- Alibaba Share Repurchase Update as of June 30, 2024 (alibabagroup)

- Susquehanna Upgrades PayPal (NASDAQ:PYPL) to “Positive” (marketbeat)

- Alibaba Reports $26 Billion In Buybacks Left, Hong Kong Outperforms (chinalastnight)

- Alibaba’s Taobao adds 1-hour delivery short cut in race against ByteDance, JD.com (scmp)

- Fed’s Goolsbee makes case for rate cut in coming months, citing ‘warning signs’ of a slowdown (marketwatch)

- Powell Talks Up Progress, Putting Rate Cuts Back Into View (wsj)

- Powell Cites ‘Real Progress’ as Central Bankers Assess Inflation Fight (nytimes)

- PayPal upgraded, Crowdstrike downgraded: Wall Street’s top analyst calls (thefly )

- Nvidia Stock Is Down Again. Why AI Chip Exports to China Remain a Problem. (barrons)

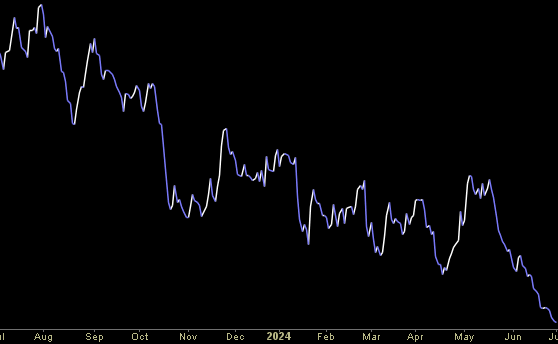

- 12 Stocks to Buy Before the Fed Cuts Rates (barrons)

- Constellation Brands Stock Is Rising After Earnings. What We Know. (barrons)

- Value Stocks Have Been on the Junk Heap. They’re Due for a Pop. (barrons)

- Stock market’s upcoming earnings season may delay ‘overdue’ pullback for S&P 500, says LPL (marketwatch)

- China leading generative AI patents race, UN report says (reuters)

- The Underground Network Sneaking Nvidia Chips Into China (wsj)

- Hedge fund selling of tech stocks has limited potential for crash, JPMorgan says (marketwatch)

- ADP says 150,000 private-sector jobs created in June, smallest gain in five months (marketwatch)

- ADP Payrolls Disappoint In June – 3rd Straight Monthly Decline In Additions (zerohedge)

- Jobless claims — aka layoffs — rise to 238,000 and stay near one-year high (marketwatch)

- Initial Jobless Claims Disappoint (Again), Continuing Claims Worst Since Dec 2021 (zerohedge)

- Approval of Newest Alzheimer’s Drug Will Accelerate New Era of Treatment (wsj)

- Why Beryl Is the Strongest Hurricane to Form This Early (wsj)

- The S&P 500’s reliance on a few winning stocks is getting worse (marketwatch)

- Biden’s LNG Export Ban Is Blocked (wsj)

- Auto Sales Grew Slightly in Second Quarter (nytimes)

- Home Affordability in the US Sinks to Lowest Point Since 2007 (bloomberg)

- Homebuilders Cut on ‘Sluggish’ Housing Market, Florida Woes (bloomberg)

- New York City Apartment Construction Is Grinding to a Halt (bloomberg)

- MrBeast has his critics, but creator marketing experts explain why he’ll always come out on top (businessinsider)

- Walt Disney numbers raised on ‘Inside Out 2’ strength (streetinsider)

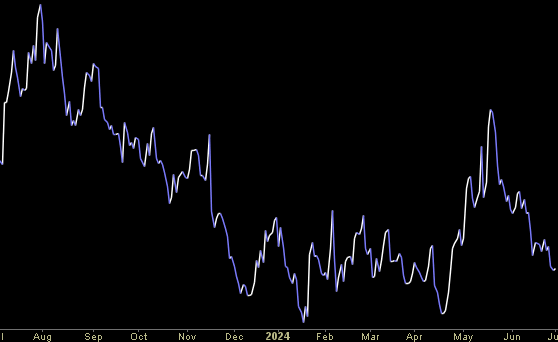

- Yen slides to fresh lows, market ‘challenges’ Japan authorities to act (streetinsider)

- 2 Stocks Down 74% and 57.5% to Buy Right Now (yahoo)

- Amazon’s international unit on track to swing into annual profit (ft)

- China kicks off largest AI conference in Shanghai as tech rivalry with the US heats up (scmp)

- Alibaba’s online flea market draws moonlighters seeking side income in brutal job market (scmp)

- Chinese fintech giant Ant Group spins off database firm OceanBase, giving Alibaba a stake (scmp)

Tom Hayes – Guest on “The David Lin Report” – 7/1/2024

Where is money flowing today?

Quote of the Day…

Be in the know. 15 key reads for Tuesday…

- Chicago Fed’s Goolsbee on Interest Rates, Inflation, Unemployment (bloomberg)

- 1 Incredible Growth Stock Down 81% You’ll Regret Not Buying on the Dip (fool)

- Euro zone inflation eases to 2.5% as core print misses estimate (cnbc)

- 5 Cheap Stocks Buying Back Shares at Reasonable Prices (barrons)

- Advice from a ‘nervous and jumpy’ Wall Street bull as second half gets under way (marketwatch)

- Fed’s Powell Takes the Stage With Other Global Bank Chiefs (barrons)

- Tech Industry Wants to Lock Up Nuclear Power for AI (wsj)

- A Real-Estate Fund Industry Is Bleeding Billions After Starwood Capped Withdrawals (wsj)

- Gavin Newsom Hailed Within China After Biden’s Debate Troubles (bloomberg)

- Manhattan is now a ‘buyer’s market’ as real estate prices fall and inventory rises (cnbc)

- How Brad Jacobs Will Invest $4.5 Billion to Reshape Building Supplies (bloomberg)

- Six Flags merges with Cedar Fair to become largest amusement park operator in North America (FoxBusiness)

- Goldman: Hedge funds sold global equities at the fastest pace in two years in June (streetinsider)

- Amazon’s international unit on track to swing into annual profit (ft)

- China’s central bank announces treasury bond borrowing to stabilize market yields (cn)