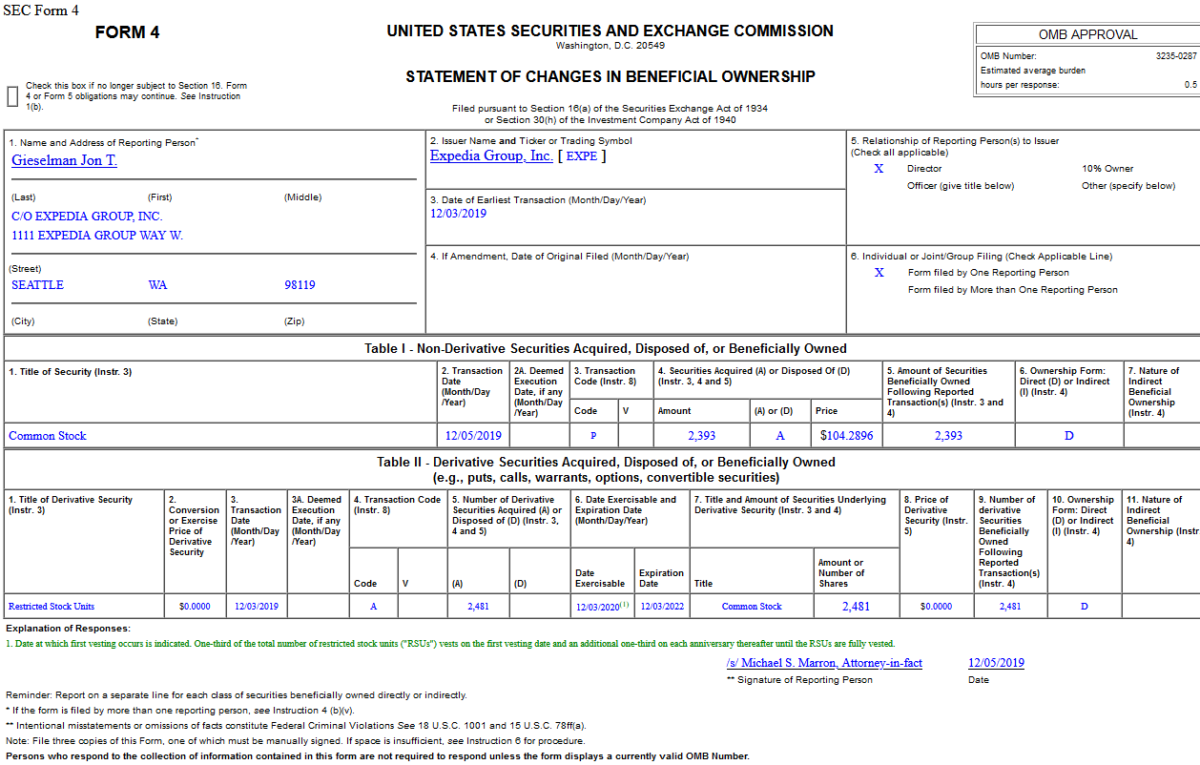

On December 5, 2019, Jon Gieselman – Director of Expedia Group, Inc. (EXPE) – purchased 2,393 shares of EXPE at $104.29. His out of pocket cost was $249,565.

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Friday…

- Saudi, Russia win over oil producers to deeper cuts (Reuters)

- Ulta Stock Is Soaring After Reporting Earnings That Were Much Better Than Last Quarter’s Disaster (Barron’s)

- China to Waive Trade War Tariffs for Some U.S. Soy, Pork Purchases (Bloomberg)

- Citi Tells Rich Clients Stop Being So Nervous About Stocks (Bloomberg)

- U.S. adds 266,000 jobs in November, unemployment dips to 3.5% (MarketWatch)

- BIS Wants Central Banks at Center of Digital Cash Revolution (Bloomberg)

- China offers official reassurance on trade talks with US (FoxBusiness)

- TikTok takes on Facebook in US advertising push (Financial Times)

- Europe First: taking on the dominance of the US dollar (Financial Times)

- Mnuchin Working Closely With Fed, Bank Regulators on Repo Market Issues (Wall Street Journal)

Unusual Options Activity – HUYA Inc. (HUYA)

Data Source: barchart

Today some institution/fund purchased 1,065 contracts of Jan $19 strike calls (or the right to buy 106,500 shares of HUYA Inc. (HUYA) at $19). The open interest was just 118 prior to this purchase. Continue reading “Unusual Options Activity – HUYA Inc. (HUYA)”

