- Psst! Want the Secret to Picking Winning Stocks? Keep Reading. (Barron’s)

- What is indicator “PINNING” and how does it apply right now? (ZeroHedge)

- Opinion: These battered biotech stocks are now buying opportunities even as Elizabeth Warren climbs in the polls (MarketWatch)

- Edward Norton Has Figured Some Things Out (GQ)

- Get Ready as ‘Beta-Chasing’ Stock Managers Try to Make Up Ground (Bloomberg)

- Pound Outlook Gets Brighter From Here in Most Election Scenarios (Bloomberg)

- Buffett vs Icahn rematch: Is history on Icahn’s side? (FoxBusiness)

- Is It Time to Shop for Stocks in Europe and Japan? (Barron’s)

- Issues 2020: Drug Spending Is Reducing Health-Care Costs (Manhattan Institute)

- Gene Therapy: For Investors, a Source of Dreams—and Duds (CIO)

- The Rig Count Collapse Is Far From Over (OilPrice)

- Bond Women: How Rising Stars Lashana Lynch and Ana de Armas Are Helping Modernize 007 (Hollywood Reporter)

- The Drilling Frenzy Is Over For U.S. Shale (OilPrice)

- Miranda Lambert’s ‘Wildcard’ Is a Country-Rock Masterpiece (RollingStone)

- China’s Ultrawealthy Catch the Family Office Bug (OZY)

- HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 2 (Hedge Fund Tips)

- Value Stocks Have Another Big-Name Bull in Their Corner (Barron’s)

- Repo Fragility Exacerbated by a Hot New Corner of Funding Market (Bloomberg)

- Chesapeake Energy: Going Concern Worries Out Of Control (Seeking Alpha)

- Companies run by billionaires performed twice as well as the market average in the last 15 years and it’s part of the ‘billionaire effect,’ new study says (Business Insider)

Be in the know. 20 key reads for Saturday…

- Leon Cooperman – Looking For More For Less (Podcast)

- Illusion of Transparency: Your Poker Face is Better Than You Think (Farnam Street)

- Hedge Fund and Insider Trading News: David Einhorn, Ken Fisher, Tom Steyer, Jim Simons, QAD Inc. (QADA), Chesapeake Energy Corporation (CHK), and More (Insider Monkey)

- Carl Icahn Renews Attack on Occidental Petroleum (Barron’s)

- Elon Musk Is in a Twitter Fight With Hedge Fund. Both Sides Could Be Right. (Barron’s)

- Joe Biden allies are worried that a Mike Bloomberg candidacy could clinch the nomination for Elizabeth Warren (CNBC)

- Get ready for another Santa Claus rally: Fundstrat’s Tom Lee (MarketWatch)

- Kolanovic Says Value Renaissance Will Live Beyond Short Covering (Bloomberg)

- Trump Advisers Want to Get WiFi, Amazon Deliveries in National Parks (Futurism)

- Michael Bloomberg Earned $48 Billion and Eternal Adoration From Wall Street. But Does Anyone Else Want Him to Be President? (Institutional Investor)

- Is Buying Stocks at an All-Time High a Good Idea? (Meb Faber)

- The Four Most Important Market Indicators (The Reformed Broker)

- Why You Shouldn’t Bet Against Warren Buffett (Forbes)

- the rolls-royce cullinan uses 1344 lights to create ‘starry sky’ effect inside (designboom)

- How Billionaire Jim Simons Learned To Beat The Market—And Began Wall Street’s Quant Revolution (Forbes)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- The American Dream And The Children Of Immigrants (NPR Planet Money)

- How Seriously Should We Take Michael Bloomberg’s Potential 2020 Run? (FiveThirtyEight)

- Boys Will Be Boys in “Ford v Ferrari” (The New Yorker)

- Why The Repo Markets Went Crazy (Podcast) (Bloomberg)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 2

Article referenced in VideoCast above:

The Katy Perry “Hot ‘N Cold” Stock Market (and Sentiment Results)

Unusual Options Activity – Occidental Petroleum Corporation (OXY)

Data Source: barchart

Today some institution/fund purchased 13,839 contracts of December $42.50 strike calls (or the right to buy 1,383,900 shares of Occidental Petroleum Corporation (OXY) at $42.50). The open interest was just 2,067 prior to this purchase. Continue reading “Unusual Options Activity – Occidental Petroleum Corporation (OXY)”

Where is money flowing today?

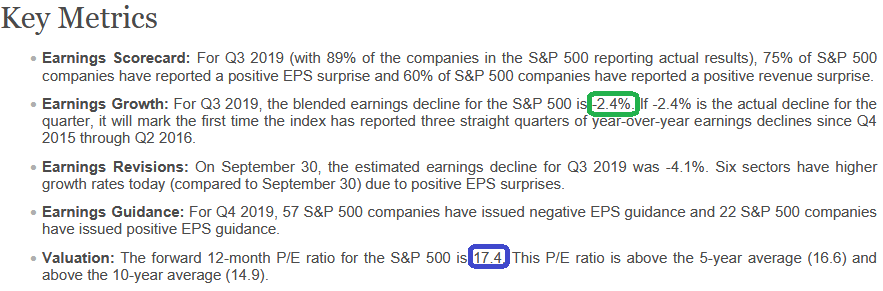

Q3 Earnings Continue to Improve

Data Source: Factset

This week we picked up another 30bps in Earnings improvement of Q3 S&P 500 earnings results. Three weeks ago estimates were at -4.8%. This week they are at -2.4% with 11% of the S&P left to report. Continue reading “Q3 Earnings Continue to Improve”

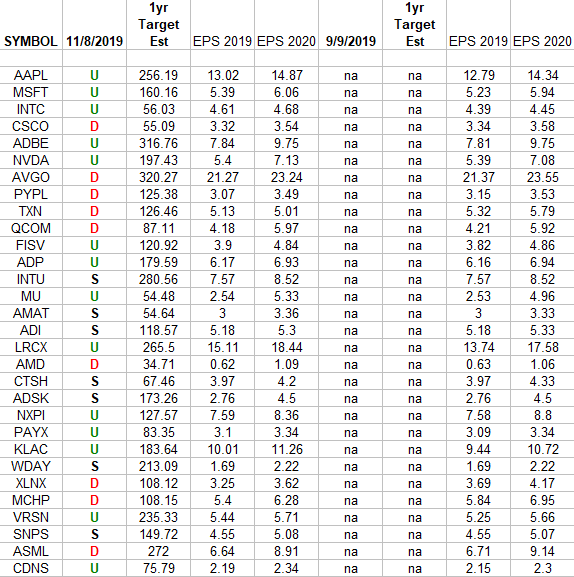

NASDAQ (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the top 30 weighted Nasdaq stocks. I have columns for what the 2019 and 2020 estimates were on 9/9/2019 today. Continue reading “NASDAQ (top 30 weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Friday…

- Chesapeake Energy’s CEO, chairman buy stock on the dip below $1 (MarketWatch)

- It’s Showtime for Streaming. What’s Ahead for Netflix, Disney, and Apple. (Barron’s)

- If You Can Take the Risk, Take on Chesapeake (TheStreet)

- Cliff Asness: It’s ‘Time to Sin’ (Institutional Investor)

- Active Equity Managers Actually Do Generate Alpha. Here’s How They Squander It. (Institutional Investor)

- The Katy Perry “Hot ‘N Cold†Stock Market (and Sentiment Results) (Hedge Fund Tips)

- Epic Meltdowns. Vicious Arguments. Jim Simons’ Renaissance Made Him Billions – But It Came at a Price. (Institutional Investor)

- Carried Interest Warning From Court May Be Trouble for Treasury (Bloomberg)

- Kanye West Says Yeezy Line to Be Made In America ()

- Teva Pharmaceutical Is in Recovery ()