Be in the know. 13 key reads for Tuesday…

- Powell says the Fed is ‘strongly committed’ to 2% inflation goal (CNBC)

- What to Do When You’re a Distressed-Asset Investor (and Nothing’s in Distress) (Institutional Investor)

- The Bias That Pays Off in the Hedge Fund Industry (Institutional Investor)

- Are Index Funds Headed for a Reckoning? (Institutional Investor)

- China’s top negotiators say US talks going strong, Phase 1 soon (Fox Business)

- It’s not just trade hopes fueling the U.S. stocks rally (Reuters)

- Investors Could Do Much Worse Than ‘Japanification’ (Wall Street Journal)

- CNBC’s Jim Cramer, a longtime Tesla critic, says he might be about to buy a Model X (MarketWatch)

- Disney+ averaging almost a million new subscribers a day (New York Post)

- Dallas Fed President Robert Kaplan says the fourth-quarter economy is ‘weak’ (CNBC)

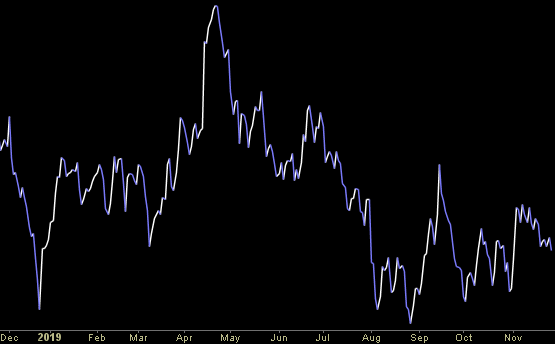

- It’s 2019, But It Sure Feels a Lot Like 1998 for Stocks (Bloomberg)

- Fed Chair Powell Says a Solid Labor Market Could Get Even Stronger (New York Times)

- Teva, Drugmakers in Talks With U.S. to End Generics Probes (Bloomberg)

Unusual Options Activity – Gilead Sciences, Inc. (GILD)

Data Source: barchart

Today some institution/fund purchased 717 contracts of June $60 strike calls (or the right to buy 71,700 shares of Gilead Sciences, Inc. (GILD) at $60). The open interest was just 373 prior to this purchase. Continue reading “Unusual Options Activity – Gilead Sciences, Inc. (GILD)”

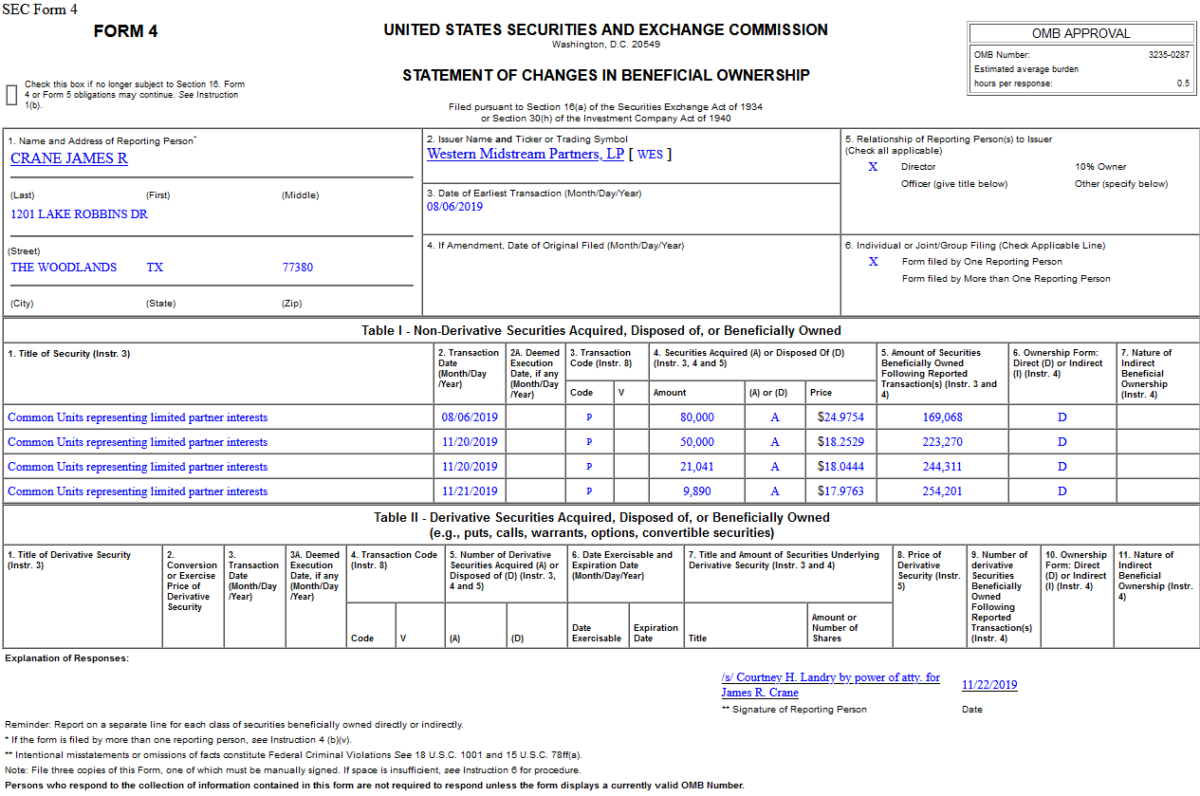

Insider Buying in Western Midstream Partners, LP (WES)

Where is money flowing today?

