Quote of the day…

Be in the know. 10 key reads for Friday…

- Billionaires Circle Distressed Assets in U.S. Oil and Gas Patch (Bloomberg)

- Hedge Fund and Insider Trading News: Leon Cooperman, Kyle Bass, Jana Partners, Golden Entertainment Inc (GDEN), Liberty Broadband Corp (LBRDA), and More (Insider Monkey)

- Beware Telco and Cable Stocks Amid Streaming War (Barron’s)

- Oil Prices Are Steady. Why Are Risky Energy Companies Unpopular as Ever? (Barron’s)

- Subzero Interest Rates Are Luring Insurers to Risk (New York Times)

- U.S. ‘getting close’ to trade deal with China: White house economic adviser (Reuters)

- Independent Research Firm Thinks It’s Finally Safe to Buy Uber Stock (24/7 Wall Street)

- Warren Buffett’s Berkshire Hathaway reveals new RH, Occidental stakes (MarketWatch)

- One of the hottest new hedge funds is loading up on FAANG stocks (Business Insider)

- Nancy Pelosi says a USMCA trade deal breakthrough could be ‘imminent’ (CNBC)

Unusual Options Activity – Western Digital Corporation (WDC)

Data Source: barchart

Today some institution/fund purchased 925 contracts of Feb $50 strike calls (or the right to buy 92,500 shares of Western Digital Corporation (WDC) at $50). The open interest was just 125 prior to this purchase. Continue reading “Unusual Options Activity – Western Digital Corporation (WDC)”

Where is money flowing today?

Be in the know. 12 key reads for Thursday…

- Paul Tudor Jones sees an ‘explosive combination’ of forces driving the market higher (CNBC)

- China’s Genetics Giant Wants Everyone to Live to at Least 99 (Bloomberg)

- Google is getting into banking. It’s not as crazy as it sounds. (Barron’s)

- One year after Amazon’s HQ2 announcement, here’s what happened to house prices in Northern Virginia (MarketWatch)

- Tesla stock is back from oblivion and could keep climbing (Barron’s)

- Chip Makers Push Spending to the Extreme (Wall Street Journal)

- The Lil Nas X – “Old Town Road” Stock Market (and Sentiment Results) (ZeroHedge)

- Goldman Sachs keeps losing top traders to hedge funds (EFC)

- Paying to play: Hedge fund fees may not be as expensive as they seem, especially compared to banks (Financial Post)

- Walmart Boosts Outlook After Beating Estimates; Shares Gain (Bloomberg)

- Glaxo Wants to Look Inside Your Gut to Discover New Vaccines (Bloomberg)

- Chesapeake Energy stock rallies as Morgan Stanley says it can manage debt (MarketWatch)

The Lil Nas X – “Old Town Road” Stock Market (and Sentiment Results)

This week we are going to discuss the Stock Market in the context of Lil Nas X’s Billboard #1 hit – “Old Town Road.” In the ever popular lyrics he makes the case: Continue reading “The Lil Nas X – “Old Town Road” Stock Market (and Sentiment Results)”

Be in the know. 10 key reads for Wednesday…

- Rally just getting started and stocks could gain more than 20% from here, chart analysis shows (CNBC)

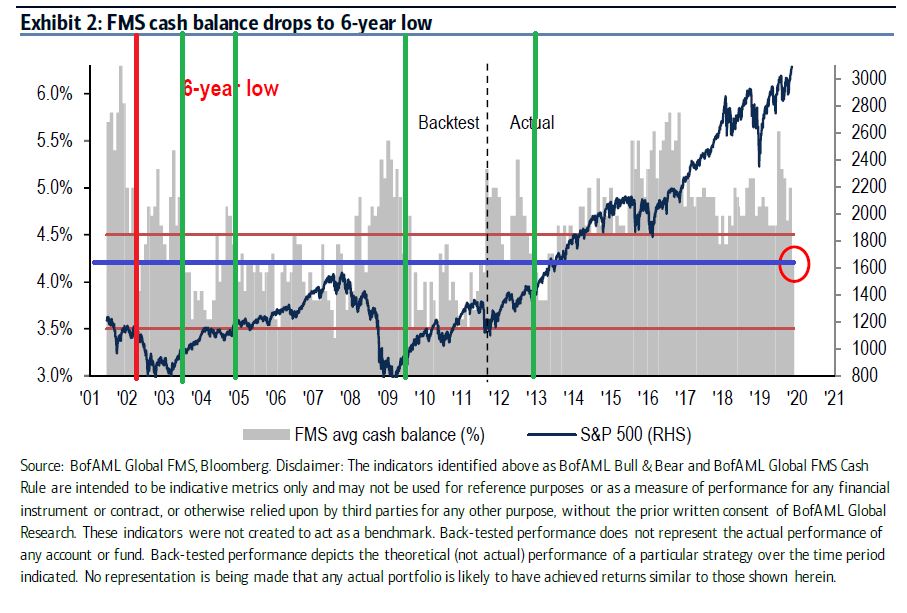

- Global Fund Manager Survey (BAML): Bullish or Bearish? (ZeroHedge)

- Hedge Fund and Insider Trading News: Viking Global, Renaissance Technologies, Och-Ziff Capital Management, Parker-Hannifin Corp (PH), Cognex Corporation (CGNX), and More (InsiderMonkey)

- Trump Says a Trade Deal Between the U.S. and China Is ‘Close’ (Barron’s)

- Trump May Punt on Auto Tariffs as European Carmakers Propose Plan (New York Times)

- Guy Fieri expands fried chicken chain with new Tennessee locations (New York Post)

- Sandy and Joan Weill Give $106 Million to Fund Neuroscience Hub (Bloomberg)

- Jeremy Siegel: The S&P 500 will see at least a ’10% pop’ on US-China trade settlement (CNBC)

- Trump advisor Kudlow teases middle class tax cut as 2020 campaign heats up (CNBC)

- ‘Too big to fail’ remains the prevailing view on Chesapeake,” said Paul Sankey, an analyst with Mizuho. (Barron’s)

Global Fund Manager Survey (BAML): Bullish or Bearish?

Data Source: Bank of America Merrill Lynch

This morning, the monthly Bank of America Merrill Lynch Global Fund Managers Survey was published. The key point that is being focused on is the fact that cash levels have dropped dramatically in the past 30 days (from 5% to 4.2%). Additionally, equity positioning jumped 20% – to 21% overweight. This was a one year high. Continue reading “Global Fund Manager Survey (BAML): Bullish or Bearish?”

Unusual Options Activity – Extreme Networks, Inc. (EXTR)

Data Source: barchart

Today some institution/fund purchased 1,021 contracts of June $9 strike calls (or the right to buy 102,100 shares of Extreme Networks, Inc. (EXTR) at $9). The open interest was just 189 prior to this purchase. Continue reading “Unusual Options Activity – Extreme Networks, Inc. (EXTR)”