Be in the know. 12 key reads for Thursday…

- Alibaba to benefit more from cross-border link, trading history of Tencent, Meituan shows (scmp)

- China to Cut Rates on $5 Trillion Mortgages as Soon as September (bloomberg)

- ECB Cuts Interest Rate. It’s Finally on the Same Page as the Fed. (barrons)

- PPI Inflation Data Was Tame in August. (barrons)

- Jobless claims inch up to 230,000, but still no sign of rising layoffs (marketwatch)

- Xi Urges Efforts to Hit Annual Growth Target Amid Rising Doubt (bloomberg)

- PGA Tour Meets With Saudi Fund in Hopes of Getting Closer to Deal (nytimes)

- “Gelsinger insists the time to reap the rewards is finally arriving. He says Intel’s foundry business has “engagements” with a number of customers for $15 billion, spread out over multiple years.” (bloomberg)

- Ajit Jain, Buffett’s insurance leader for nearly 40 years, dumps more than half of Berkshire stake (cnbc)

- Chinese chip making shows progress with new EUV patent from domestic lithography champion (scmp)

- 5B Southbound Trading Net Inflow to BABA-W (aastocks)

- Consumer Staples Stocks Are Looking Pricey. It’s Time to Sell. (barrons)

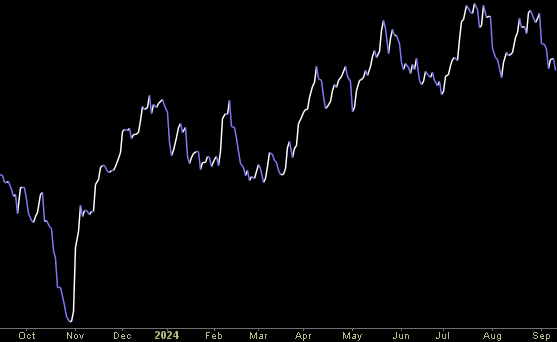

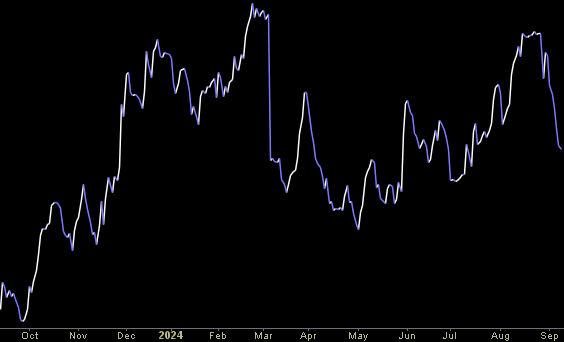

“Jackets and Packets” Stock Market (and Sentiment Results)…

Each week we like to cover one or two companies we have discussed in our weekly podcast|videocast(s).

Continue reading ““Jackets and Packets” Stock Market (and Sentiment Results)…”

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 18 key reads for Wednesday…

- CPI data tees up Fed to begin gradually cutting rates next week (wsj)

- Shelter Inflation Makes 50 Basis Point Cut a Heavier Lift (wsj)

- Goldman Sachs Strategists Say Stocks Unlikely to Sink Into Bear Market (bloomberg)

- One of the world’s largest consulting firms will spy on employee locations as it forces workers back into the office (nypost)

- Google and Apple Face Billions in Penalties After Losing E.U. Appeals (nypost)

- Berkshire Hathaway Big Bet on Occidental Petroleum May Be Going Bad (barrons)

- Lithium Mining Stocks Are Soaring. Supply Is the Reason. (barrons)

- Alibaba Is Battling with Temu Parent PDD. Founder Jack Ma Says That’s a Good Thing. (barrons)

- Inflation unexpectedly cools to slowest rate in more than three years (foxbusiness)

- Alibaba Shares Rise on Hopes for Higher Demand From Mainland Investors (wsj)

- Sunbelt Manufacturing Boom Lures Property Investors (wsj)

- Fed Backpedals on Plan to Increase Big Bank Capital (wsj)

- Topgolf Sent Callaway Into the Rough (wsj)

- Lululemon Is Seeing a Slowdown in Its Women’s Business. Has It Reached Its Ceiling? (wsj)

- Here Are the Key Takeaways From the US CPI Report for August (bloomberg)

- Alibaba logistics arm Cainiao launches next-day delivery in Europe, builds new hubs (scmp)

- Alibaba founder Jack Ma urges business empire to remain steadfast, ‘believe in the future’ (scmp)

- “Mainland investors bought $400 million of stock today via Southbound Stock Connect versus yesterday’s $1.086 billion. It is worth noting Alibaba bought the equivalent of 719,500 US-listed ADRs yesterday, which means the buyback accounted for 4.7% of yesterday’s ADR volume (15.327 million ADRs shares traded).” (chinalastnight)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Quote of the Day…

Be in the know. 12 key reads for Tuesday…

- Will Ferrell Goes Shopping ‘Everywhere’ in PayPal’s Biggest US Campaign Ever (paypal)

- Alibaba to join Stock Connect from Tuesday (scmp)

- Boeing’s stock bounces as averted strike and return of Starliner remove headwinds (marketwatch)

- Morgan Stanley’s Wilson Says Yen Carry Risk Lingers for Stocks (bloomberg)

- Apple to Unveil a New iPhone. Will Upgrades Make a Comeback? (barrons)

- Why Now May Be the Time to Invest in Small-Cap Stocks (wsj)

- Storm Forming in Gulf of Mexico Forecast to Hit US as Hurricane (bloomberg)

- Wealthy Americans Are Spiking Portugal’s Algarve Housing Market (bloomberg)

- Six issues Brian Niccol will have to fix at Starbucks as he takes over as CEO (cnbc)

- Carry trade unwind could replicate August mayhem, suggests currency strategist, as yen strengthens (cnbc)

- PayPal Expands Role In Shopify Payments (benzinga)

- Alibaba Added to Southbound Stock Connect (chinalastnight)