Just when you thought the coast was clear… Continue reading “The “‘Great Wall’ of Worry” Stock Market (and Sentiment Results)…”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

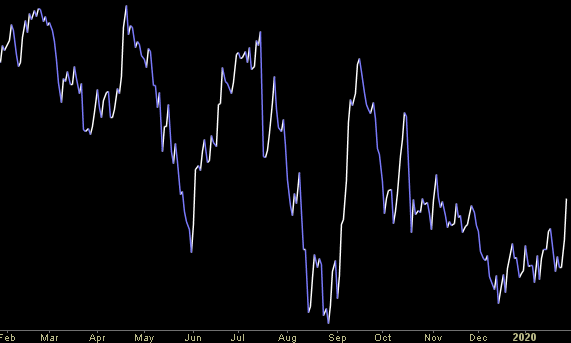

Unusual Options Activity – Occidental Petroleum Corporation (OXY)

Data Source: barchart

Today some institution/fund purchased 924 contracts of June $42.5 strike calls (or the right to buy 92,400 shares of Occidental Petroleum Corporation (OXY) at $42.5). The open interest was just 474 prior to this purchase. Continue reading “Unusual Options Activity – Occidental Petroleum Corporation (OXY)”

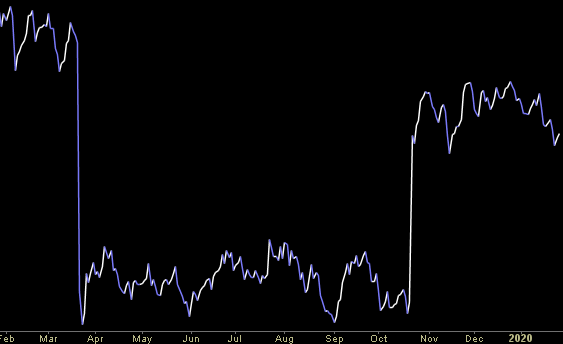

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Wednesday…

- Chesapeake Energy’s stock bounces off 26-year low after production update (MarketWatch)

- For Fed’s Policy Meeting, Balance-Sheet Plans Take Focus (Barron’s)

- How to Profit From Stock Buybacks (Barron’s)

- 4 Big Dividend Oil Stocks to Buy Now With Crude Down Almost 20% in January (24/7 Wall Street)

- House Democrats call for $760 billion in infrastructure spending over five years (Reuters)

- Johnson & Johnson starts developing vaccine for coronavirus (Yahoo! Finance)

- USMCA to create 600,000 jobs, US Energy Secretary tells FOX Business (Fox Business)

- Red Flags in Alluring Private Equity Track Records (Institutional Investor)

- More affordable iPhone 11 is unlikely star of Apple earnings (Financial Times)

- Boeing Just Reported a Massive Loss. Why Its Stock Is Gaining. (Barron’s)

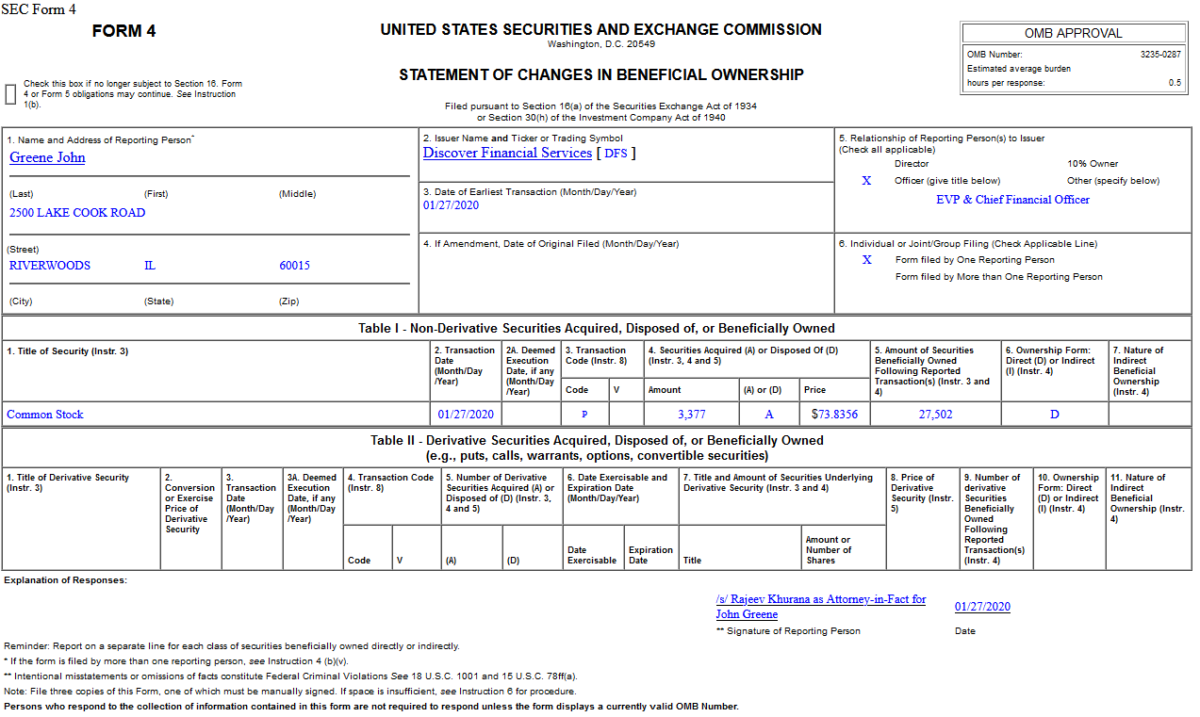

Insider Buying in Discover Financial Services (DFS)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 8 key reads for Tuesday…

- 5 reasons coronavirus fears are overblown — and 14 stocks to buy now – (MarketWatch)

- U.S. Drugmakers Ship Therapies to China, Seeking to Treat Coronavirus (Wall Street Journal)

- Yahoo! Finance TV Appearance on Monday (Video) (Hedge Fund Tips)

- The S&P 500 Just Broke a Streak of Not Moving 1%. Here’s What History Says Happens Next. (Barron’s)

- The Coronavirus Slammed Stocks. How the Fed and Beijing Can Help the Economy. (Barron’s)

- Investors Poured Billions Into This Strategy. It’s Not Panning Out. (Institutional Investor)

- Lockheed Martin beats estimates, raises sales forecast on higher F-35 deliveries (Reuters)

- Ultrafast Trading Costs Stock Investors Nearly $5 Billion a Year, Study Says (Wall Street Journal)