- U.S. Consumer Tech Sales Projected to Increase 4% in 2020. These Trends Will Drive the Growth. (Barron’s)

- ‘Bad’ Manufacturing Data Contained Good News for Industrial Stocks. Here’s Why. (Barron’s)

- UK economy boosted by ‘greater Brexit clarity’ after conservative win (Fox Business)

- Barron’s Picks And Pans: Amazon, Dine Brands, Walgreens And More (Yahoo! Finance)

- Top Energy Stocks for January 2020 (Investopedia)

- Don’t laugh: Here’s why the ‘great rotation’ from bonds to stocks could finally happen in 2020 (MarketWatch)

- Here’s how the Dow and S&P 500 perform in years after they ring up gains of 20% (MarketWatch)

Quote of the Day…

Be in the know. 20 key reads for Sunday…

- The Tech That Will Invade Our Lives in 2020 (New York Times)

- Inside the world of one of YouTube’s most popular food vloggers (Vox)

- ‘Points Guy’ Brian Kelly on Maximizing Travel Rewards (Podcast) (Bloomberg)

- Typical January Trading: Volatile Last 20 Years (Almanac Trader)

- The MMT backlash takes a new form (FT Alphaville)

- Hedge Fund and Insider Trading News: Bill Ackman, Marshall Wace, Greenlight Capital, Becton Dickinson and Co (BDX), On Track Innovations Ltd (OTIVF), and More (Insider Monkey)

- This Icelandic Retreat Is Reminiscent of a Bond Villain’s Lair (Fortune)

- 22 of the Most Expensive Homes in the World for Sale (Robb Report)

- 18 Travel Experiences To Add To Your Bucket List In 2020 (BuzzFeed)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Here’s What’s Coming To Netflix, Hulu, Amazon, HBO and Disney+ in January (Maxim)

- Episode 216: How Four Drinking Buddies Saved Brazil (NPR Planet Money)

- The Great British Bicycle Bubble (NPR Planet Money)

- Salesforce CEO Marc Benioff Runs a $143 Billion Company From an iPhone. Here’s Why That Makes Perfect Sense (Inc.)

- Why So Many Emerging Markets Are Blowing Up Right Now (Podcast) (Bloomberg)

- Scientists Spot Addiction-Associated Circuit in Rats (Scientific American)

- Issues 2020: A Fracking Ban Would Trigger Global Recession (Manhattan Institute)

- Top 10 Tips to Meet Your New Year’s Resolution. (LiveLux)

- 20 Questions We Have for the 2020s (Popular Mechanics)

- 713: The Tipping Point Between Failure and Success (Harvard Business Review)

Quote of the Day…

Be in the know. 15 key reads for Saturday…

- Forget About Dogs Of The Dow, Upgrade To Dobermans (Forbes)

- Hedge Fund Tips – Episode 10 – VideoCast. Stock Market Commentary. (ZeroHedge)

- How Trump Planned the Drone Strike With a Tight Circle of Aides (Bloomberg)

- Here’s what typically happens to the financial markets after major Middle East crisis events (CNBC)

- Billionaires shop at Costco too—see Mark Zuckerberg checking out TVs (CNBC)

- Strait of Hormuz, the world’s biggest oil chokepoint, in focus as Iran tensions flare (MarketWatch)

- Lennar Stock Looks Like a Bargain. Here’s Why. (MarketWatch)

- Large Macy’s Option Trader Betting On A Rebound Year (Benzinga)

- How Uncut Gems Won Over the Diamond District (Vanity Fair)

- Amazon Is a Free-Cash Rocket Ship.Time to Jump on Board. (Barron’s)

- There Are Slim Pickings in the Restaurant Sector. Here’s One Stock Worth Nibbling On. (Barron’s)

- Occidental Petroleum, Walt Disney, Nissan Motor: Stocks That Defined the Week (Wall Street Journal)

- Ten people set to shape Wall Street in 2020 (Financial Times)

- Fed minutes show confidence in 2020 interest rate path (Financial Times)

- Stocks Face New Risks, But Here’s Why It’s Not Time To Flee (Investor’s Business Daily)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 10

Article referenced in VideoCast above:

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

In this episode we cover:

- general stock market commentary

- positioning and sentiment

- CNBC and Fox Business quotes from this week

- Increased Guidance on tap?

- Earnings by Sectors

- Energy E&P thesis

- CEO/CFO sentiment

- Fed Liquidity

- AAII sentiment

- NAAIM positioning

- S&P and Euro Stoxx 600 earnings

- Dogs of Dow

- Transports

- Jude Clemente Energy Article in Forbes

- Rig count

Podcast – Hedge Fund Tips with Tom Hayes – Episode 1

Article referenced in podcast above:

The Earth, Wind & Fire “Shining Star” Stock Market (and Sentiment Results)

In this episode we cover:

- general stock market commentary

- positioning and sentiment

- CNBC and Fox Business quotes from this week

- Increased Guidance on tap?

- Earnings by Sectors

- Energy E&P thesis

- CEO/CFO sentiment

- Fed Liquidity

- AAII sentiment

- NAAIM positioning

- S&P and Euro Stoxx 600 earnings

- Dogs of Dow

- Transports

- Jude Clemente Energy Article in Forbes

- Rig count

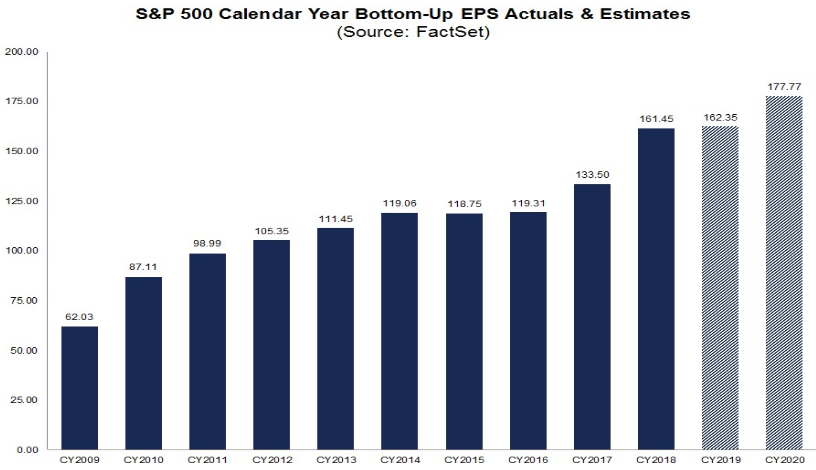

2020 Earnings Estimates: US down modestly, Europe UP

Data Source: Factset

S&P 500 Earnings:

This week, 2020 EPS estimates came down from 178.24 to 177.77. While this is a drop of 26bps, the 2020 Earnings Growth rate stayed up at 9.6% due to a slight down-tick in 2019 estimated results. Q4 2019 Estimates have dropped 10bps (from -1.4% to -1.5% since 12/20). Continue reading “2020 Earnings Estimates: US down modestly, Europe UP”

Where is money flowing today?

Quoted in Fox Business article today:

Thanks for Daniella Genovese for including me in her article on FoxBusiness today. You can find it here: