Be in the know. 10 key reads for Monday…

- NY Fed raises repo limits to ensure ample supply of bank reserves (Reuters)

- Never Mind The Stock Market. The Real Pain Will Be in the Credit Markets. (Barron’s)

- Hedge-fund manager who called the coronavirus market meltdown says selloff is overdone, covers shorts (MarketWatch)

- How the Trump Campaign Took Over the G.O.P. (New York Times)

- Saudi Aramco shares dive, Gulf debt hit as oil price plunges (Reuters)

- Putin Dumps MBS to Start a War on America’s Shale Oil Industry (Yahoo! Finance)

- Virtu Financial founder says stock market is ‘one big opportunity right now’ (CNBC)

- How Tupperware Lost Its Grip on America’s Kitchens (Wall Street Journal)

- All Your Coronavirus Travel Questions Answered (Wall Street Journal)

- What’s Your Workout? A Huge Leap to Replace the Rush of Ice Hockey (Wall Street Journal)

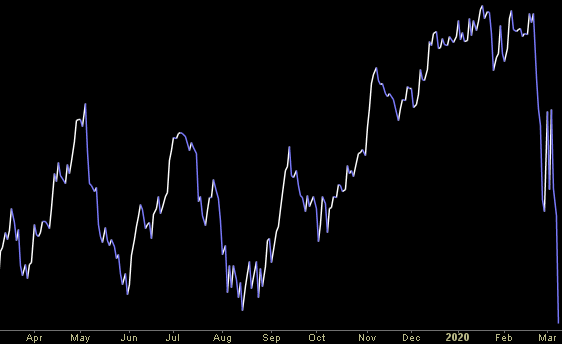

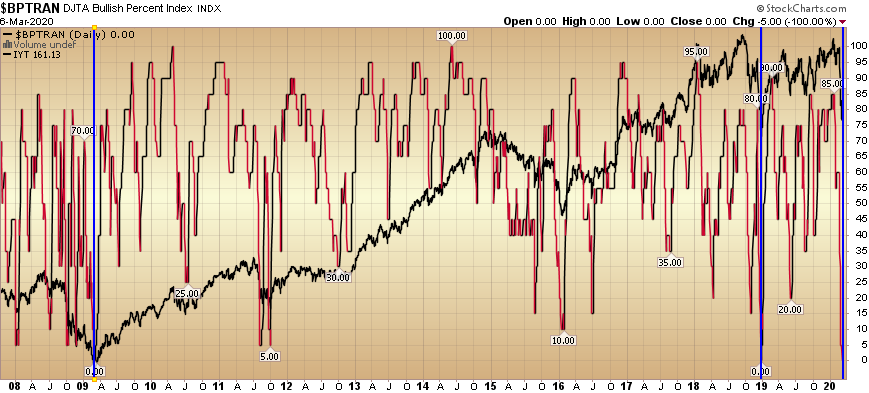

Interesting: Bullish Percent Transports

I was just going through my normal weekend work. The last two times that “Bullish Percent” got to ZERO for the Transports (sector) were March 2, 2009 (one week before the financial crisis bottom), and Christmas Eve 2018 (the bottom).

It is hard to see how we turn here with all of the pessimism, but that’s usually when something comes around from thin air. What could the catalysts be in coming weeks? We don’t know, but here are some ideas:

- Gilead’s Remdesivir is proven effective in the Phase 3 test and rolled out for mass human use to treat COVID19.

- Russia comes back to the table with OPEC+ and they implement cuts.

- Fed Meeting March 18.

- Global Coordinated Fiscal Stimulus Package Announced.

While all four scenarios seem low probability – looking at the futures down 1000+ points – it is frequently at these points of acute pessimism that something changes in the near term. Time will tell…

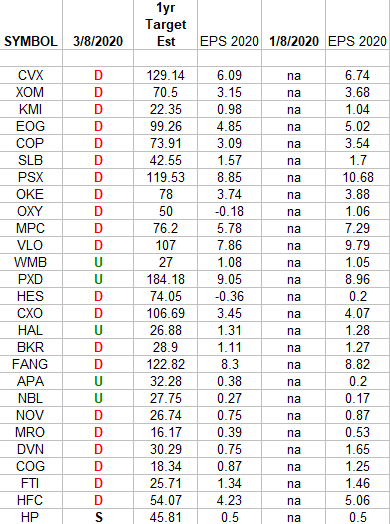

Energy Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Energy Sector ETF (XLE). Continue reading “Energy Earnings Estimates/Revisions”

