Be in the know. 10 key reads for Wednesday…

- Piper remains buyer of Regeneron into rally after good news ‘trifecta’ (TheFly)

- Saudis to Press OPEC Members for Production Cuts Ahead of Aramco IPO (Wall Street Journal)

- France Is Europe’s New Economic Growth Engine (Bloomberg)

- Presidential Cycle Stars Align for Stocks in 2020 (Almanac Trader)

- SEC gives America Inc a helping hand (Reuters)

- The $5.7 billion American Dream mall has theme parks, indoor skiing and secret gardens (New York Post)

- The World Has Gone Mad and the System Is Broken (Ray Dalio)

- Raymond James 4 Analyst Favorite Health Care Picks (24/7 Wall Street)

- Germany posted a surprise rebound in manufacturing — the ‘deep recession in German industry may be bottoming out’ (Business Insider)

- Aston Martin’s Make-Or-Break $189,900 SUV Gamble Starts in China (Bloomberg)

Unusual Options Activity – Under Armour, Inc. (UAA)

Data Source: barchart

Today some institution/fund purchased 4,677 contracts of Jan 2022 $30 strike calls (or the right to buy 467,700 shares of Under Armour, Inc. (UAA) at $30). The open interest was just 149 prior to this purchase. Continue reading “Unusual Options Activity – Under Armour, Inc. (UAA)”

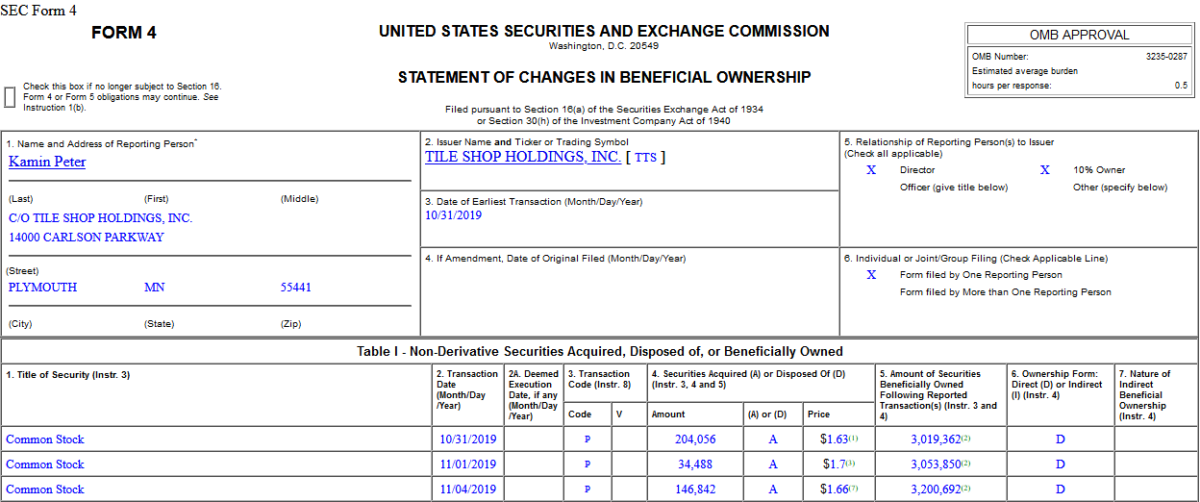

Insider Buying in Tile Shop Holdings, Inc. (TTS)

Where is money flowing today?

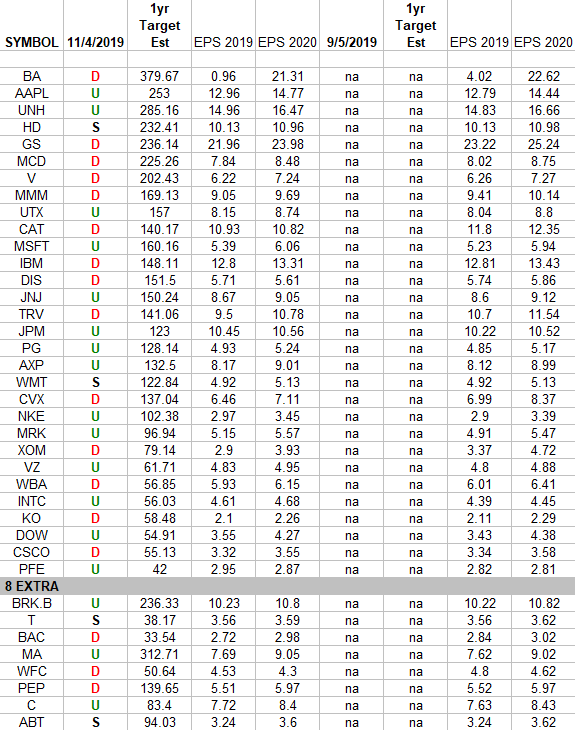

DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the DOW 30 PLUS 8 of the S&P 500 top 30 weights [that are not either included in the DOW 30 or in the top 30 weights of the Nasdaq]. The 8 companies are at the bottom of the spreadsheet under the heading “EXTRA”. The purpose of this is so we have up to date EPS earnings/revisions for the top 30 weighted stocks in the DOW, S&P500, Russell 2000, and Nasdaq. Continue reading “DOW + (8 S&P 500 top weights) Earnings Estimates/Revisions”

Be in the know. 10 key reads for Tuesday…

- Regeneron Earnings Crush Views; Biotech Plans $1 Billion Buyback. Revenues up 23% yoy, EPS up 13% yoy: (Investor’s Business Daily)

- Xi Jinping Vows Commitment to Global Trading Order as U.S. Deal Nears (Bloomberg)

- Top Morgan Stanley fund manager sees stocks rallying another 5% before 2020 (CNBC)

- Billionaire Leon Cooperman warns Elizabeth Warren is ‘taking the country down a very wrong path’ (Business Insider)

- Milton Friedman Got Another Big Idea Right (Bloomberg)

- Wall Street Gets 3-Year Reprieve From SEC on MiFID Compliance (Bloomberg)

- Fed is open to changing its plan to calm repo markets if necessary, top staffer says (MarketWatch)

- Kraft Heinz Starts to Pick Up the Pieces (Wall Street Journal)

- Alibaba Plans to Spend More in 2020. Wall Street Is Cheering. (Barron’s)

- Natural Gas Soars on Cold-Weather Forecasts (Wall Street Journal)

Unusual Options Activity – DXC Technology Company (DXC)

Data Source: barchart

Today some institution/fund purchased 1,571contracts of March $31 strike calls (or the right to buy 1,571,000 shares of DXC Technology Company (DXC) at $31). The open interest was just 100 prior to this purchase. Continue reading “Unusual Options Activity – DXC Technology Company (DXC)”