- Bridgewater’s Greg Jensen sees gold rallying as central banks ease (Financial Times)

- Burger King offers Prince Harry a job (New York Post)

- US natgas production to slip for first time since 2016 (Financial Times)

- FOX Business EXCLUSIVE: Breakdown of China’s $200B buys from America under historic phase one trade deal (Fox Business)

- This Is What Sets Top-Performing Hedge Fund Managers Apart (Institutional Investor)

- It May Be Time to Shop for Shares of U.K. Property Firms (Barron’s)

- Sen. Rob Portman: Trump’s Trade Deal Forces China to Start Playing by the Rules (Barron’s)

- Are Amazon and FedEx Really Ready to Be Friends Again? (24/7 Wall Street)

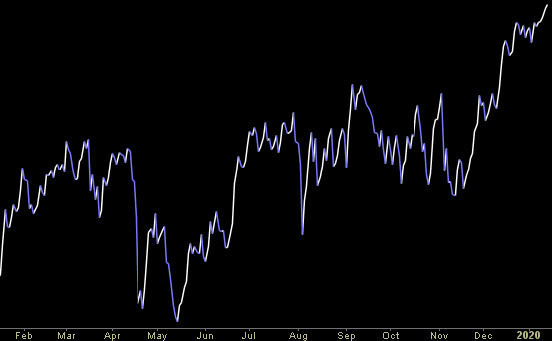

- The Fed (Mostly) Didn’t Cause the Latest Stock Market Melt-Up (Wall Street Journal)

- Nio’s stock soars on heavy volume after report of funding secured (MarketWatch)