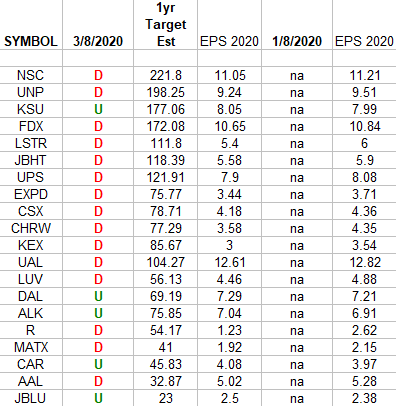

Transports Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) holdings. Continue reading “Transports Earnings Estimates/Revisions”

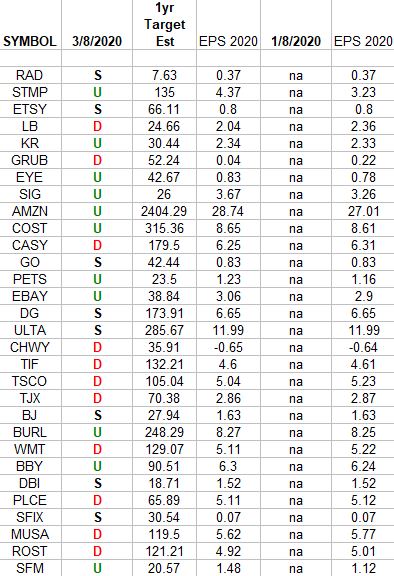

Retail Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”

Be in the know. 10 key reads for Sunday…

- Bonds Rally as Stocks Close Lower (Wall Street Journal)

- The US government has never had a better opportunity to truly reshape our economy (Business Insider)

- Wash Your Hands—but Beware the Electric Hand Dryer (Wired)

- The Koenigsegg Gemera is the world’s most wickedly weird hybrid (The Verge)

- Episode 977: Where’s The Vaccine? (NPR Planet Money)

- CRISPR Treatment Inserted Directly into the Body for the First Time (Scientific American)

- Did Passive Investing Fuel A Bubble In Tech Stocks? (Podcast) (Bloomberg Odd Lots)

- A simple guide to the vaccines and drugs that could fight coronavirus (Vox)

- ‘Unclean! Unclean!’: The Questionable History of Quarantines (Popular Machanics)

- Sam Zell Is Buying the Dips in Energy (Chief Investment Officer)

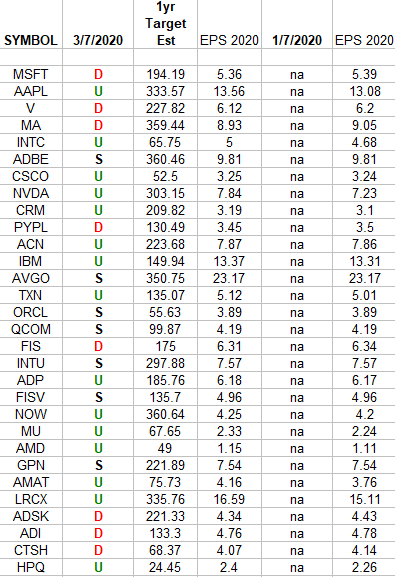

Technology Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Technology Sector ETF (XLK) top 30 weighted stocks. Continue reading “Technology Earnings Estimates/Revisions”

Be in the know. 10 key reads for Saturday…

- 11 Stocks and ETFs for a Post-Virus World (Barron’s)

- Volatility (ValueWalk)

- 12 Dividend Stocks to Buy Amid Turmoil in the Markets (Barron’s)

- Oil Plunges 8% as OPEC Can’t Find Agreement (Barron’s)

- How to Find a Bottom in Industrial Stocks Using Dividend Yields (Barron’s)

- Jack Welch Remembered by Businessweek’s Former Executive Editor (Bloomberg)

- These nine companies are working on coronavirus treatments or vaccines — here’s where things stand (MarketWatch)

- Using Models to Stay Calm in Charged Situations (Farnam Street)

- What Happens to Stocks After a Big Down Month? (A Wealth of Common Sense)

- Should I Sell My Stocks? (The Irrelevant Investor)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 20

Article referenced in VideoCast above:

The Old Dominion “Snapback” Stock Market? (and Sentiment Results)