8/13/2020

CGTN America – Thomas Hayes – Chairman of Great Hill Capital – August 13, 2020

Unusual Options Activity – Invesco Mortgage Capital Inc. (IVR)

Data Source: barchart

Today some institution/fund purchased 1,894 contracts of Jan 2020 $4 strike calls (or the right to buy 189,400 shares of Invesco Mortgage Capital Inc. (IVR) at $4). The open interest was just 1,5359 prior to this purchase. Continue reading “Unusual Options Activity – Invesco Mortgage Capital Inc. (IVR)”