Data Source: Finviz

Be in the know. 12 key reads for Friday…

- Top financiers want Biden to drop out so Bloomberg can win: ’He has no chance’ (Fox Business)

- Oil prices steady but set for weekly gain on supply cut optimism (Business Insider)

- How a Small-Cap Fund Finds Exceptional Growth Overseas (Barron’s)

- Labor Force Participation Rate Mystery: Why Have So Many Americans Stopped Working? (Investor’s Business Daily)

- Veteran strategist eyes health care and financials in anticipation of ‘choppy and frustrating’ markets (MarketWatch)

- FC’s celebrity investors have a chokehold on $300M dividend (New York Post)

- Judy Shelton, Trump’s Fed Nominee, Faces Bipartisan Skepticism (New York Times)

- Doubting America Can Cost You a Lot of Money (Bloomberg)

- EXCLUSIVE: Kudlow reveals when middle class can expect ‘tax cuts 2.0’ (Fox Business)

- Investor complacency sets in while coronavirus spreads (Financial Times)

- Warren Buffett loves using Valentine’s Day to explain why See’s Candies is his ‘dream business’ (Business Insider)

- Value Investing’s Time to Shine Again Is Approaching (Bloomberg)

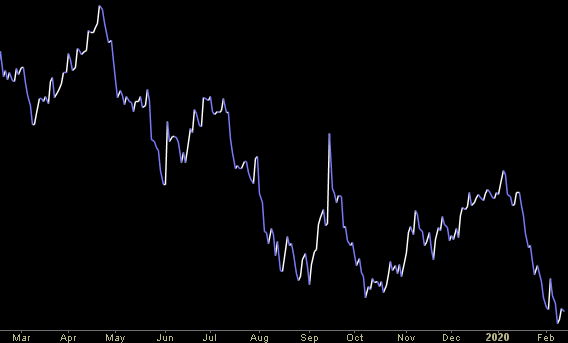

Unusual Options Activity – Chevron Corporation (CVX)

Data Source: barchart

Today some institution/fund purchased 610 contracts of December $130 strike calls (or the right to buy 61,000 shares of Chevron Corporation (CVX) at $130). The open interest was just 386 prior to this purchase. Continue reading “Unusual Options Activity – Chevron Corporation (CVX)”

