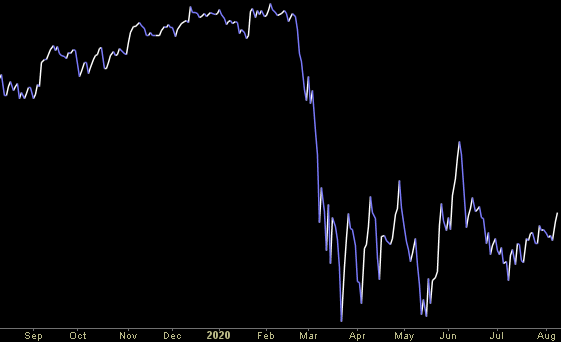

Data Source: barchart

Today some institution/fund purchased 4,000 contracts of Jan 2020 $4 strike calls (or the right to buy 400,000 shares of Banco Bradesco S.A. (BBD) at $4). The open interest was just 1,144 prior to this purchase. Continue reading “Unusual Options Activity – Banco Bradesco S.A. (BBD)”