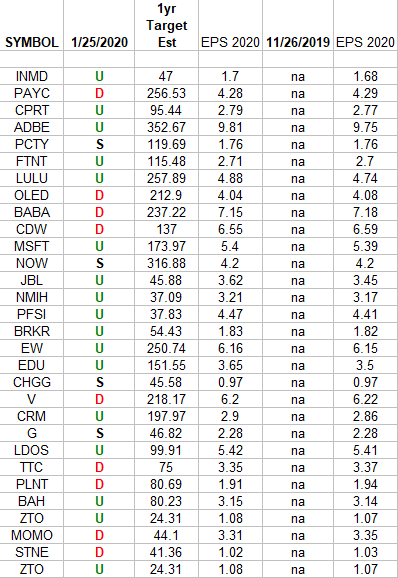

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted stocks in the IBD 50 Growth Index (ETF: FFTY) Continue reading “IBD 50 Growth Index (top 30 weights) Earnings Estimates”

Be in the know. 12 key reads for Sunday…

- Mario Gabelli Says It’s Time to Invest in Stocks That Will Save the World. These Two Stocks Fit the Bill. (Barron’s)

- How Will You Measure Your Life? (HBR)

- The House From Entourage Sells for $5.32 Million (Architectural Digest)

- DeLorean Confirms Plans to Produce Limited Run of Iconic DMC-12 (Maxim)

- Metallica frontman’s built-from-scratch vintage car collection goes on view in LA (designboom)

- February Almanac: Weak Link in Best Six Months (Almanac Trader)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Episode 966: The Rise Of Putin (NPR)

- Why Is Joe Rogan So Popular? (The Atlantic)

- Taylor Swift: No Longer ‘Polite at All Costs’ (Variety)

- Japan’s Mystical Masterpiece, The Four Seasons Hotel Kyoto (JustLuxe)

- Libya Oil Closure a ‘Bullet in the Head,’ Says Bank Governor (Bloomberg)

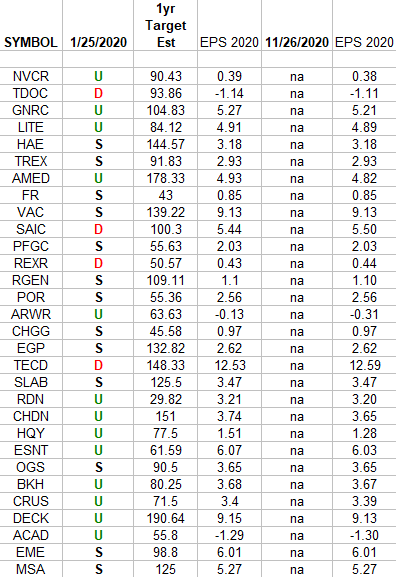

Russell 2000 (top weights) Earnings Estimates

In the spreadsheet above I have tracked the earnings estimates for the top weighted Russell 2000 small cap stocks. I have columns for what the 2020 estimates were 11/26/2019 and today. Continue reading “Russell 2000 (top weights) Earnings Estimates”

Be in the know. 10 key reads for Saturday…

- How the stock market has performed during past viral outbreaks, as epidemic locks down 16 Chinese cities (MarketWatch)

- Sam Zell — Strategies for High-Stakes Investing, Dealmaking, and Grave Dancing (#407) (Tim Ferriss)

- Sports Gambling Will Be Huge. Buy These Stocks. (Barron’s)

- Stocks Catch a Cold After Fed Stops Expanding Its Balance Sheet (Barron’s)

- Porsche’s first Super Bowl ad since 1997 features car chase with its all-electric Taycan (CNBC)

- EIA expects U.S. net natural gas exports to almost double by 2021 (EIA)

- Life is Short (safalniveshak)

- Seth Klarman passionately defends value investing and said its time is coming again soon (CNBC)

- You Can Buy Into These Sports Teams. But the Valuations Are Lofty. (Barron’s)

- Opinion: Here’s what the Super Bowl ‘Predictor’ sees for stocks in 2020, depending on whether the 49ers or the Chiefs win (MarketWatch)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 14

Podcast – Hedge Fund Tips with Tom Hayes – Episode 4

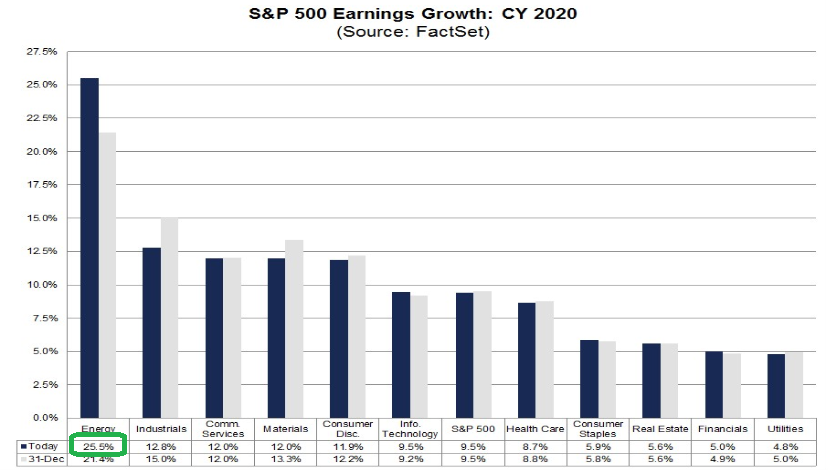

Energy Estimates Up Again This Week

Data Source: Factset

Quick notes on earnings this week. Th most notable change is that 2020 estimates for the Energy Sector went up again this week jumping from 21.4% earnings growth to 25.5% in the past few weeks.

Earnings:

The S&P 500 remains strong at 9.5% EPS growth ($177.41).

Guidance:

The percent of companies issuing negative EPS guidance so far is 58% (7 out of 12). This is below the 5-year average of 70%.