I will be on the “Claman Countdown” today – on Fox Business – just after 3pm. Tune in if you are free…

Be in the know. 10 key reads for Monday…

- Saudis Weigh Large 1M barrel/day Oil Cuts in Response to Coronavirus (Wall Street Journal)

- OPEC+ considering further 500,000 bpd oil output cut: Sources (CNBC)

- Gilead Drug to Undergo Human Trials in China to Cure Coronavirus (Bloomberg)

- Gilead Sciences (GILD) Shares Surges as Remdesivir May Be Effective in Treating Coronavirus (Street Insider)

- Experimental drug for coronavirus to be tested in Wuhan (Global Times)

- Cocktail of flu, HIV drugs appears to help fight coronavirus: Thai doctors (Reuters)

- Toronto patient with 1st confirmed case of coronavirus discharged from hospital (CityNews)

- The ‘Odd’ Part of the Economy That Baffles Steve Schwarzman (Institutional Investor)

- He Really, Really Wants to Win at Cornhole (Wall Street Journal)

- The Rotation To Value Is Inevitable (ZeroHedge)

Be in the know. 15 key reads for Sunday…

- Kobe Bryant’s Last Great Interview (YouTube)

- How Amazon Keeps Defying Gravity (New York Times)

- February’s First Trading Day: DJIA & NASDAQ up 76.2% of the Time Last 21 Years (Almanac Trader)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Inside big tech’s quest for human-level A.I. (Fortune)

- Fed’s Clarida: U.S. economy in good place, coronavirus a ‘wildcard’ (Reuters)

- Hedge Fund and Insider Trading News: Jamie Dinan, Ray Dalio, Israel Englander, Air Products & Chemicals, Inc. (APD), Cidara Therapeutics Inc (CDTX), and More (Insider Monkey)

- The First Action-Packed ‘Fast and Furious 9’ Trailer Is Here (Men’s Journal)

- This American-Made Supercar Could Make History With a Win at Le Mans (Maxim)

- Hedge Fund Tips – Episode 15 – VideoCast. Stock Market Commentary. (ZeroHedge)

- Using Fiscal Stimulus To Stave Off A Recession (Podcast) (Bloomberg)

- The Big Question Hanging Over China’s Virus Attack: How Long Before Containment? (Barron’s)

- Barron’s Picks And Pans: Intel, Johnson & Johnson, T-Mobile And More (Yahoo! Finance)

- Why hedge funds are still searching for the next big thing (Financial Times)

- 4 Bargains to Be Found Among Stocks Hit by Coronavirus Fears (Barron’s)

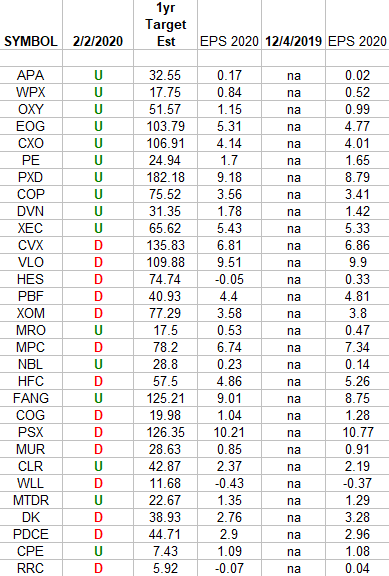

Exploration & Production Sector (XOP) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Exploration & Production Sector (XOP). I have columns for what the 2020 estimates were: 12/4/2019 and today. Continue reading “Exploration & Production Sector (XOP) – Earnings Estimates/Revisions”

