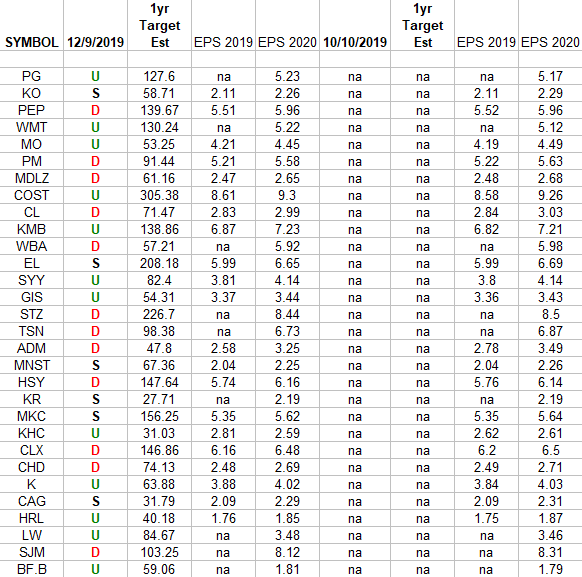

In the spreadsheet above I have tracked the earnings estimates for the Consumer Staples Sector ETF (XLP) top 30 weighted stocks. The column under the date 12/9/2019 has a letter that Continue reading “Consumer Staples (top 30 weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 15 key reads for Monday…

1. Hedge funds key in exacerbating repo market turmoil, says BIS (Financial Times)

2. RPT-U.S. banks’ reluctance to lend cash may have caused repo shock – BIS (Yahoo! Finance)

3. Now Repo Distortions Are Emerging in Europe’s $9 Trillion Market (Bloomberg)

4. Will sterling hold its gains through the UK general election? (Financial Times)

5. UK property investors pull cash at fastest rate this year (Financial Times)

6. Top DoubleLine investor sees opportunity in Brazil amid tariff threat (Yahoo! Finance)

7. Jeffrey Gundlach extended interview with Yahoo Finance [TRANSCRIPT] ()

8. The Taylor Swift “Bad Blood†Energy Market (and Sentiment Results) (ZeroHedge)

9. Big-name US investors take aim at beaten-up energy sector (Financial Times)

10. JPMorgan Sees $410 Billion Bump to Stocks’ Demand-Supply Balance (Bloomberg)

11. Japan’s economy expanded at a much faster-than-initially-reported pace in the third quarter. (Business Insider)

12. China says hopes it can reach trade agreement with US as soon as possible. (Business Insider)

13. Here’s the hard-money call for why the boom in the economy and stock market will continue (MarketWatch)

14. Not the sign of a Top: Investors Bail on Stock Market Rally, Fleeing Funds at Record Pace (Wall Street Journal)

15. Pound Rally Gets Nod From Signal That’s Been Right for a Decade (Bloomberg)

Be in the know. 10 key reads for Sunday…

- Big-name US investors take aim at beaten-up energy sector (Financial Times)

- The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results) (ZeroHedge)

- Sweet Success: WhIsBe Is Bringing His $60,000 Vandal Gummy Bears To Art Week Miami (Forbes)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- Politics Aside, what could happen to markets in the event of impeachment in the House? (Almanac Trader)

- Episode 773: Slot Flaw Scofflaws (NPR Planet Money)

- Making Sense of the Genome, at Last (Nautilus)

- Fed Adds $72.8 Billion to Markets, Balance Sheet Moves to $4.07 Trillion (Wall Street Journal)

- This wealth manager picked a home-run stock in 2019. Here’s what he likes for 2020 (MarketWatch)

- S&P 500 Melt-Up Is So Hot It’s Making Cheerleaders Into Skeptics (Bloomberg)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 6

Articles referenced in VideoCast above:

The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results)

My quotes in the Financial Times today:

Source: Financial Times 12/7/2019 Weekend Edition (link below)

I was quoted in the Financial Times today. Thank you Jennifer! Please check out Jennifer Ablan’s (U.S. Markets Editor) full article, “Big-name US investors take aim at beaten-up energy sector” here:

Be in the know. 20 key reads for Saturday…

- Larry Kudlow: China deal ‘close’ as Beijing cuts some tariffs (New York Post)

- US unemployment rate falls to 3.5%, lowest in 50 years (New York Post)

- Golden Globe Nominations 2020 Predictions: All of Vanity Fair’s Picks (Vanity Fair)

- ‘The Irishman’ Is a Netflix Hit, Even If Few Make It to the End (Bloomberg)

- Repo-Market Minnows Say Fixing the Mess Means Going Beyond Big Banks (Bloomberg)

- FDA Approving Drugs at Breakneck Speed (Bloomberg)

- OPEC’s Oil Surprise Came as Skeptics Were Doubting Price Rise (Bloomberg)

- The Bloomberg 50: The People Who Defined Global Business in 2019 (Bloomberg)

- Trump Orders Toilet Rule Review, Saying People Flush 10 Times (Bloomberg)

