Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Quote of the Day…

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 23 key reads for Monday…

- Intel Stock Rises on Report of Apollo Investment. Why It’s a Good Sign. (barrons)

- China Stimulus Hopes Add to Fed Cues as EM Stocks Hit July Highs (bloomberg)

- China stimulus calls are growing louder — inside and outside the country (cnbc)

- China’s youth unemployment hits fresh high amid economic slowdown and restrictive hiring policies (cnbc)

- Nvidia Stock Is Slumping. What What Tesla Can Tell Us. (barrons)

- The Dow at 50,000. How It Could Happen—and When. (barrons)

- These Restaurants Are Ordering Up CEOs. How It Goes Down With the Stocks. (barrons)

- Fed’s Bostic Sees a U.S. Economy Ready for Neutral Interest Rates (barrons)

- Wall Street’s most cautious voice says defensive stocks are now too rich. What alternatives are left? (marketwatch)

- Boeing’s Defense Head Leaves. Starliner Wasn’t the Only Reason. (barrons)

- ‘Reagan’ Defies Negative Reviews And Holds Strong In Box Office Top 5 (forbes)

- Investors cheer a soft landing scenario after Fed’s big rate cut. But they’re still keeping their guard up for a downturn. (marketwatch)

- The Fed’s rate cut should make it easier to get a job — eventually. Here are the industries that could ramp up hiring first. (marketwatch)

- How Bill Ackman Is Pursuing Howard Hughes’ Real Estate Empire (barrons)

- Amazon Fell Behind in AI. An Alexa Creator Is Leading Its Push to Catch Up. (wsj)

- The Rate Cut Happened. Not All Borrowing Costs Are Going Down. (wsj)

- Elliott Hill Loved Nike and Left It. Now He’s Back as CEO (wsj)

- How a Surfer Who Never Finished College Became a Biotech Billionaire (wsj)

- Rather than taxing Americans on the money they earn at their jobs and on their investments, Mr. Trump instead suggested imposing a broad tax on the goods that Americans buy from abroad. In his view, such tariffs could replace income taxes as the main source of federal revenue. (nytimes)

- Minneapolis Fed President Neel Kashkari: Fed is likely to make smaller rate moves going forward (youtube)

- Bull Market Chance at 80% With Fed Cuts, Says Ed Yardeni (bloomberg)

- How Foot Locker is waging a comeback after its breakup with Nike (cnbc)

- S. business activity suffers small loss of momentum in September, PMI shows (marketwatch)

Quote of the Day…

Be in the know. 7 key reads for Sunday…

- Alibaba Cloud unveils latest Qwen 2.5 LLM, CEO addresses speed of AI development (technode)

- Alibaba, Nvidia collaborate on advanced autonomous-driving solution (scmp)

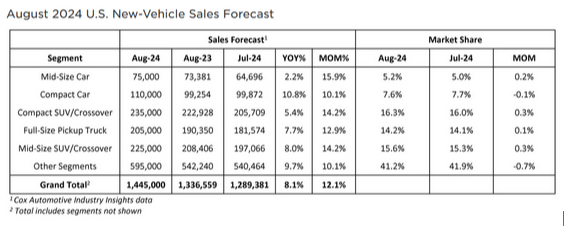

- Cox Automotive Forecast: August U.S. Auto Sales Show Stability Amid Seasonal and Labor Day Boost (coxautoinc)

- This Bulletproof Rezvani Vengeance SUV Has A Private Jet-Style Interior (maxim)

- Qualcomm wants to buy Intel. Would that be enough to overtake Nvidia? (fastcompany)

- AliViews: Eddie Wu Discusses AI, Alibaba Cloud and More at the 2024 Apsara Conference (alizila)

- The Fed’s Jumbo Rate Cut Is a Sign of True Confidence (barrons)

Quote of the Day…

Be in the know. 12 key reads for Saturday…

- Qualcomm Approached Intel About a Takeover in Recent Days (wsj)

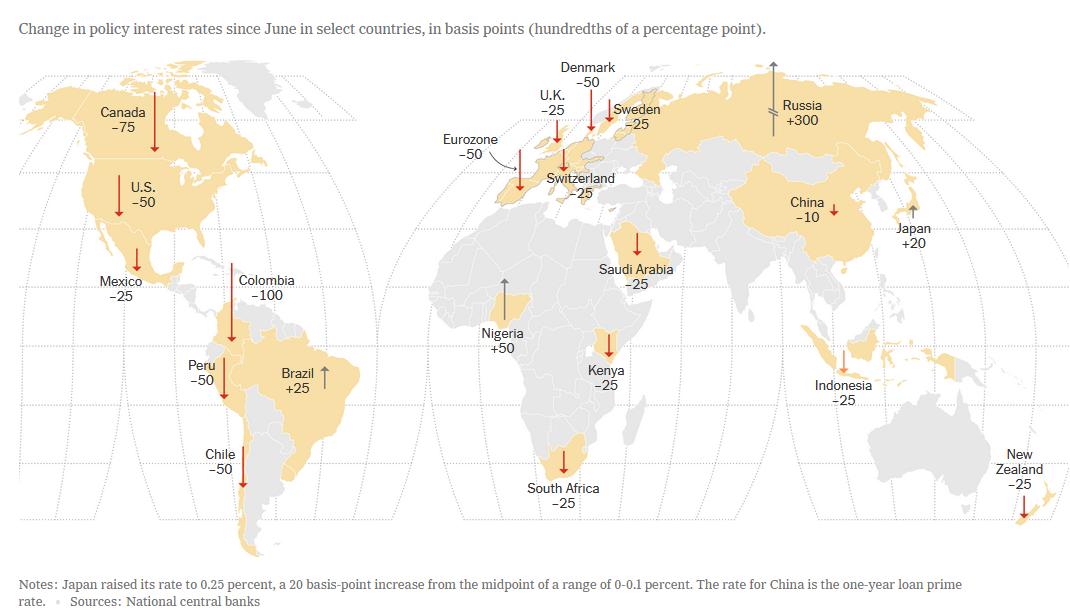

- Interest Rates Fall, but Central Banks Are No Longer in Lock Step (nytimes)

- Small-cap stocks post longest rally since 2021 after Fed rate cut. What’s next? (marketwatch)

- Nike Has a New CEO. 4 Things to Know. (barrons)

- The Price War in Weight-Loss Drugs Is Here (wsj)

- The Work From Home Free-for-All Is Coming to an End (wsj)

- Boeing ousts head of troubled space unit after astronauts left stranded, billions in losses (nypost)

- Mobileye Jumps After Intel Says It Won’t Sell Majority Stake (bloomberg)

- Why a top analyst just raised his year-end S&P 500 price target to the highest on Wall Street (businessinsider)

- The mystery of Masayoshi Son, SoftBank’s great disrupter (ft)

- Three Mile Island Plans to Reopen as Demand for Nuclear Power Grows (nytimes)

- Lotus Unveils Wedge-Shaped ‘Theory 1’ Concept EV (maxim)