- Biotech Stocks Are Poised to Rise in 2020, Analyst Says. Here Is His Top Pick. (Barron’s)

- The Pound Is Only Heading in One Direction (Bloomberg)

- Where Can Investors Find Value in a Long Bull Market? Here Are Our 10 Stock Picks for 2020. (Barron’s)

- Lachlan Murdoch Purchases ‘Beverly Hillbillies’ Mansion for Record Price (Fortune)

- Here’s What Every Michelin 3-Star Restaurant in the US Is Serving on New Year’s Eve (Robb Report)

- We Have a Trade Deal and Brexit Clarity. That’s Good News for Stocks. (Barron’s)

- TOP 10 concept cars of 2019 (designboom)

- This Mind-Blowing Mojave Desert Compound Will Train Astronauts For Life on Mars (Maxim)

- Fed’s Clarida Dismisses Weak Retail Sales, Says Outlook Solid (Bloomberg)

- Artificial Intelligence And Machine Learning Lead Charts: 2020 Tech Trends (ValueWalk)

- The Top 20 Destinations For 2020 (Forbes)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- China to target around 6% growth in 2020, step up state spending: sources (Reuters)

- U.S. Mnuchin says trade deal with China to boost global economy (Reuters)

- Warren Buffett said an 89-year-old carpet seller would ‘run rings around’ Fortune 500 CEOs. Here’s the remarkable story of Mrs B (Business Insider)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 7

Quote of the Day…

Be in the know. 20 key reads for Saturday…

- It’s Time To Get Greedy In The Energy Sector (The Felder Report)

- GOLDMAN SACHS: These 20 unloved stocks are spring-loaded for surprisingly big gains in 2020 (Business Insider)

- U.S.-China trade deal swaps tariff rollbacks for farm, energy purchases (Reuters)

- Here are the best-performing stocks of the decade (CNBC)

- PBD TOP 100 MOVIES (Patrick Bet-David)

- U.S. and China Reach ‘Phase-One’ Deal Easing Trade Tensions (Bloomberg)

- McDonald’s launching first vegan meal in the UK (New York Post)

- Boris Johnson’s chance to forge a new role for Britain (Financial Times)

- Here’s what the new trade deal means for the markets (CNBC)

- What you need to save monthly to retire with $1 million to $3 million, broken down by age (CNBC)

- Tradeoffs: The Currency of Decision Making (Farnam Street)

- Automation and artificial intelligence could save banks more than $70 billion by 2025 (Business Insider)

- These 3D-Printed Houses Could Solve Homelessness (Futurism)

- Gary Keller — How to Focus on the One Important Thing (#401) (Tim Ferriss)

- Hedge Funds Have Taken Smaller Active Bets — and Delivered Less Alpha — Since the Financial Crisis (Institutional Investor)

- Bull Markets Last Much Longer Than You Think (A Wealth of Common Sense)

- One Ratio to Rule Them All: EV/EBITDA (Focused Compounding)

- John Malone Has A Very Simple Approach To Screening For Opportunities (GreenBackD)

- Copper’s seasonal rally underway (Almanac Trader)

- The NHL’s Best Fans 2019: No. 4 Golden Knights Prove Hockey Can Thrive In The Desert (Forbes)

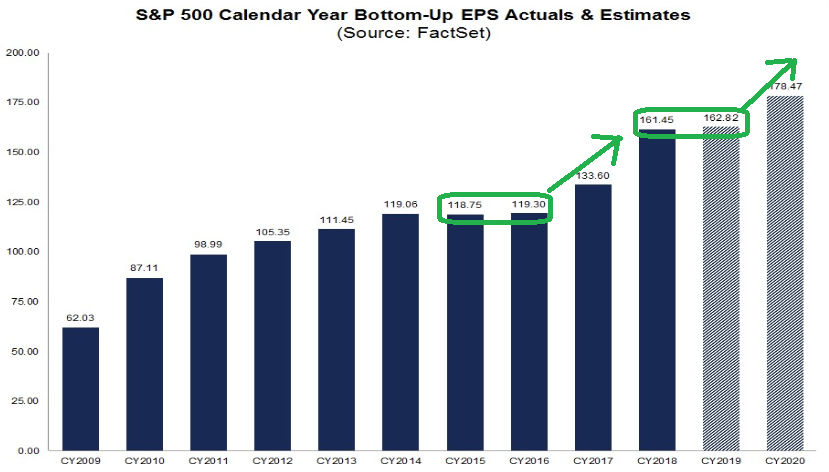

2020 Earnings Estimates Stand Strong

Data Source: Factset

S&P 500 Earnings estimates for 2020 held in strong this week at $178.47 – down modestly from $178.57 last week. While the normal trajectory over the next two weeks – heading into earnings season – would be to lower estimates further, we may find that this time is different. Continue reading “2020 Earnings Estimates Stand Strong”

Where is money flowing today?

Deutsche Bank Aktiengesellschaft (DB) – Unusual Options Activity

Today some institution/fund purchased 661 contracts of Jan 2021 $3 strike calls (or the right to buy 661,000 shares of Deutsche Bank Aktiengesellschaft (DB) at $3). The open interest was just 100 prior to this purchase. Continue reading “Deutsche Bank Aktiengesellschaft (DB) – Unusual Options Activity”

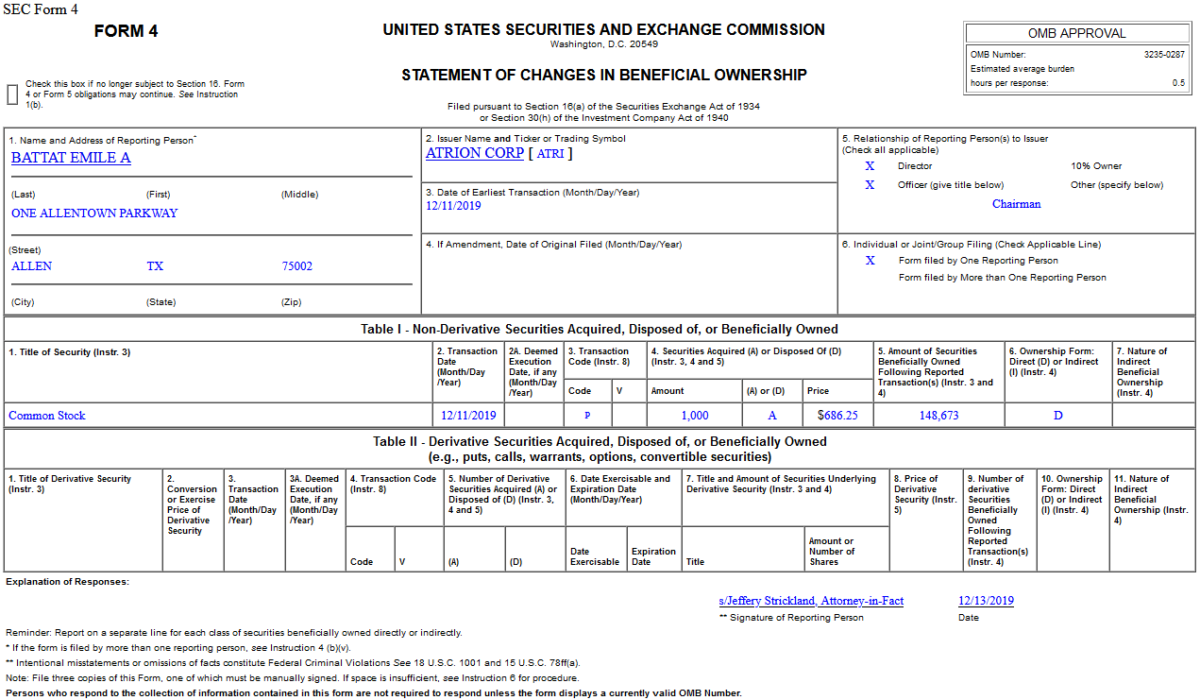

Insider Buying in Atrion Corporation (ATRI)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 15 key reads for Friday…

- Regeneron (REGN) Upgraded to “Top Pick for 2020†and “Outperform†by Credit Suisse (TheFly)

- US and China agree to phase one trade deal, December Chinese tariffs canceled (Fox Business)

- 100 Books Everyone Should Consider Reading (AOM)

- Fed Statement on Repo Operations (NY Fed)

- Fed Aims a Half-Trillion Dollar Liquidity Hose at Year-End Risks (Bloomberg)

- Johnson secures crushing UK election victory (Financial Times)

- Watch Out, China: Why Investors May Flock to India Next (Institutional Investor)

- Shares and sterling soar as trade and Brexit fog lifts (Reuters)

- Trump says Britain, U.S. free to strike new trade deal after Brexit (Reuters)

- Are Energy Stocks Hot Again? (Oil Price)

- Emerging Markets Cut Rates With Russia Following Turkey, Brazil (Bloomberg)

- Happy birthday, Taylor Swift! (New York Post)

- The Hedge Fund CQS Is Looking at Unloved Parts of the Credit Market for 2020 (Barron’s)

- Big Pharma’s Coming Back in 2020. ()

- Navy SEAL: How To Pick Yourself Back Up From Failure (Investor’s Business Daily)