- Here are 10 songs Warren Buffett has referenced over 2 decades of annual shareholder letters (Business Insider)

- Is Taylor Swift’s ‘Christmas Tree Farm’ a sign that millennials are boosting live tree sales? (MarketWatch)

- Why the Bull Market Is Only at Mid-Cycle (Jeff Staut) (Bloomberg)

- Inside Miami Art Week With Lenny Kravitz, Princess Eugenie, Rosario Dawson, and Dom Pérignon (Vanity Fair)

- MIT Says New Technique Lets You Hack Your Own Brain Waves (Futurism)

- Quant Mutual Funds Lag Stocks This Year, Bank of America Says (Institutional Investor)

- Survivorship Bias: The Tale of Forgotten Failures (Farnam Street)

- Why Warren Buffett Is The G.O.A.T, And Berkshire’s Secret Sauce (Greenbackd)

- ‘No Time To Die’: Watch the First Trailer for Daniel Craig’s Final Bond Movie (Maxim)

- Top 10 Best Things To Do In Las Vegas: What to check out (ValueWalk)

- Biased Algorithms, Biased World (The Big Picture)

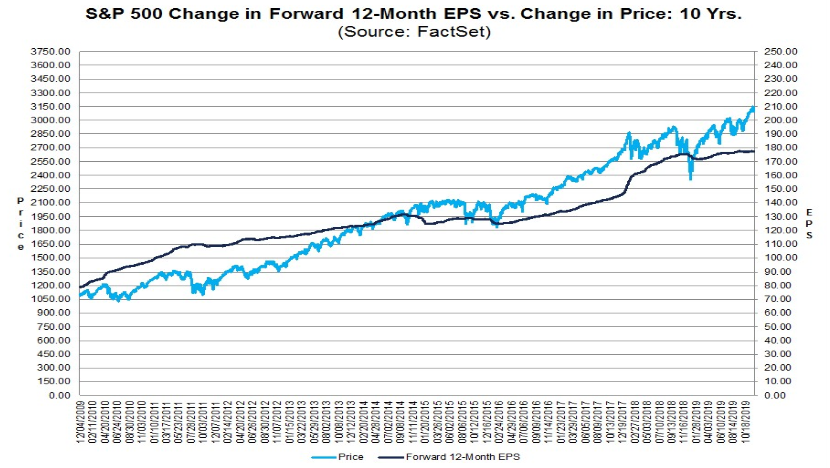

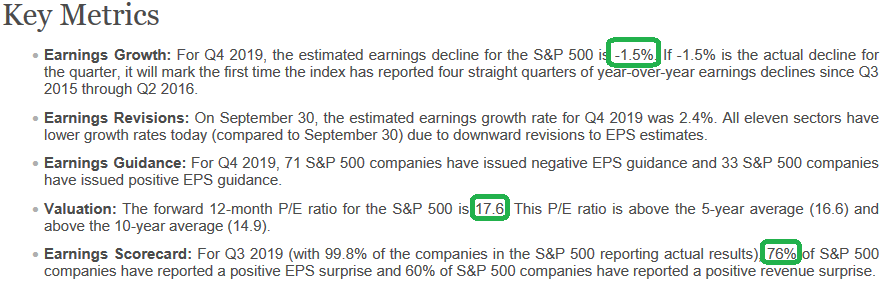

2020 Earnings Estimates Holding Strong at 9.8% Growth

Unusual Options Activity – Amazon.com, Inc. (AMZN)

Data Source: barchart

Today some institution/fund purchased 2,405 contracts of Feb $1820 strike calls (or the right to buy 240,500 shares of Amazon.com, Inc. (AMZN) at $1820). The open interest was just 168 prior to this purchase. Continue reading “Unusual Options Activity – Amazon.com, Inc. (AMZN)”

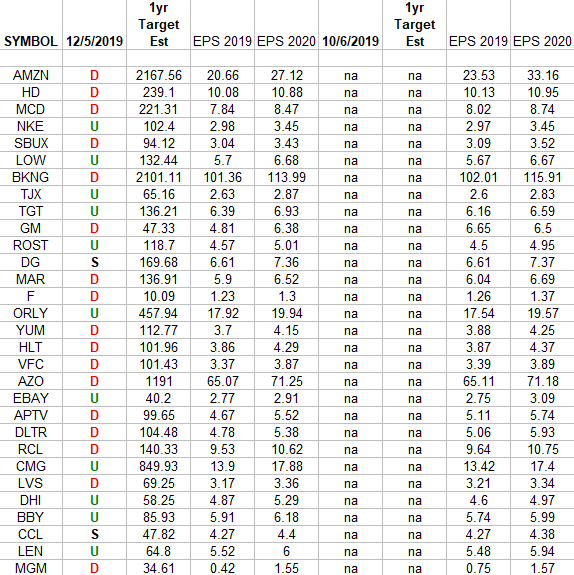

Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Discretionary Sector ETF (XLY) top 30 weighted stocks. The column under the date 12/5/2019 has a Continue reading “Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions”