- Leon Cooperman says the market has become too pessimistic on energy stocks, too euphoric on Tesla (CNBC)

- Junk bond king’s pardon ‘is spectacular’ for Wall Street (Financial Times)

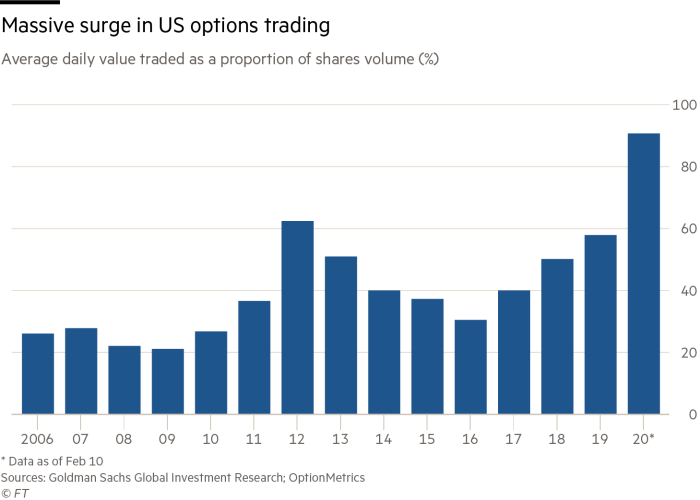

- Record Wall Street rally triggers boom in options (Financial Times)

- Q4 13F Roundup: How Buffett, Einhorn, Ackman And Others Adjusted Their Portfolios (Benzinga)

- The Michael Milken Project (Institutional Investor)

- ‘Very Big Trade Deal’ With India In Progress Ahead Of Visit, Trump Says (Benzinga)

- Building Permits Surge To 13 Year Highs Thanks To Warm Weather In Northeast (ZeroHedge)

- China’s virus-hit industrial cities start to ease curbs, restore production (Reuters)

- Oil up on slowing pace of coronavirus, Venezuela sanctions (Reuters)

- It’s Michael Milken’s World. The Rest of Us Just Live in It. (Barron’s)

- Hedge Funds Keep Backpedaling From S&P 500’s Biggest Winners (Bloomberg)

- What Warren Buffett Might Tell Investors in His Annual Letter This Week (Barron’s)

- Gilead’s Coronavirus Drug Trial Slowed by Lack of Eligible Recruits (Wall Street Journal)

- Fed’s Balance Sheet Dominates What to Watch For in FOMC Minutes (Bloomberg)

- Why Teva’s Grand Turnaround Could Just Be Getting Started (24/7 Wall Street)

- Pound Climbs After Inflation Tempers Risk of a Rate Cut (Bloomberg)

- SoftBank plans to borrow up to $4.5 billion using its domestic telecom’s shares as collateral. (Business Insider)

- Billionaire investor Leon Cooperman ramps up his criticism of Bernie Sanders, calling him a ‘bigger threat’ to the stock market than coronavirus (Business Insider)

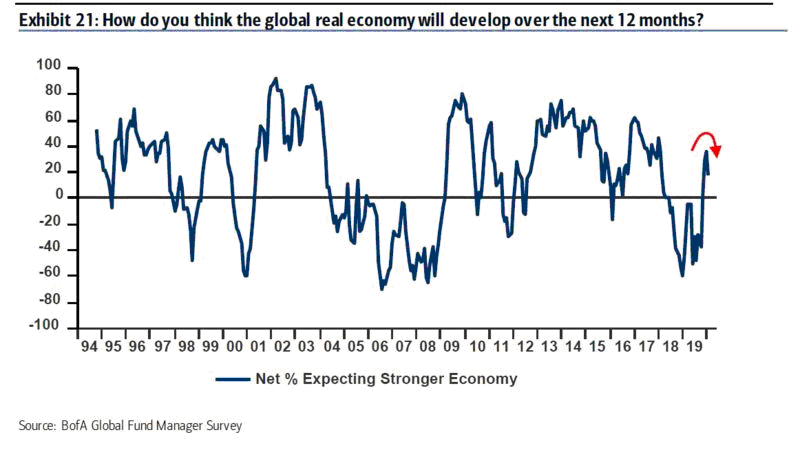

- February Bank of America Global Fund Manager Survey Results (Summary) (Hedge Fund Tips)

- It’s never been this hard for companies to find qualified workers (CNBC)

My quotes in the Financial Times today:

I was quoted in the Financial Times today. Please check out Jennifer Ablan’s (U.S. Markets Editor) full article, “Record Wall Street rally triggers boom in options” here:

February Bank of America Global Fund Manager Survey Results (Summary)

Data Source: Bank of America

Each month, Bank of America conducts a survey of ~200 fund managers with > $600B AUM. Here are the key takeaways from the survey published on Feb 18, 2020: Continue reading “February Bank of America Global Fund Manager Survey Results (Summary)”

Fox Business Appearance Thursday

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

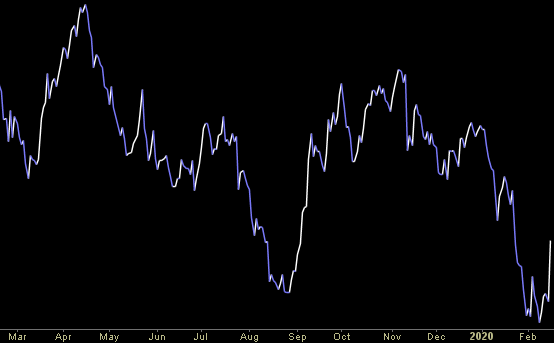

Where is money flowing today?

Be in the know. 8 key reads for Tuesday…

- Franklin Resources and Legg Mason shares surge as firms announce they will combine into a $1.5 trillion asset manager (Business Insider)

- DuPont CEO and CFO to leave company (MarketWatch)

- Buy Amarin Because It Is Cheap, Analyst Says (MarketWatch)

- The Real Chinese Trade Spat Is About Engines, Not Soybeans (Wall Street Journal)

- Starting to look like Tom Brady won’t be returning to the Patriots (Fox Business)

- Hedge fund Renaissance built stake ahead of Tesla share surge (Financial Times)

- How Millennials Could Make the Fed’s Job Harder (New York Times)

- 12 Stock Picks That Will Please Both Growth and Value Investors (Barron’s)

Be in the know. 10 key reads for President’s Day…

- Stocks Today Hold Bullish Bent; 5 Reasons Why The Nasdaq May Hit 10,000 (Investor’s Business Daily)

- The $99 Watch With $20,000 Ambitions (Bloomberg)

- Macau Casinos Allowed to Reopen Thursday After Virus Shutdown ()

- Bridgewater, Dalio Donate $10 Million For China Virus Fight (Bloomberg)

- Joe Rogan ate nothing but meat for 30 days and said his ‘energy levels were amazing’ (CNBC)

- Chinese stimulus boosts stocks globally (MarketWatch)

- The Pinsa Pie Tries to Elbow Into New York’s Crowded Pizza Market (Wall Street Journal)

- Hedge Funds Bet Aussie Will Overcome Impact of Coronavirus (Yahoo! Finance)

- Notable Insider Buys Last Week: Enterprise Products Partners, Kellogg And More (Benzinga)

- FedEx driver stops to pick up, fold fallen American flag in front yard (USA Today)

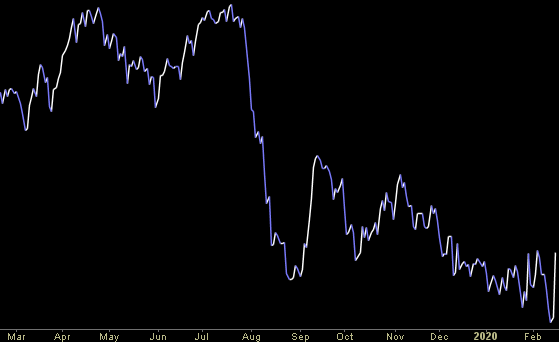

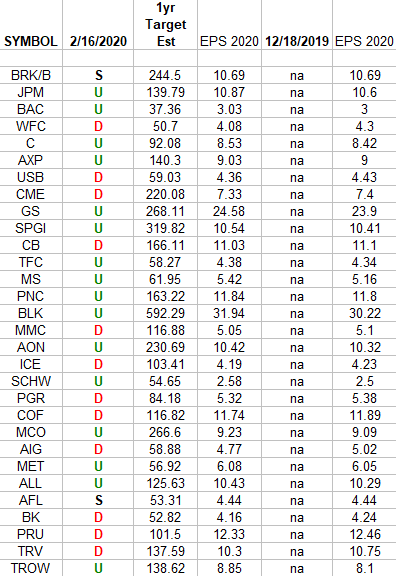

Financials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”