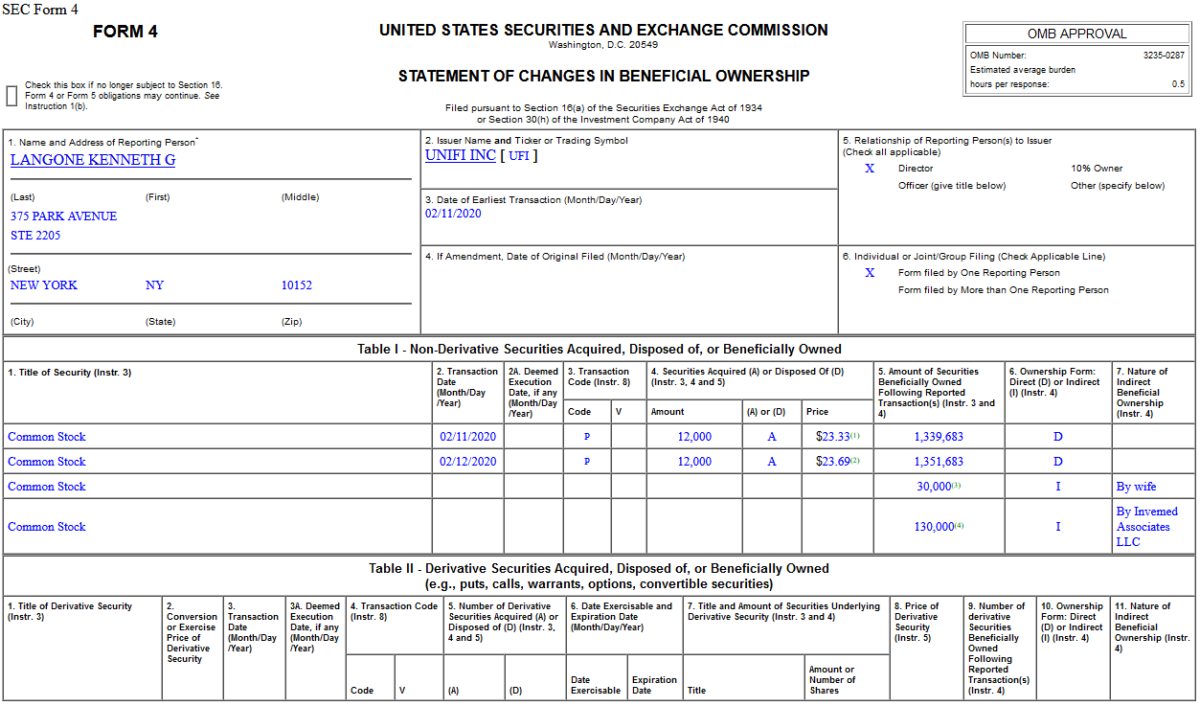

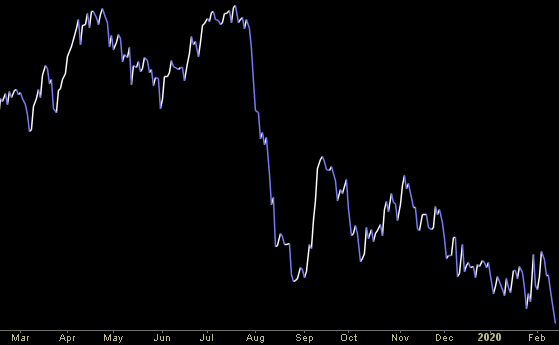

Insider Buying in Unifi, Inc. (UFI)

On Feb 12, 2020, Billionaire Kenneth Langone – Director of Unifi, Inc. (UFI) – purchased another 24,000 shares of UFI at ~$23.51. His out of pocket cost was $564,240. Continue reading “Insider Buying in Unifi, Inc. (UFI)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 10 key reads for Thursday…

- Eight Stocks Wall Street Loves for Valentine’s Day (Barron’s)

- What Denny’s CEO Tells Himself In The Mirror Every Day (Investor’s Business Daily)

- Charlie Munger Talks About Chinese Companies, Poor Investment Choices, And Why He Would Never Buy Tesla Stock (Benzinga)

- The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)… (ZeroHedge)

- Kraft Heinz’s Earnings Were Only OK. Why Investors Should Be Happy. (Barron’s)

- Value-Oriented Dividend Stocks Will Pay Investors Who Wait, Strategist Says (Barron’s)

- Time for a cut? OPEC Sees Coronavirus Weighing Heavily on Oil Demand (Wall Street Journal)

- Hedging Strategy Likely Exacerbated Oil’s Fall (Wall Street Journal)

- Trump’s Rosy Economic Growth Forecast Isn’t Crazy (Bloomberg)

- 5 Contrarian Dividend Stocks to Buy as Market Rips to All-Time Highs (24/7 Wall Street)

The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)…

This week’s Stock Market commentary and sentiment can best be described by country star Chris Janson’s song, “Good Vibes:”

I ain’t watchin’ TV today

Bad news, it can just stay away

If you ain’t got anything good to say

Then shut your mouth

I got my windows down and my blinders on

Radio set to my favorite song

All green lights on the road I’m on

Man, there ain’t no doubt

Continue reading “The Chris Janson “Good Vibes” Stock Market (and Sentiment Results)…”

Yahoo! Finance TV Appearance on Wednesday (Video)

Thanks @SeanaNSmith @GreteSuarez @YahooFinance for having me on today. https://t.co/iBxpOr5OlO

— Thomas J. Hayes (@HedgeFundTips) February 12, 2020