- Were pessimistic manufacturing surveys wrong? (Barron’s)

- Coachs parent flopped on fashion and lost its CEO. The case for a turnaround. (Barron’s)

- ConocoPhillips Stock Is Nothing to be Afraid of, Analyst Says (Barron’s)

- Explainer: The Fed has a repo problem. What’s that? (Reuters)

- The Fed Needs to Give the Economy a Booster Shot (Bloomberg)

Unusual Options Activity – Wells Fargo & Company (WFC)

Today some institution/fund purchased 684 contracts of Oct. 25 $50 strike calls (or the right to buy 64,800 shares of Wells Fargo & Company (WFC) at $50). The open interest was just 384 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”

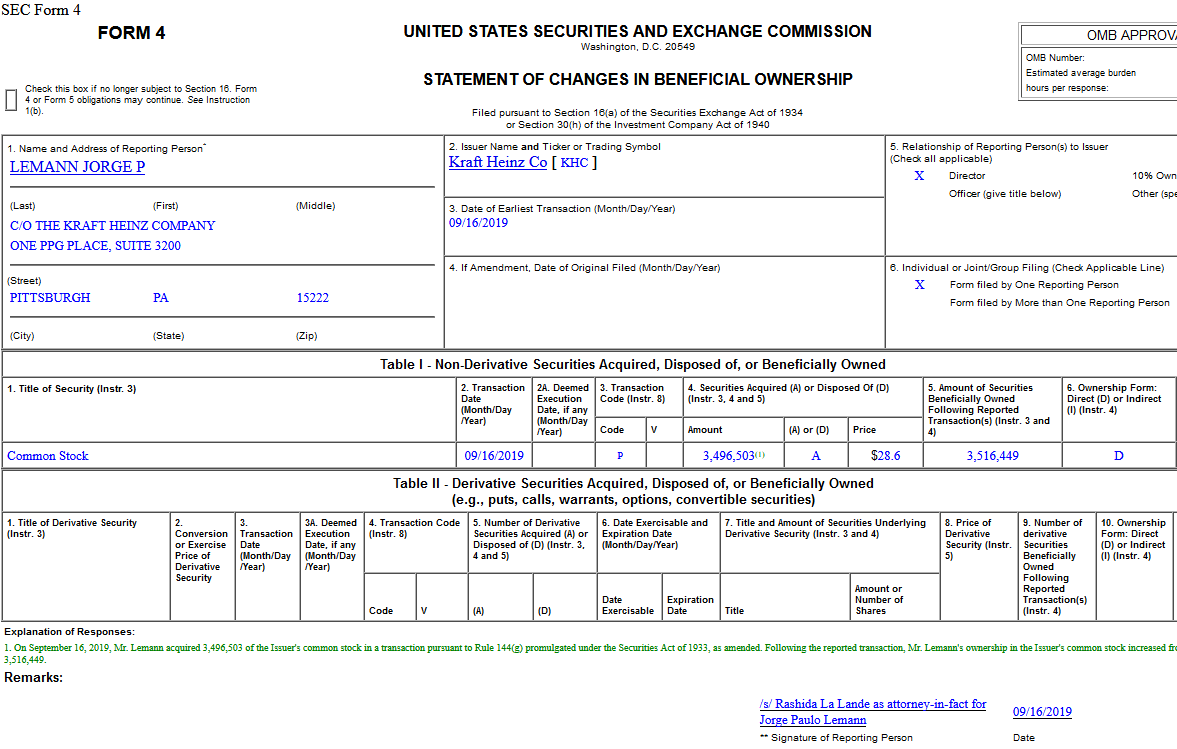

Billionaire buys $100,000,000 of Ketchup

Insider Buying in The Kraft Heinz Company (KHC) Continue reading “Billionaire buys $100,000,000 of Ketchup”

Where is money flowing today?

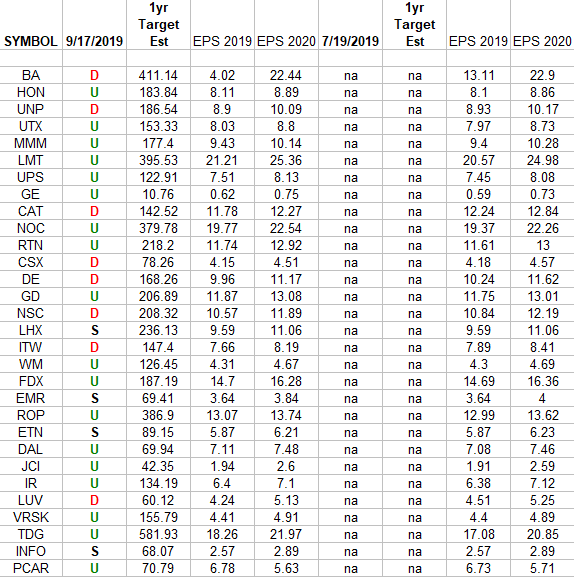

Industrials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Industrials Sector ETF (XLI) top 30 weighted stocks. The column under the date 9/17/2019 has a letter that represents the movement in 2019 earnings Continue reading “Industrials (top 30 weights) Earnings Estimates/Revisions”

Be in the know. 10 key reads for Tuesday…

- Wall Street May Get $40 Billion Reprieve From Trump Regulators (Bloomberg)

- Banks Warm to Mortgage Bonds That Burned Them in 2008 (Wall Street Journal)

- Global Fund Managers Favor US Stocks, But Not Yet Ready for Value Rotation –BAML (The Street)