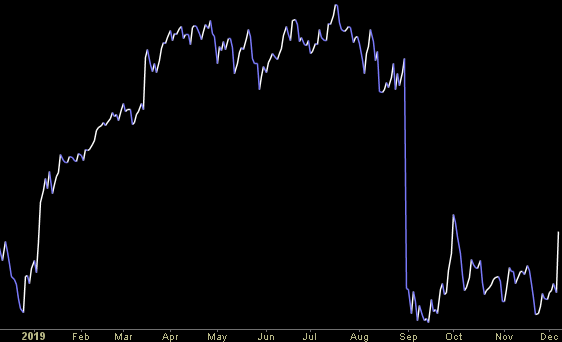

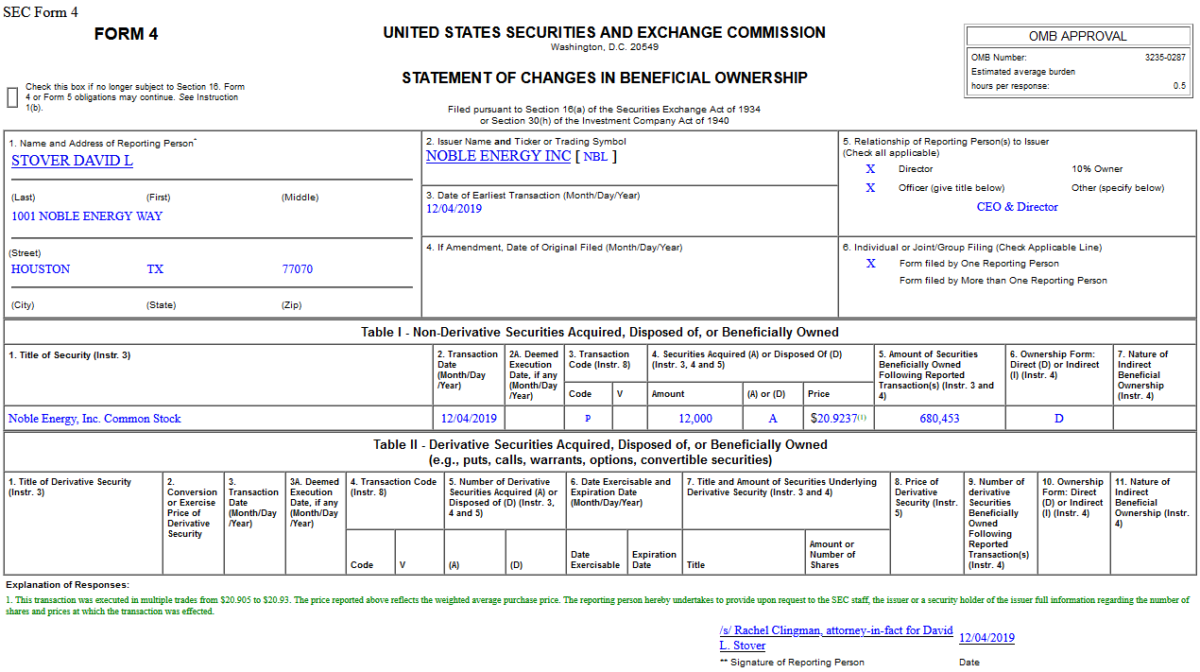

Insider Buying in Noble Energy, Inc. (NBL)

Where is money flowing today?

Be in the know. 15 key reads for Thursday…

- Chesapeake Debt Deal Staves Off Bankruptcy (Yahoo! Finance)

- Chris Hogan: How to have the happiest Christmas ever (I dare you!) (Fox Business)

- Dollar General’s Earnings Show Retail Is Great as Long as You Sell at a Discount (Barron’s)

- Japan launches $122 billion stimulus to fight trade risks, post-Olympic slump (Business Insider)

- Steve Cohen Is in Talks to Buy the Mets. You Could Buy a Piece of Another Team. (Barron’s)

- Carl Icahn Says the HP-Xerox Merger Is a ‘No-Brainer’ (Barron’s)

- Oil rises as OPEC weighs deeper output cuts (Street Insider)

- Robert Shiller on the ‘Trump Narrative’ That’s Lifting Stocks, and Other Investor Enthusiasms (Barron’s)

- This Billionaire CEO’s Brilliant Idea Made Him Rich, Twice (Investor’s Business Daily)

- U.S. Jobless Claims Unexpectedly Drop to Lowest in Seven Months (Bloomberg)

- Soros CIO Puts Conservative Stamp on Fund Built With Bold Bets (Bloomberg)

- Math Whiz Trades Without Humans to Make $700 Million Fortune (Bloomberg)

- US Trade Deficit Shrinks To Smallest In 16 Months (ZeroHedge)

- How Steve Miller’s ‘Fly Like an Eagle’ Took Off (Wall Street Journal)

- Pound Hits Fresh High on Boris Johnson’s Election Prospects (Wall Street Journal)

The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results)

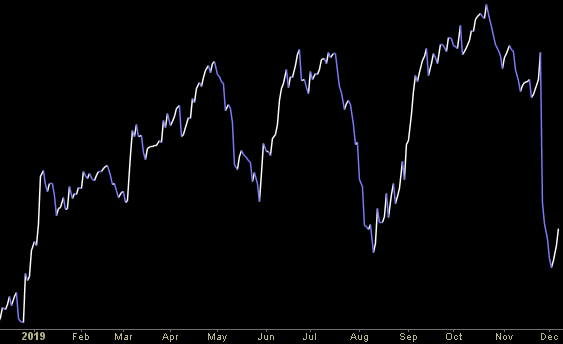

In previous weeks we discussed being bullish on the general market over the intermediate term, while recognizing and respecting a short term “overbought” condition that could either be worked off in time (grind sideways) or price (short term pullback) to shake out the “late money” that missed the rally from Aug/Sept lows.

Continue reading “The Taylor Swift “Bad Blood” Energy Market (and Sentiment Results)”