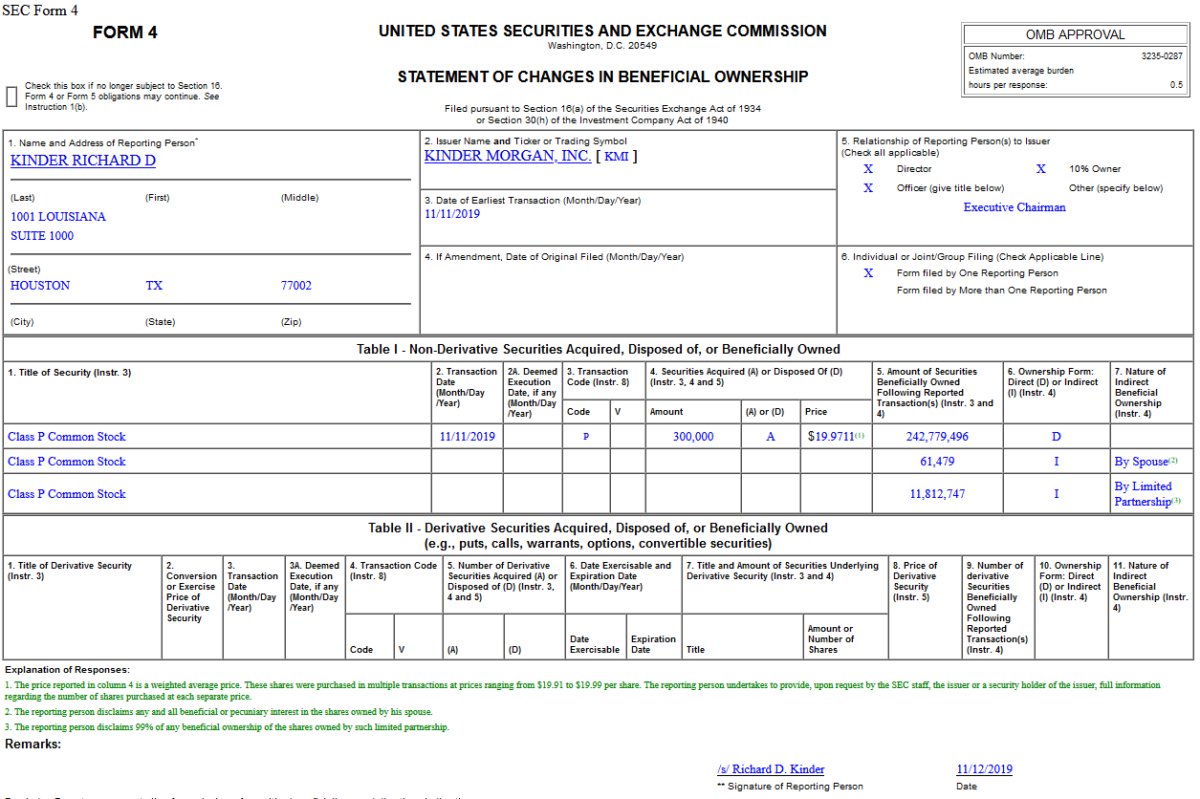

On November 11, 2019, Richard Kinder – Executive Chairman of Kinder Morgan, Inc. (KMI) – purchased 300,000 more shares of KMI at $19.97. His out of pocket cost was $5,991,330.

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 15 key reads for Tuesday…

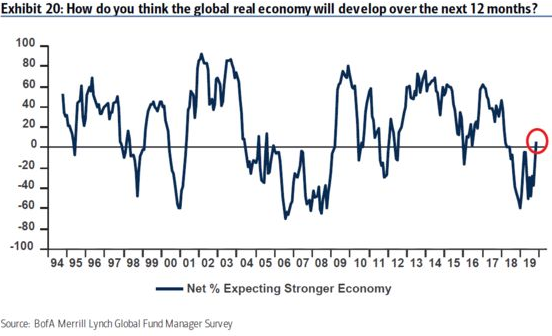

- ‘Fear of missing out’ triggers huge fund manager shift from cash to stocks, Bank of America Merrill Lynch says (MarketWatch)

- Opinion: Winter is coming: These stocks can fire up your portfolio as energy demand spikes (MarketWatch)

- Opinion: The U.S. can slash health-care costs 75% with 2 fundamental changes — and without ‘Medicare for All’ (MarketWatch)

