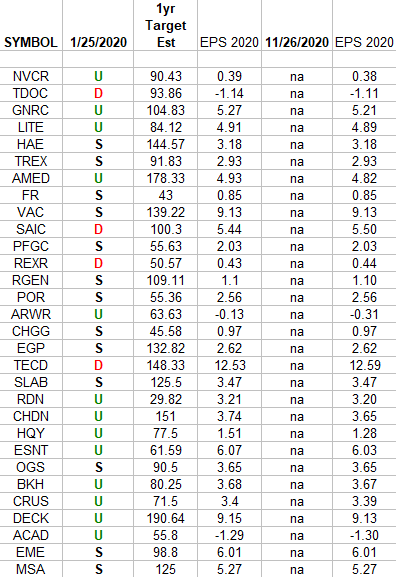

In the spreadsheet above I have tracked the earnings estimates for the top weighted Russell 2000 small cap stocks. I have columns for what the 2020 estimates were 11/26/2019 and today. Continue reading “Russell 2000 (top weights) Earnings Estimates”

Be in the know. 10 key reads for Saturday…

- How the stock market has performed during past viral outbreaks, as epidemic locks down 16 Chinese cities (MarketWatch)

- Sam Zell — Strategies for High-Stakes Investing, Dealmaking, and Grave Dancing (#407) (Tim Ferriss)

- Sports Gambling Will Be Huge. Buy These Stocks. (Barron’s)

- Stocks Catch a Cold After Fed Stops Expanding Its Balance Sheet (Barron’s)

- Porsche’s first Super Bowl ad since 1997 features car chase with its all-electric Taycan (CNBC)

- EIA expects U.S. net natural gas exports to almost double by 2021 (EIA)

- Life is Short (safalniveshak)

- Seth Klarman passionately defends value investing and said its time is coming again soon (CNBC)

- You Can Buy Into These Sports Teams. But the Valuations Are Lofty. (Barron’s)

- Opinion: Here’s what the Super Bowl ‘Predictor’ sees for stocks in 2020, depending on whether the 49ers or the Chiefs win (MarketWatch)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 14

Podcast – Hedge Fund Tips with Tom Hayes – Episode 4

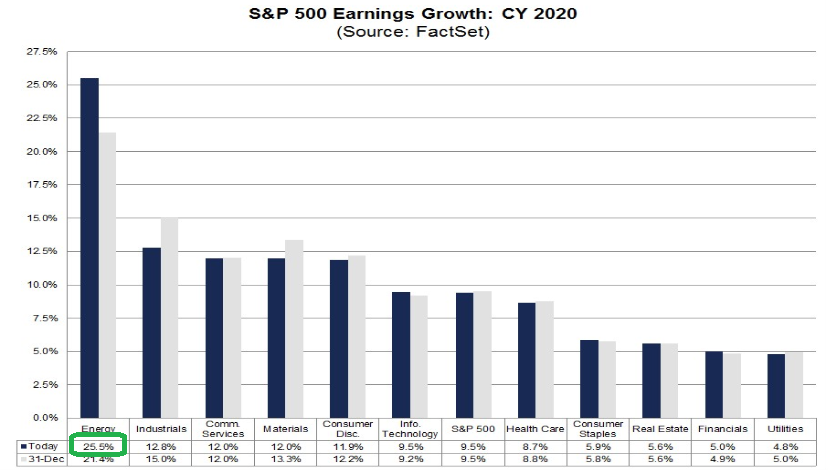

Energy Estimates Up Again This Week

Data Source: Factset

Quick notes on earnings this week. Th most notable change is that 2020 estimates for the Energy Sector went up again this week jumping from 21.4% earnings growth to 25.5% in the past few weeks.

Earnings:

The S&P 500 remains strong at 9.5% EPS growth ($177.41).

Guidance:

The percent of companies issuing negative EPS guidance so far is 58% (7 out of 12). This is below the 5-year average of 70%.

Yahoo! Finance TV Appearance January 27.

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Be in the know. 12 key reads for Friday…

- Tiger Cubs, the Next Generation: Meet Chase Coleman’s Proteges (Bloomberg)

- 3 Pieces to the 2020 Earnings Puzzle (and Sentiment Results) (Zero Hedge)

- Adding a Chronograph Makes This Already-Great Watch Even Better (Bloomberg)

- Exclusive: U.S. pushing India to buy $5-6 billion more farm goods to seal trade deal – sources (Reuters)

- European stocks climb as economic data fuels growth hopes (Reuters)

- 3 Oil and Gas Equipment Stocks in Possible New Uptrend (Investopedia)

- Legendary investor Bill Miller scored 120% returns though he did ‘nothing’ in the last months of 2019 (Business Insider)

- Trump is studying ‘numerous’ middle-class tax cut plans ahead of election, White House says (Business Insider)

- If You Missed Out on Tesla, Consider This Chinese Car Maker (Barron’s)

- Vietnam’s Economy Is Booming. Just Don’t Expect to Find Its Stocks In Your Emerging Markets Fund. (Barron’s)

- Help! I’m Trapped Inside TikTok and I Can’t Get Out (Wall Street Journal)

- Activist Investors and the Art of the Deal (Wall Street Journal)