- GE Rallies As Cash Burn Beats; CEO Sees Positive Flow In 2021 (Investor’s Business Daily)

- 3 Things to Watch at Today’s Fed Meeting (Barron’s)

- The S&P 500 Is Positive 100 Days Before the Election. What History Says Could Happen Next. (Barron’s)

- 3 Oil Stocks With Healthy-Looking Dividends (Barron’s)

- Why Europe’s top asset manager expects U.S. stocks to outperform — and one reason is stock buybacks (MarketWatch)

- Oil boosted by data showing drop in U.S. crude inventories (MarketWatch)

- Powell is expected to say the Fed will keep doing whatever it can while it considers its next move (CNBC)

- Intel (INTC) CEO Swan Buys $400K in Stock Following Big Slide (StreetInsider)

- Henry Blodget Was Banned From the Financial Industry. So He Built a Financial Media Empire. (Institutional Investor)

- Merck Positioning to Take the Lead U.S. COVID-19 Antiviral Market from Remdesivir: EIDD-2801 (TrialSiteNews)

- Herd Immunity Seems to Be Developing in Mumbai’s Poorest Areas (Bloomberg)

- Golf’s Slow Pace Challenged by an Electric Bike That Caddies, Too (Bloomberg)

- Warren Buffett’s Latest Stock Buy Adds To Bet On Main Street Economic Recovery (Investor’s Business Daily)

- EU, Gilead Reach Deal on Supply of Antiviral Drug Remdesivir (Bloomberg)

- Facebook Offers Money to Reel In TikTok Creators (Wall Street Journal)

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Tuesday…

- Republican Stimulus Package May Come With a Benefit for Big Banks (New York Times)

- Warren Buffett pumps another $400 million into Bank of America, boosting his stock purchases to $1.2 billion in 8 days. (Business Insider)

- 10 Cheap Stocks for Contrarians (Barron’s)

- GOP Rolls Out $1 Trillion Stimulus to Start Talks With Democrats (Bloomberg)

- The Dollar Is Dropping. What It Means for Stocks. (Barron’s)

- Kodak Stock Is Up 175% Today. It Has Nothing to Do With Photography. (Barron’s)

- Bill Gates says there could be a ‘substantial’ reduction in coronavirus death rate by end of 2020 (CNBC)

- Coronavirus cases appear to slow in key hot spot states (CNBC)

- Intel’s Fabs Aren’t Going Anywhere (Wall Street Journal)

- How the Jeep Wrangler, Ford Bronco, and Land Rover Defender Stack Up (Bloomberg)

Tom Hayes – CGTN Appearance – 7/27/2020

Tom Hayes – The Claman Countdown – Fox Business Appearance – 7/27/2020

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

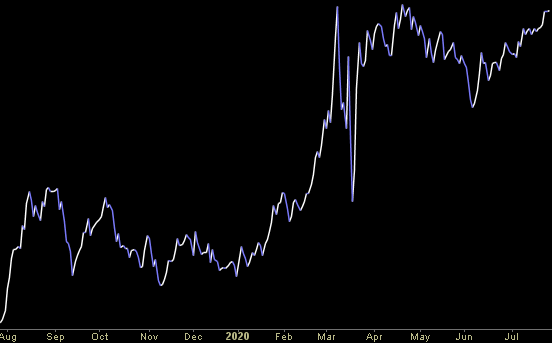

Tom Hayes – Quoted in Reuters article – 7/27/2020

Thanks to Devik Jain and Medha Singh for including me in their article on Reuters today. You can find it here:

Click Here to View The Full Article on Reuters