- Oil Prices Can’t Make or Break Emerging Markets Anymore (Barron’s)

- Value Stocks Look Ready to ‘Take the Reins.’ Here’s Why. (Barron’s)

- U.S. Tells Saudi Arabia Oil Attacks Were Launched From Iran (Wall Street Journal)

- Former Oil CEO Aims to Change How the U.S. Exports Natural Gas (Wall Street Journal)

- Saudis Face Lengthy Oil Halt With Few Options to Fill Gap (Bloomberg)

- Opinion: Stock investors have overreacted to the Saudi oil attack (MarketWatch)

- Former Cisco CEO John Chambers makes fast friends with anyone, including royalty — here’s how he does it (Business Insider)

Unusual Options Activity – Square, Inc. (SQ)

Today some institution/fund purchased 1,010 contracts of June 2020 $80 strike calls (or the right to buy 101,000 shares of Square, Inc. (SQ) at $80). The open interest was just 199 prior to this purchase. Continue reading “Unusual Options Activity – Square, Inc. (SQ)”

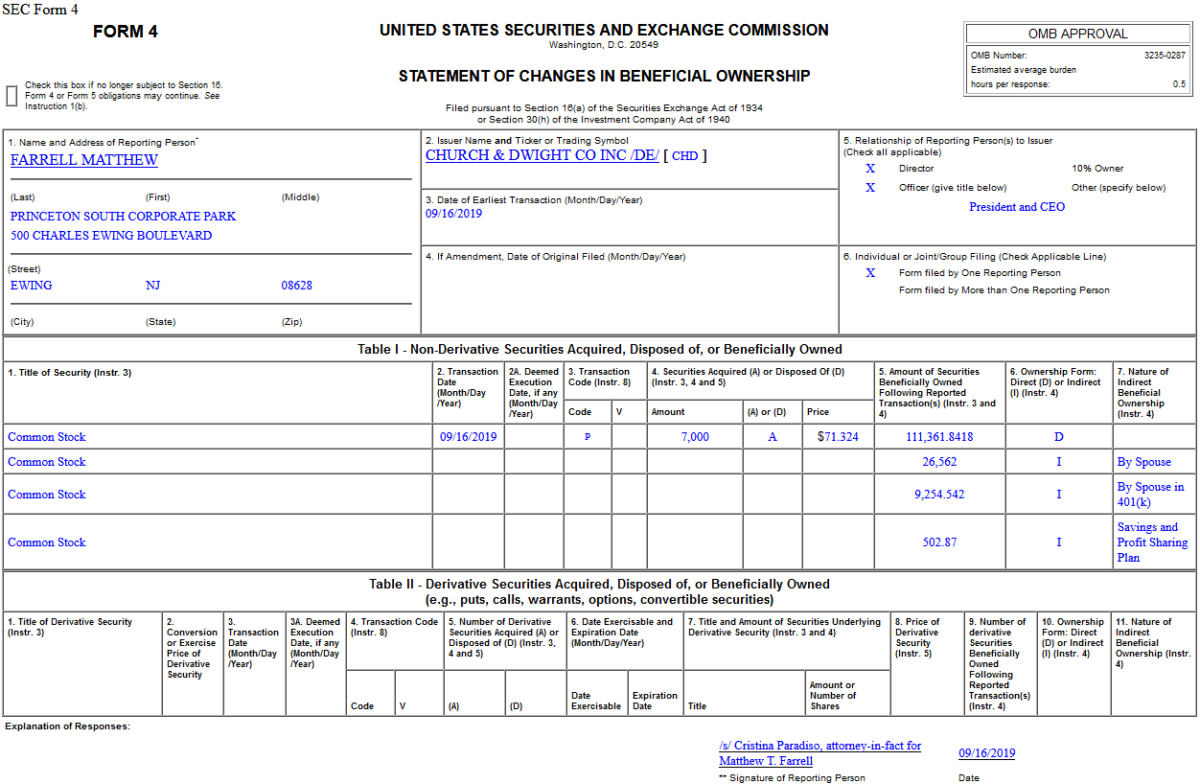

Insider Buying in Church & Dwight Co., Inc. (CHD)

Where is money flowing today?

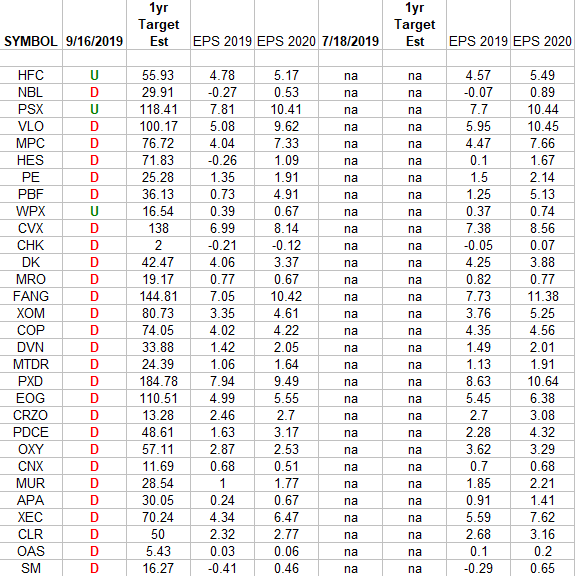

Exploration & Production Sector (XOP) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Exploration & Production Sector (XOP). I have columns for what the 2019 and 2020 estimates were: 7/18/2019 and today. Continue reading “Exploration & Production Sector (XOP) – Earnings Estimates/Revisions”