On November 6, 2019, Brad Martin – Director of Chesapeake Energy Corporation (CHK) – purchased 250,000 shares of CHK at $.85. His out of pocket cost was $213,000.

Where is money flowing today?

Quote of the day…

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Thursday…

- Do you double dip your chips? New report reveals surprising trans-Atlantic cultural differences (MarketWatch)

- The Katy Perry “Hot ‘N Cold†Stock Market (and Sentiment Results) (ZeroHedge)

- Baidu’s Search for Growth Isn’t Over (Wall Street Journal)

- Stock futures climb after report China, U.S. agree to cancel tariffs in stages (MarketWatch)

- Oil Could Go to $85 in 2020: 3 Top Stocks to Buy Now (24/7 Wall Street)

- Japan Abe pledges ‘timely’ steps to fight risks, signals more spending (Reuters)

- Three Magic Words Boosting European Stocks: Trade Talks Progress (Yahoo! Finance)

- Teva Pharma Earnings Miss, But Drug Giant Rises On Guidance (Investor’s Business Daily)

- Regeneron Upgraded to Buy at Citi ($420 PT) (TheFly)

- Jim Grant: Why Private Equity Isn’t for You (Barron’s)

The Katy Perry “Hot ‘N Cold” Stock Market (and Sentiment Results)

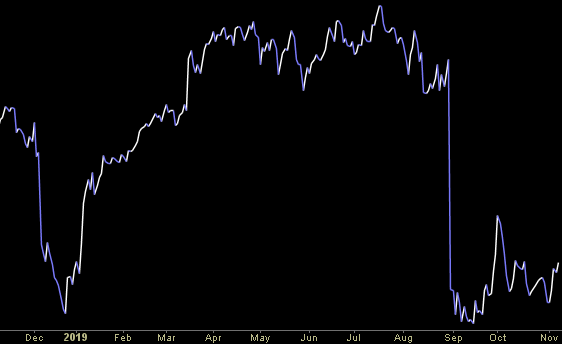

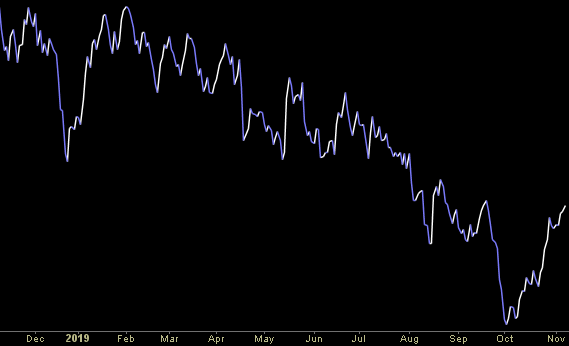

In last week’s note on stock market sentiment, we laid out a bullish case over the next 6 months, and simultaneously cautioned against possible mini-shakeouts in the short term designed to take out the late money – that has just joined the party off of the August lows (in recent days/weeks). Continue reading “The Katy Perry “Hot ‘N Cold” Stock Market (and Sentiment Results)”

Unusual Options Activity – Gilead Sciences, Inc. (GILD)

Data Source: barchart

Today some institution/fund purchased 1,100 contracts of May $67.5 strike calls (or the right to buy 110,000 shares of Gilead Sciences, Inc. (GILD) at $67.5). The open interest was just 237 prior to this purchase. Continue reading “Unusual Options Activity – Gilead Sciences, Inc. (GILD)”

Where is money flowing today?

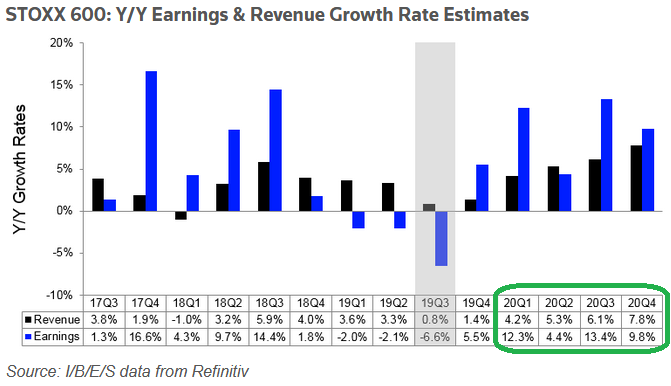

European Earnings Holding at ~Double Digit Growth for 2020…

Data Source: I/B/E/S data from Refinitiv

We’ve been covering for weeks that while pessimism was at an extreme on European equities (predominantly due to German Manufacturing/Exports), 2020 Earnings Estimates were holding in strong. See our note from Sept 12: Continue reading “European Earnings Holding at ~Double Digit Growth for 2020…”