- Intel Has a Great Chip for the First Time In Years (barrons)

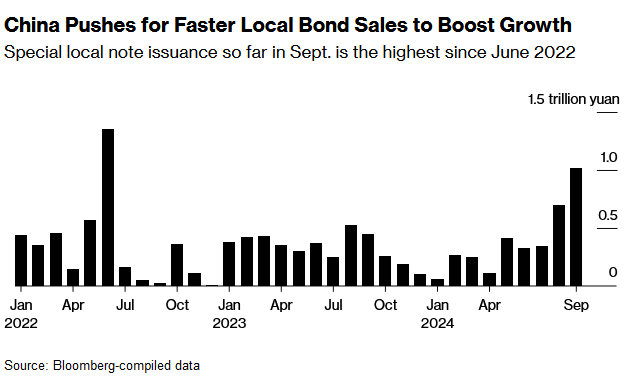

- China’s Politburo Supercharges Stimulus With Housing, Rates Vows (bloomberg)

- China pledges to ensure fiscal spending among steps signaling urgency (bloomberg)

- Hedge Funds Snap Up Chinese Equities on Stimulus Optimism (bloomberg)

- House, Senate Approve Spending Bill to Keep Government Open (barrons)

- Alibaba’s Singles’ Day preparation includes US$5.7 billion in aid to merchants (scmp)

- China Weighs Injecting $142 Billion of Capital Into Top Banks (bloomberg)

- China Seeks to Resolve Structural Issues to Shore Up Employment (bloomberg)

- Fed’s Kugler Sees Plenty More Rate Cuts Ahead (barrons)

- Why now may be a good time to take ‘opportunistic’ profits in gold and silver (marketwatch)

- The Policy Dragon Awakens As Mainland China & Hong Kong Rally (chinalastnight)

- Visa Is in the Hot Seat. MasterCard and Others Could Benefit. (barrons)

- Boeing, Union to Resume Pay Talks as Strike Nears Third Week (bloomberg)

- Tracking Hurricane Helene’s Latest Path (bloomberg)

- PayPal expands services to allow merchants to buy and sell crypto (cnbc)

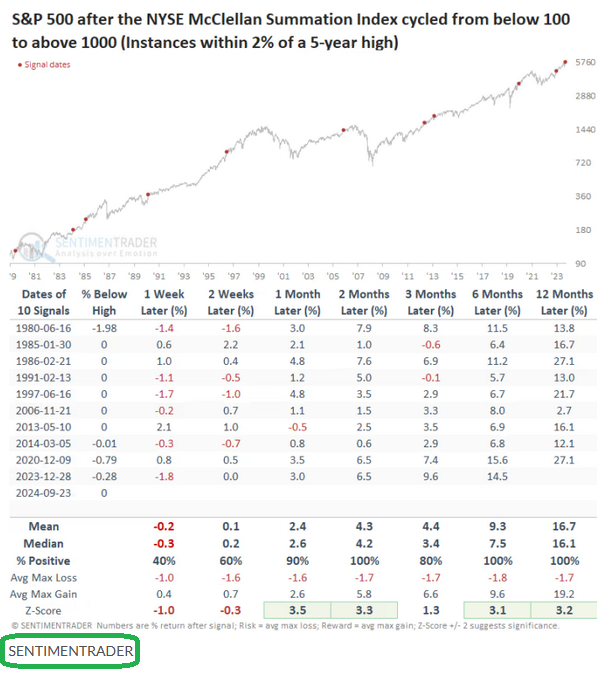

- Here are the most important days for the stock market between now and the November election, according to BofA (businessinsider)

- Wall Street just got another sign that dealmaking is on its way back (finance.yahoo)

- Dollar General asks shareholders to reject investment firm’s stock-purchase offer (marketwatch)

- China’s yuan continues upward climb after Beijing’s stimulus roll-out (scmp)

- Chinese homeowners cheer Beijing’s move to cut mortgage rates by a half point (scmp)