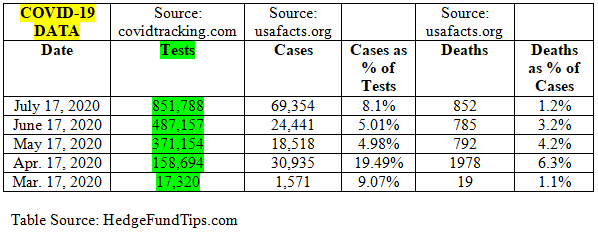

From April 17, 2020 (when testing infrastructure was fully up and running) to July 17, 2020, COVID-19 testing is up ~436%. Over the same dates, cases are up only ~124%. While it is correct to say we have “record cases,” it pales in comparison to the growth of “record testing.”

What is even more noteworthy over the same dates is the fact that Deaths (as a percent of cases) plummeted from 6.3% to 1.2% showing TREATMENT SUCCESS at a “Record High.”

We all want to see BOTH cases and deaths come down as fast as possible through the implementation of the “Holy Trinity” (Masks in Public, Social Distancing, Hygiene/Washing Hands), continued Treatment Success/improvement/discoveries, and possibly a Vaccine sooner than expected. However, in the interim, the data shows there is good reason to be cautiously optimistic (but not complacent).