Where is money flowing today?

Quote of the Day…

Be in the know. 12 key reads for Monday…

- Stocks Continue to Rise. How Much Is Due to the ‘January Effect?’ (Barron’s)

- Trump administration nears decision on LNG shipping by train (Financial Times)

- Goldman Sachs says Europe’s stocks have a huge ‘cushion’ not seen since the financial crisis (Business Insider)

- Commodities may not stay cheap forever (Financial Times)

- History will repeat itself when it comes to stocks in 2020, Goldman Sachs says (MarketWatch)

- Biotech Stocks Could Soar In 2020 On CRISPR Gene Editing And Precision Medicine (Investor’s Business Daily)

- Time to Buy Long-Dated TIPS, Says Bank of America (MarketWatch)

- Stock Picker Who Pummeled The Market By 76% Reveals His 2020 Bets (Investor’s Business Daily)

- China’s yuan rallies, yen slides ahead of U.S. trade deal (Street Insider)

- Photos of Yelp’s top 100 places to eat in 2020 (USA Today)

- U.S.-China phase one trade deal: 7 things you need to know (FoxBusiness)

- Barron’s Picks And Pans: Apple, Bank of America, Lockheed Martin And More (Yahoo! Finance)

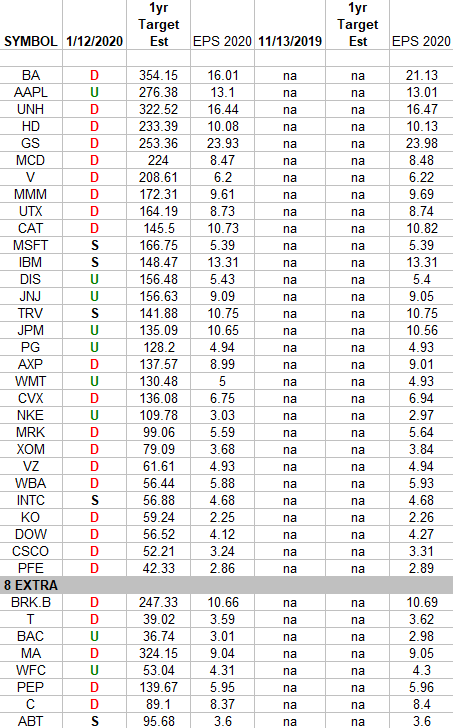

DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the DOW 30 PLUS 8 of the S&P 500 top 30 weights [that are not either included in the DOW 30 or in the top 30 weights of the Nasdaq]. Continue reading “DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions”

Be in the know. 20 key reads for Sunday…

- January Expiration Week: Mixed Bag Last 21 Years (Almanac Trader)

- The Man Who’s Spending $1 Billion to Own Every Pop Song (Medium)

- U.S., China agree to have semi-annual talks aimed a reforms, resolving disputes: WSJ (Reuters)

- Hedge Fund and Insider Trading News: Chase Coleman, Ray Dalio, Daniel Loeb, Ken Griffin, Salesforce.com, Inc. (CRM), Goldman Sachs Group Inc (GS), and More (Insider Monkey)

- Where’s Your Flying Car? Hyundai and Uber Say They’re Working on It (New York Times)

- The 8 Most Beautiful Castle Gardens in Europe (Architectural Digest)

- Bloomberg Spent $200 Million and Isn’t on Track to Score a Single Delegate (The Daily Beast)

- Nashville Goaltender Pekka Rinne Scores NHL’s First Goalie Goal In Six Years (digg)

- avatar-inspired mercedes-benz VISION AVTR concept car lands at CES 2020 (designboom)

- Matthew Benkendorf on Managing Equities (Podcast) (Bloomberg)

- The 1970 Plymouth Superbird Won 18 NASCAR Races. Now You Can Buy a Street-Legal Version of Your Own. (Robb Report)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- This Custom 1970 Dodge Challenger Has 2,500 Horsepower Under the Hood (Maxim)

- Will Northrop Grumman Stock Be a Top Performer Again in 2020? (24/7 Wall St.)

- Trump called Iran’s bluff. And he won. (Washington Post)

- The St. Louis Blues Are Finding New Ways To Beat The Odds (FiveThirtyEight)

- The new tools of monetary policy (Ben Bernanke)

- Issues 2020: A Fracking Ban Would Trigger Global Recession (Manhattan Institute)

- What It’s Like to Be an Investor in Iran’s Market Now (Podcast) (Bloomberg)

- How I Built This with Guy Raz Dell Computers: Michael Dell (Apple)

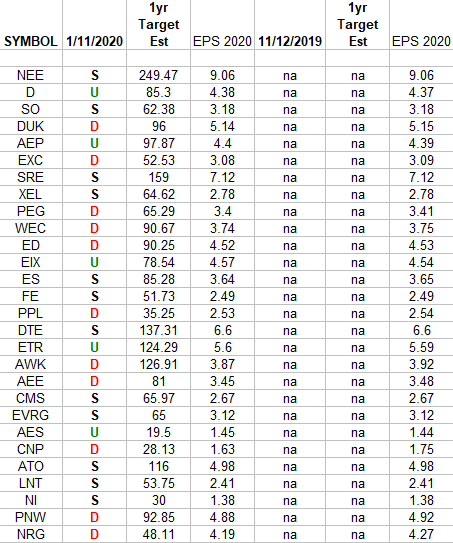

Utilities Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Utilities Sector ETF (XLU) top weighted stocks. Continue reading “Utilities Earnings Estimates/Revisions”

Be in the know. 20 key reads for Saturday…

- Biotech Looks for Fireworks in First Quarter to Regain Momentum (Bloomberg)

- Bet on the Big Banks — and Bank of America (Barron’s)

- Davos? Meet Me at Butternut Instead. (Barron’s)

- A New Hot Spot for Oil Could Boost These 4 Companies (Barron’s)

- Davos? Meet Me at Butternut Instead. (Barron’s)

- Biogen Awaits a Decision on a Key Patent. At Risk Is Its Biggest Drug (Barron’s)

- Trump Allies Explore Buyout of Conservative Channel Seeking to Compete With Fox News (Wall Street Journal)

- New Sanctions Power Could Squeeze Remaining Iranian Trade Channels (Wall Street Journal)

- The Internet of Things Is Changing the World (Wall Street Journal)

- Trump Says Iran Had Planned to Attack Four U.S. Embassies (Bloomberg)

- Hummer is back as GM revives name for electric pickup (USA Today)

- S&P 5,000? Why one fund manager says that milestone may be reached sooner than you would expect (MarketWatch)

- These were the most talked-about products at CES (CNN Business)

- Mark Zuckerberg Says He Hunts Wild Boar With a Bow and Arrow (Futurism)

- Penn Jillette on Magic, Losing 100+ Pounds, and Weaponizing Kindness (#405) (Podcast)

- The Four Traits of Successful Asset Managers (Institutional Investor)

- Gradual Improvements Redux (theirrelevantinvestor)

- Client for Life (The Reformed Broker)

- Is Vulnerability a Choice? (Farnam Street)

- Eight lessons from market history (Evidence Investor)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 11

Article referenced in VideoCast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?

Podcast – Hedge Fund Tips with Tom Hayes – Episode 2

Article referenced in podcast above:

The CAKE “Short Skirt, Long Jacket” Stock Market (and Sentiment Results)

In this episode we cover:

- Jobs Report

- Rig Count

- Harold Hamm on Oil Prices

- General stock market commentary.

- Hemline Indicator

- Valueline Geometric Index – Long Term Implications

- Positioning and sentiment.

- Increased Guidance on tap?

- Fed Liquidity.

- AAII sentiment.

- NAAIM positioning.

- Earnings by Sectors: Energy, Gold Miners, REITs

- S&P and Euro Stoxx 600 earnings.

- Where to find value? What’s Cheap?

- India Small Caps

- Commodities/CRB

- Exploration & Production

- Servicers?