- Hedge Fund and Insider Trading News: Tom Steyer, Whitebox Advisors, CQS Cayman LP, Carlson Capital, Henry Schein, Inc. (HSIC), Uber Technologies Inc (UBER), and More (Insider Monkey)

- “We say…easy part of rally over, tougher part of rally beginning…but rally it can as no ‘excess greed,’ there is ‘excess liquidity’ (and trade/fiscal easing), and corporate earnings set to accelerate.” (CNBC)

- FOMO Grows as Investors Scurry to Catch Stock Market Boom (Bloomberg)

- How Trump’s Stock Market Record Stacks Up (Bloomberg)

- Buying Stocks At Record Highs Works Until It Doesn’t (Bloomberg)

- The Unsolved Mystery of the Medallion Fund’s Success (Bloomberg)

- Trump is expected to delay European auto tariffs for 6 months, report says (CNBC)

- Stock Markets Were Wrong, and That’s Good (Wall Street Journal)

- Jim Cramer: Want to Know Why We Keep Going Up? Look at Stocks (Yahoo! Finance)

- Frackers Prepare to Pull Back, Exacerbating a Slowdown in U.S. Oil Growth (Wall Street Journal)

- The Paycheck Prognosis (Institutional Investor)

- The wealth tax plan worrying US billionaires (Financial Times)

Unusual Options Activity – Chesapeake Energy Corporation (CHK)

Data Source: barchart

Today some institution/fund purchased 1,044 contracts of Dec 27 $1 strike calls (or the right to buy 104,400 shares of Chesapeake Energy Corporation (CHK) at $1). The open interest was just 249 prior to this purchase. Continue reading “Unusual Options Activity – Chesapeake Energy Corporation (CHK)”

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 8 key reads for Monday…

- A $100 Billion Fund Manager Is Debunking Stock-Bubble Theories (Bloomberg)

- How Big Investors Cash In on ‘Alternative Data’ (Bloomberg)

- Aston Martin’s DBX Could Be Game-Changing for Stock, HSBC Says (Bloomberg)

- Barron’s Picks And Pans: Honeywell, Oshkosh, Uber, Walgreens And More (Yahoo! Finance)

- The Rust Belt Is the Next Hot Spot for Stocks. Check Out Cummins and 3 More. (Barron’s)

- Pound Jumps After Nigel Farage Promises Not to Contest Tory Seats (Bloomberg)

- 3 Merrill Lynch US Stocks That Could Rule for Investors in 2020 (24/7 Wall Street)

- Florida’s Sunshine and Tax Benefits Beckon Billionaires (Wall Street Journal)

Be in the know. 20 key reads for Sunday…

- Psst! Want the Secret to Picking Winning Stocks? Keep Reading. (Barron’s)

- What is indicator “PINNING” and how does it apply right now? (ZeroHedge)

- Opinion: These battered biotech stocks are now buying opportunities even as Elizabeth Warren climbs in the polls (MarketWatch)

- Edward Norton Has Figured Some Things Out (GQ)

- Get Ready as ‘Beta-Chasing’ Stock Managers Try to Make Up Ground (Bloomberg)

- Pound Outlook Gets Brighter From Here in Most Election Scenarios (Bloomberg)

- Buffett vs Icahn rematch: Is history on Icahn’s side? (FoxBusiness)

- Is It Time to Shop for Stocks in Europe and Japan? (Barron’s)

- Issues 2020: Drug Spending Is Reducing Health-Care Costs (Manhattan Institute)

- Gene Therapy: For Investors, a Source of Dreams—and Duds (CIO)

- The Rig Count Collapse Is Far From Over (OilPrice)

- Bond Women: How Rising Stars Lashana Lynch and Ana de Armas Are Helping Modernize 007 (Hollywood Reporter)

- The Drilling Frenzy Is Over For U.S. Shale (OilPrice)

- Miranda Lambert’s ‘Wildcard’ Is a Country-Rock Masterpiece (RollingStone)

- China’s Ultrawealthy Catch the Family Office Bug (OZY)

- HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 2 (Hedge Fund Tips)

- Value Stocks Have Another Big-Name Bull in Their Corner (Barron’s)

- Repo Fragility Exacerbated by a Hot New Corner of Funding Market (Bloomberg)

- Chesapeake Energy: Going Concern Worries Out Of Control (Seeking Alpha)

- Companies run by billionaires performed twice as well as the market average in the last 15 years and it’s part of the ‘billionaire effect,’ new study says (Business Insider)