- Gilead Sciences (GILD) Initiates Two Phase 3 Studies of Remdesivir for Treatment of COVID-19 (Street Insider)

- Wait for these signals to buy coronavirus-battered stocks, says BNY Mellon strategist (MarketWatch)

- The US-China trade war unintentionally prepared companies for coronavirus (Yahoo Finance)

- Wall Street and Atlanta Federal Reserve don’t agree on GDP (New York Post)

- TikTok Marketers Chase Billions of Views in Uncharted Terrain (Bloomberg)

- Big Oil Price Jump Predicted By Report If Fracking Ends In US (Benzinga)

- As China’s Economy Suffers, Xi Faces Pressure to Lift Virus Restrictions (Wall Street Journal)

The “Curb Your Enthusiasm” Stock Market

In last week’s note, “The 10:3 (Risk to Reward) Stock Market” we made the case that while there was limited upside, the downside risks had increased materially. You can review it here: Continue reading “The “Curb Your Enthusiasm” Stock Market”

Unusual Options Activity – The Walt Disney Company (DIS)

Data Source: barchart

Today some institution/fund purchased 1,238 contracts of June 2021 $120 strike calls (or the right to buy 123,800 shares of The Walt Disney Company (DIS) at $120). The open interest was just 737 prior to this purchase. Continue reading “Unusual Options Activity – The Walt Disney Company (DIS)”

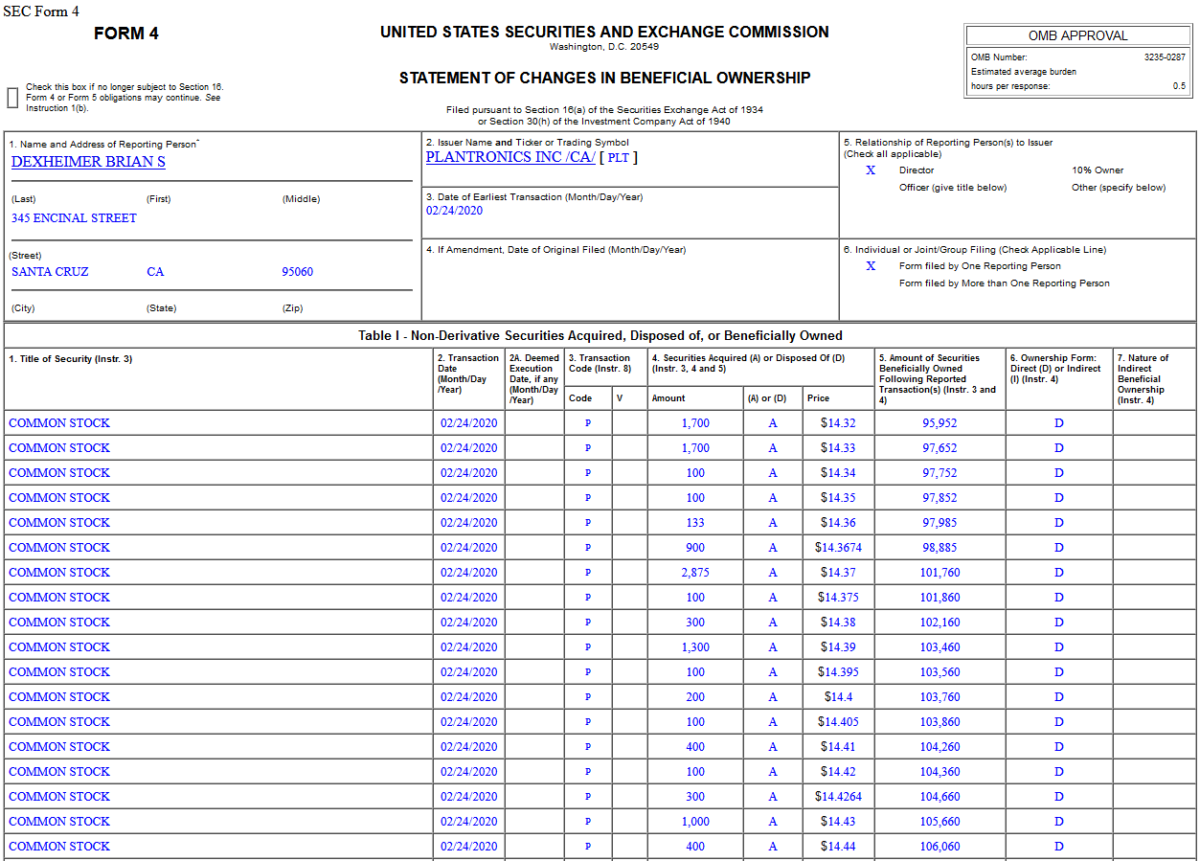

Insider Buying in Plantronics, Inc. (PLT)

Where is money flowing today?

Be in the know. 10 key reads for Wednesday…

- Shale Activist Hunts for New Target in ‘Uninvestable’ Sector (Bloomberg)

- Coronavirus Is Roughing Up the Market. Why It’s Time to Refinance Your Mortgage. (Barron’s)

- Disney’s New CEO Is a Theme Park Whiz Who Gets Hollywood, Too (Barron’s)

- Every Adult in Hong Kong to Get Cash Handout of $1,284 (Bloomberg)

- New Chinese billionaires outpace U.S. by 3 to 1: Hurun (Reuters)

- $45 Billion: That’s What This Study Says Pensions Lost in Private Equity Gains (Institutional Investor)

- Junk bond spreads surge as investors consider virus risks (Financial Times)

- Lowe’s Reports Q4 Earnings Beat (Benzinga)

- Why one quantitative analyst says stocks may have seen their ‘darkest day’ (MarketWatch)

- New Cases Drop in China as Virus Spreads Globally (Wall Street Journal)

i24News TV Appearance Tuesday (Video)

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Tuesday…

- Libya Oil Shut-In Cost Nation Over $2 Billion Since January (Bloomberg)

- Gilead’s Drug Leads Global Race for Coronavirus Treatment (Bloomberg)

- No OPEC Decision Yet on Oil Cuts, Saudi Energy Minister Says (Bloomberg)

- Breaking Down the Buffett Formula: Berkshire Hathaway’s Returns by the Numbers (Barron’s)

- He Went to a Hockey Game Expecting Dinner. He Wound Up Getting the Win. (Wall Street Journal)

- Supreme Court Seems Ready to Back Pipeline Across Appalachian Trail (New York Times)

- OPEC hasn’t run out of ideas, Saudi energy minister insists as oil prices slump (CNBC)

- Natural gas is crushing wind and solar power — Why isn’t anyone talking about it? (Fox Business)

- Conspiracy Theorists Ask ‘Who Owns the New York Fed?’ Here’s the Answer. (Institutional Investor)

- Krispy Kreme launches ‘national doughnut delivery’ starting Feb. 29 (USA Today)