Quote of the day…

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 15 key reads for Monday…

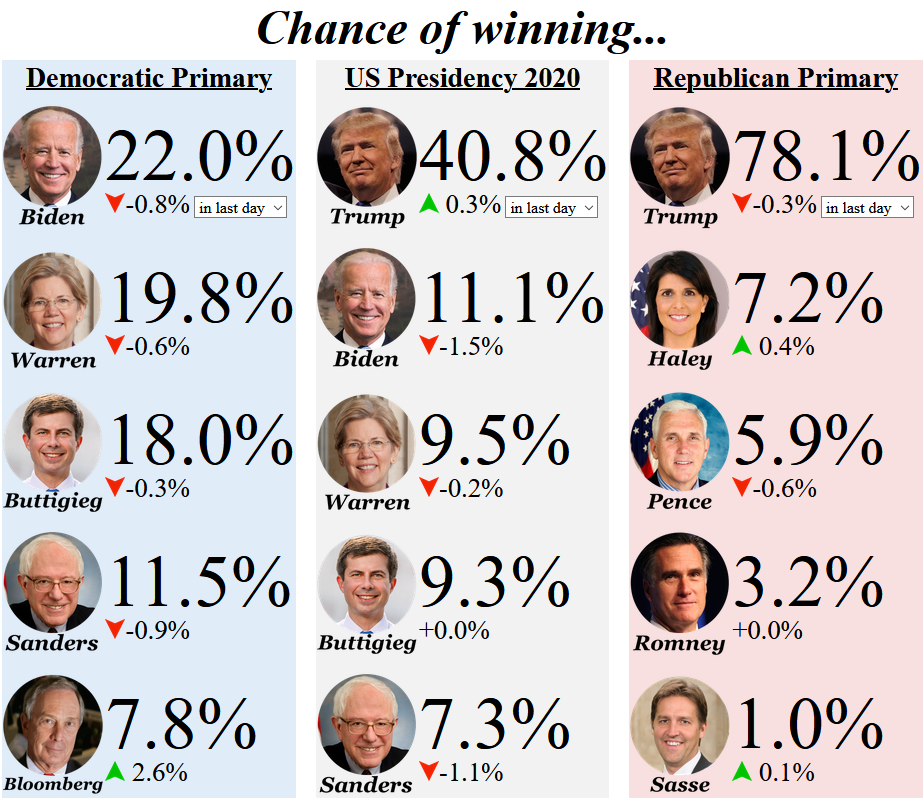

Source: Election Betting Odds

- Election Betting Odds (Biden Leads Dems again) (Election Betting Odds)

- Hedge Fund Tips – Episode 4 – VideoCast. Stock Market Commentary. (Hedge Fund Tips)

- The ‘great rotation’ will arrive in 2020 and bring another strong year for stocks, JP Morgan says (MarketWatch)

- Carl Icahn to Seek Control of Occidental’s Board (Yahoo! Finance)

- French Luxury Giant LVMH Nears Deal to Buy Tiffany (New York Times)

- Who owns the most land in America? Jeff Bezos and John Malone are among them (USA Today)

- Star Stock-Picker Moves On From U.S. and China (Bloomberg)

- How the Steel Industry Made Millions From the Climate Crisis (Bloomberg)

- Schwab and TD Ameritrade Announced a $26 Billion Merger. What You Need to Know. (Barron’s)

- HP Again Rejects Xerox Takeover Bid, Raises Prospect for Big Stock Buyback (Barron’s)

- Pfizer Has 5 Drugs in Its Pipeline That Could Turn Its Stock Around (Barron’s)

- Novartis to Buy Cholesterol-Drugmaker Medicines Co. (Wall Street Journal)

- Elon Musk Says Cybertruck Orders Have Climbed to 200,000 (Bloomberg)

- Paul Singer Has Been Called a ‘Doomsday Investor.’ Now He’s Hoping for Calm Waters. (Institutional Investor)

- Hong Kong elections a slap to Beijing’s face — Here’s what could happen (Fox Business)

Quote of the Day…

Be in the know. 16 key reads for Sunday…

- The Greatest Investor of All Time? (The Irrelevant Investor)

- Is Oil Glut Trading Regime Starting To Falling Apart? (Futures Mag)

- Tom Hanks Plays Mister Rogers: Sharing Joy Is ‘The Natural State Of Things’ (NPR)

- How Does The Economy Influence Voters? (NPR Planet Money)

- How Michael Bloomberg’s Late Bid For The Democratic Nomination Could Go (FiveThirtyEight)

- Elastic: Flexible Thinking in a Constantly Changing World (Farnam Street)

- 25 Fascinating Facts About John F. Kennedy (Mental Floss)

- Millennials finally get housing market break (Fox Business)

- The U.S. Trade Deficit: How Much Does It Matter? (CFR)

- 2019 Wriston Lecture: The End of the Computer Age (Manhattan Institute)

- Why Asset Managers Are Eyeing Millennial Wallets (OZY)

- Box Office: ‘Frozen 2’ Ends November Cold Snap, Heads for Record $110M-$120M U.S. Debut (Hollywood Reporter)

- 99 Oil Rigs Gone And Counting: Rig Count Falls Again (Oil Price)

- Early December Pattern Sparks Natural Gas Futures Rally; SoCal, Sumas Basis Soar (Natural Gas Intel)

- The 5 Types of Market Crash Predictions (A Wealth of Common Sense)

- Hedge Fund Tips – Episode 4 – VideoCast. Stock Market Commentary. (ZeroHedge)