Quote of the Day…

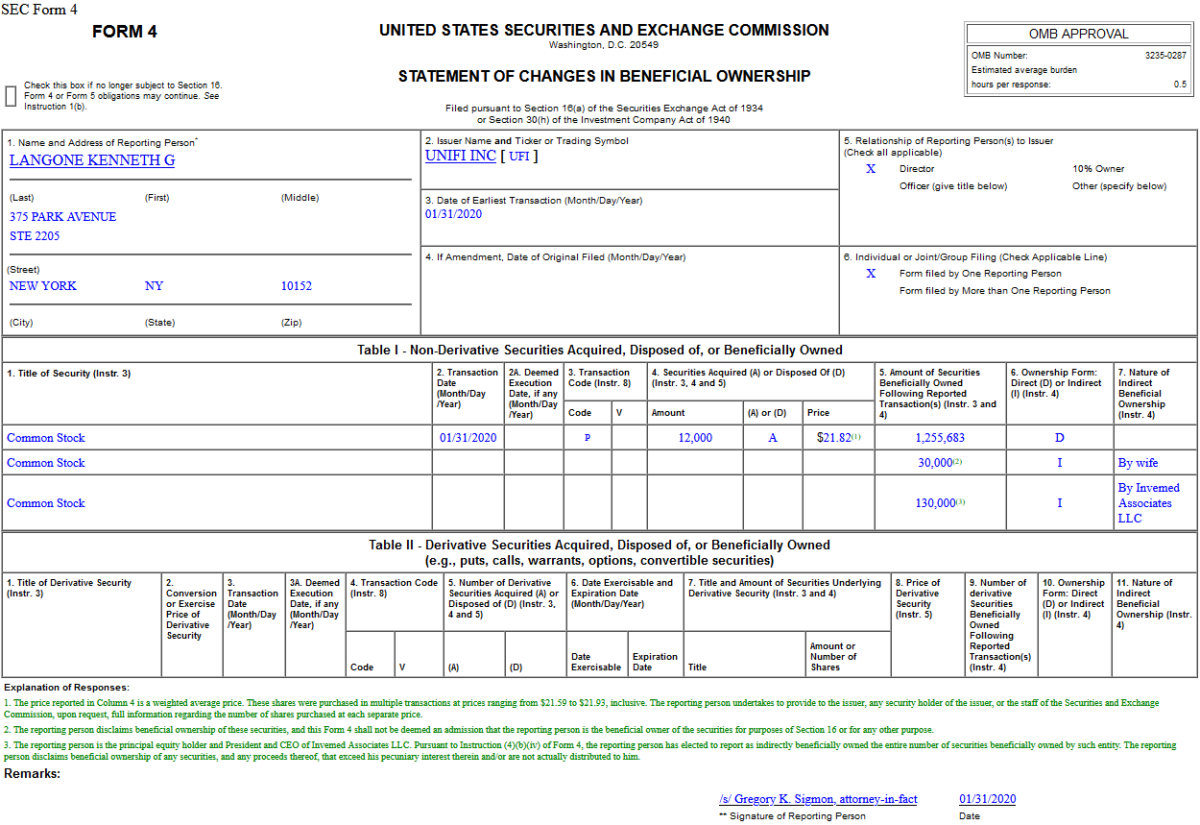

Insider Buying in Unifi, Inc. (UFI)

Unusual Options Activity – ViacomCBS Inc. (VIAC)

Data Source: barchart

Yesterday some institution/fund purchased 3,957 contracts of Jan 2021 $27.50 strike calls (or the right to buy 395,700 shares of ViacomCBS Inc. (VIAC) at $27.50). The open interest was just 711 prior to this purchase. Continue reading “Unusual Options Activity – ViacomCBS Inc. (VIAC)”

Be in the know. 10 key reads for Saturday…

- 4 Bargains to Be Found Among Stocks Hit by Coronavirus Fears (Barron’s)

- James Bond’s favorite car maker Aston Martin gets rescue investor (New York Post)

- UK formally leaves the European Union and begins Brexit transition period (CNBC)

- What Third Point Is Worried About in 2020 (Institutional Investor)

- S&P 500 wipes out gain for the year on coronavirus fears (Financial Times)

- The Inner Game: Why Trying Too Hard Can Be Counterproductive (Farnam Street)

- How Warren Buffett Made 50% Returns During His Partnership Days | Warren Buffett’s Investment Strategy Explained (Macro-Ops)

- Eight Things I Never Knew About Jack Dorsey (Ramp Capital)

- Ray Dalio Is Still Driving His $160 Billion Hedge-Fund Machine (WSJ)

- Drugmakers Are Racing to Develop a Coronavirus Vaccine (Barron’s)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 15

Article referenced in VideoCast above:

The “‘Great Wall’ of Worry” Stock Market (and Sentiment Results)…

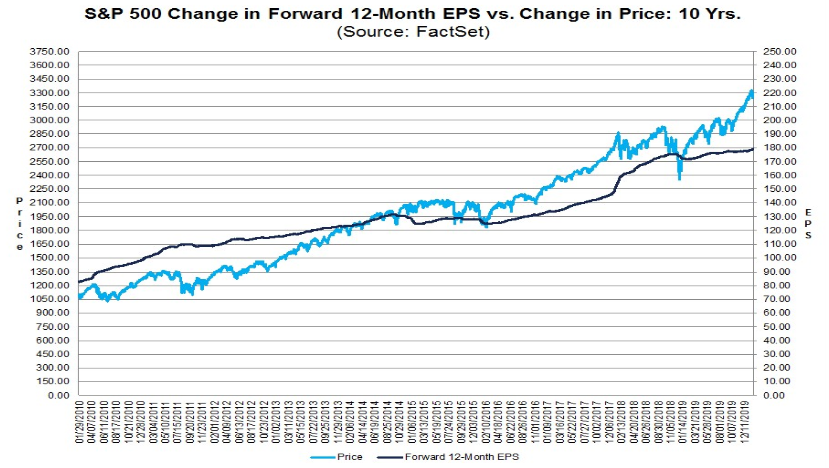

2020 EPS Estimates Up Modestly

Data Source: FactSet

A few notes on earnings this week… Continue reading “2020 EPS Estimates Up Modestly”