- China says trade deal good for all, media discourages ‘nitpicking’ (Reuters)

- “Are you tired of winning yet?” Stock Market (and Sentiment Results)… (ZeroHedge)

- U.S. Energy Industry Looks for Clarity in China Trade Deal (New York Times)

- Morgan Stanley Downgrades Tesla (TSLA) to Underweight, Raises PT (Street Insider)

- Why Raymond James Top MLPs to Buy Also May Be 2020 Best Income Ideas (24/7 Wall Street)

- Morgan Stanley 4Q earnings smash Wall Street estimates as revenue jumps across the board (Business Insider)

- Intuitive Surgical CEO Cracks The Da Vinci Code Of Success For You (Investor’s Business Daily)

- 2020 Could Be the Year for Small-Caps. Buy Only the Best. (Barron’s)

- Things May Be Looking Up for Hedge Funds (Institutional Investor)

- Nobody Makes Money Like Apollo’s Ruthless Founder Leon Black (Bloomberg)

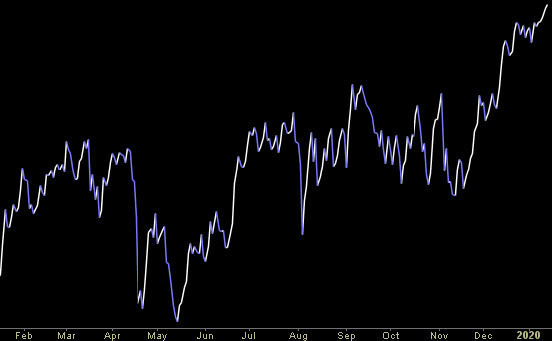

“Are you tired of winning yet?” Stock Market (and Sentiment Results)…

James Branch Cabell, “The optimist claims we live in the best of all possible worlds, and the pessimist fears this is true.”

In many of his campaign rallies, President Trump said, “you’re going to start winning so much that you’re going to beg that I can’t take it anymore!”

Well that was quite a tall order, but regardless of what side of the political spectrum you lie on, Wednesday’s “Phase 1” deal was a big win for the U.S., for China, and the rest of the world. Continue reading ““Are you tired of winning yet?” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Be in the know. 10 key reads for Wednesday…

- Bridgewater’s Greg Jensen sees gold rallying as central banks ease (Financial Times)

- Burger King offers Prince Harry a job (New York Post)

- US natgas production to slip for first time since 2016 (Financial Times)

- FOX Business EXCLUSIVE: Breakdown of China’s $200B buys from America under historic phase one trade deal (Fox Business)

- This Is What Sets Top-Performing Hedge Fund Managers Apart (Institutional Investor)

- It May Be Time to Shop for Shares of U.K. Property Firms (Barron’s)

- Sen. Rob Portman: Trump’s Trade Deal Forces China to Start Playing by the Rules (Barron’s)

- Are Amazon and FedEx Really Ready to Be Friends Again? (24/7 Wall Street)

- The Fed (Mostly) Didn’t Cause the Latest Stock Market Melt-Up (Wall Street Journal)

- Nio’s stock soars on heavy volume after report of funding secured (MarketWatch)

Unusual Options Activity – Encana Corporation (ECA)

Data Source: barchart

Today some institution/fund purchased 19,376 contracts of Jan 2021 $5 strike calls (or the right to buy 19,376 shares of Encana Corporation (ECA) at $5). The open interest was 11,7607 prior to this purchase. Continue reading “Unusual Options Activity – Encana Corporation (ECA)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Bloomberg Interview Clips from Today and Yesterday

Yesterday I had the pleasure of being interviewed by Alisa Parenti of Bloomberg News for about 10-15 minutes.

They then cut up clips of the phone interview and play them not only on Bloomberg Radio, but also a couple hundred iHeart and CBS stations across the country.

Locally, you can hear the reports at :26 and :56 past the hour on 1010 WINS or :25 and :55 past the hour on WCBS today.

Be in the know. 12 key reads for Tuesday…

- Oil Companies Are Finally Pumping Out Cash. That’s Good News for Their Stocks. (Barron’s)

- Buy Occidental Petroleum Stock, Morgan Stanley Says. Its Dividend Is ‘Best-In-Class.’ (Barron’s)

- JPMorgan posts record profit in strong start to US earnings season (Financial Times)

- Citigroup earnings beat expectations on 49% fixed-income trading surge (CNBC)

- For Howard Marks, Investing Is Like a Game (Institutional Investor)

- Hedge fund puts $550m into technology stock option financing (Financial Times)

- EXCLUSIVE: JPMorgan CEO Jamie Dimon praises ‘phase one’ US-China trade deal (Fox Business)

- 2 GM engineers arrested after 100-mph Kentucky joyride in new Corvettes (USA Today)

- Big Commitments for China Energy/Ag Buys in Phase 1 Trade Deal (Reuters)

- Worry over ‘Japanification’ of the economy is overblown (Barron’s)

- Warren Buffett Should Buy FedEx. It’s Cheap and Elephant-Sized. (Barron’s)

- Xi Strikes Optimistic Tone After Riding Out Trade War With Trump (Bloomberg)