- China Weighs Cutting Mortgage Rates in Two Steps to Shield Banks. Officials proposed rate cuts of about 80 basis points. Move to boost household consumption, ease pressure on banks (bloomberg)

- Nvidia Stock Drops Again. ‘Its Valuation Is Out of Control.’ (barrons)

- Boeing Speeds 737 Deliveries to China in Respite for New CEO (bloomberg)

- The average analyst price target for Boeing shares is about $214. (barrons)

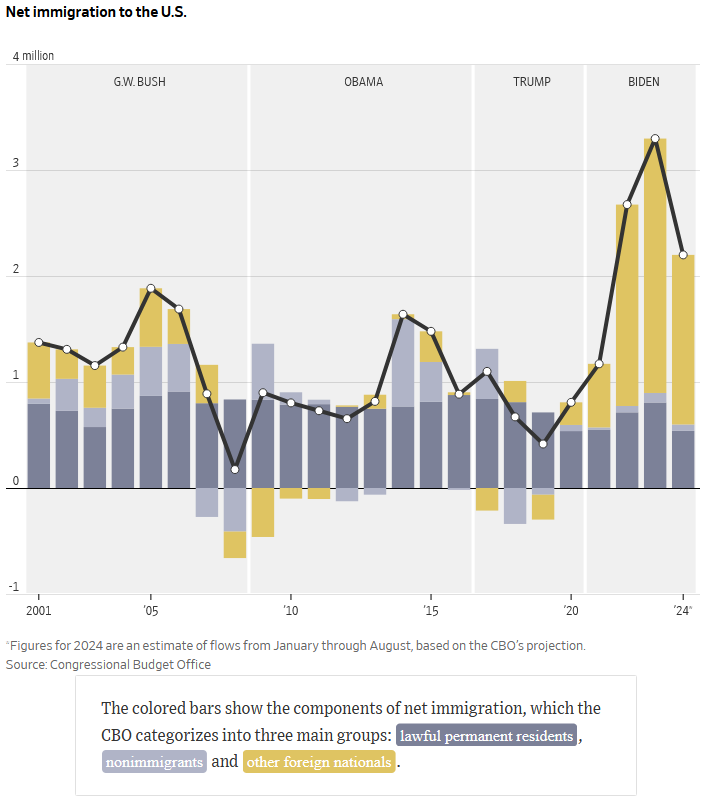

- How Immigration Remade the U.S. Labor Force (wsj)

- Qualcomm-Arm processor chips have compatibility problems with ‘Fortnite’ and other titles (wsj)

- Intel will evaluate its next steps at a board meeting in mid-September, according to people familiar with the matter. (bloomberg)

- China Is Trading Its Own Bonds to Stifle a Runaway Bond Rally (bloomberg)

- The Black Hole of Private Credit That’s Swallowing the Economy (bloomberg)

- China Stocks Listed in US Near Cheapest Ever Versus Nasdaq Peers (bloomberg)

- Alibaba Embraces Tencent’s WeChat Pay as China’s Tech Walls Fall (bloomberg)

- Atlanta Fed President Bostic says officials can’t wait for inflation to hit 2% before cutting (cnbc)

- Nvidia, beware — the top spot in S&P 500 valuations is often a slippery slope (marketwatch)

- Temu’s Parent, a Victim of Competition or Its Own Success? (wsj)

- Fed’s Bostic: Economy is ‘losing momentum’ but there is no sense of looming crash or panic from business leaders (marketwatch)

- Alibaba sets up new ‘digital technology’ firm under e-commerce unit Taobao and Tmall Group (scmp)

- Growth Stocks Rebound As Banks’ Balance Sheets Face Mortgage Refinancing (chinalastnight)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Quote of the Day…

Be in the know. 15 key reads for Tuesday…

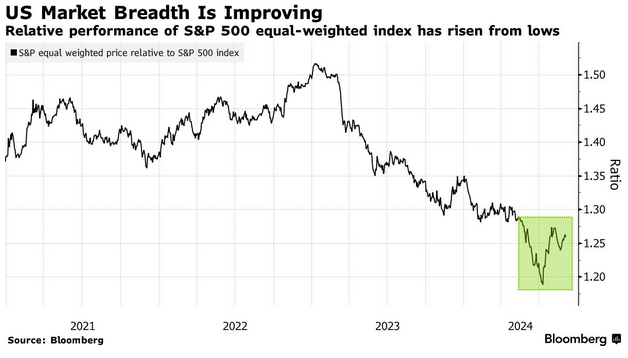

- Stock Laggards Are Due a Catch Up (bloomberg)

- Discretionary Stocks Are Set to Rally. Why Amazon and Tesla Hold the Key. (barrons)

- Stocks Typically Suffer in September. Why Markets Face More Pain This Year. (barrons)

- Biotech Stocks Are Showing Signs of Life. Why the Rally Could Continue. (barrons)

- Septembers in presidential-election years aren’t so bad for the stock market. (marketwatch)

- Treasury yields edge lower as traders await start of four-day data dump (marketwatch)

- Boeing Investors Weigh Cost of a Strike as Clock Ticks on Contract (barrons)

- Disney Narrows Search for the Next Bob Iger. How the Top 2 CEO Candidates Stack Up. (barrons)

- Americans Are Really, Really Bullish on Stocks (wsj)

- Americans’ Economic Mood Brightens—a Bit (wsj)

- Shorts Are Circling Some of the AI Boom’s Biggest Question Marks (bloomberg)

- Investors should be cautious for the next 8 weeks, says Fundstrat’s Tom Lee (cnbc)

- Chinese e-commerce giant Pinduoduo updates rules to kick out sellers of shoddy products (scmp)

- Alibaba-backed e-wallet operator buys Ant Bank Macao, eyes financial services for tourists (scmp)

- Google, DOJ Trial Drama To Hit Earnings By Up To 10%, Says JPMorgan: ‘Status Quo Is No Longer Possible’ (benzinga)

Quote of the Day…

Be in the know. 8 key reads for Labor Day…

- New report offers more details into Intel’s possible plans to slash costs, sell units (marketwatch)

- Banks May Think Twice Before Lowering Savings Account Rates in Lockstep with the Fed (barrons)

- Chinese EV Makers Boost Deliveries by 30% in August (barrons)

- China’s Sputtering Growth Engines Raise Urgency for Stimulus (bloomberg)

- Yen Forecasters Chart Path Past 140 as Global Rate Tracks Emerge (bloomberg)

- Ant Group’s blockchain arm Zan wants to be the Google or Microsoft of Web3 in Hong Kong (scmp)

- Hong Kong property: cash-rich buyers make most of Peak distress amid 50% price slump (scmp)

- U.S. stock-market rebound faces ‘huge’ jobs reports after Labor Day weekend (marketwatch)