Be in the know. 18 key reads for Friday…

- The US needs to build 2 million houses to revive the American dream of homeownership (finance.yahoo)

- The S&P 500 would be nearly 20% lower without AI mania, says this chart (marketwatch)

- Ford Motor Director Scooped Up Stock (barrons)

- Yen, Japanese bond yields fall on Bank of Japan ‘stalling tactic’ (marketwatch)

- Import prices fall sharply in another sign of fading U.S. inflation (marketwatch)

- Chinese companies fuel convertible bond surge, likely ‘precursor’ to IPO rush (scmp)

- Premier Li says China’s economic upgrade to bring new opportunities for global development (people.cn)

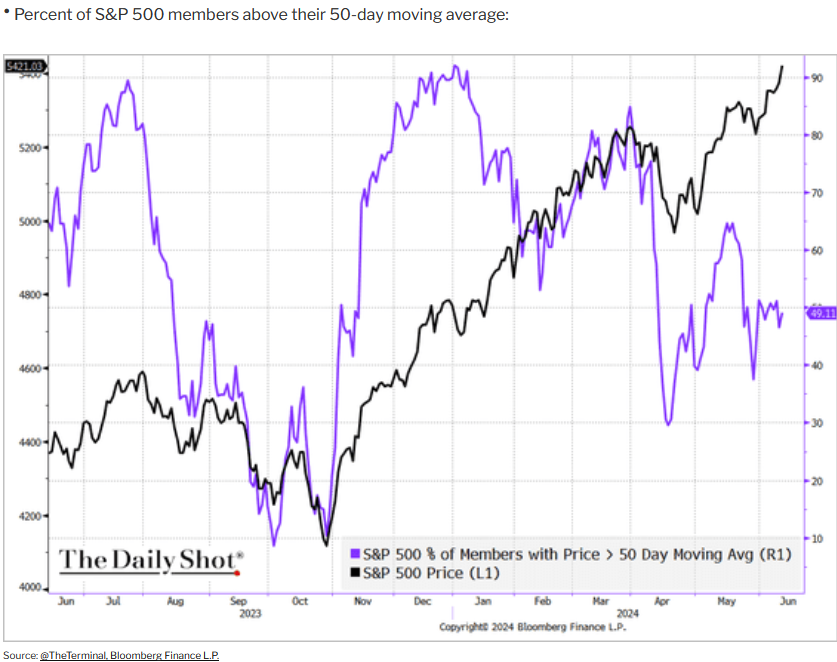

- Stockton: The steady uptrend we’ve seen in tech since October may not keep repeating itself (cnbc)

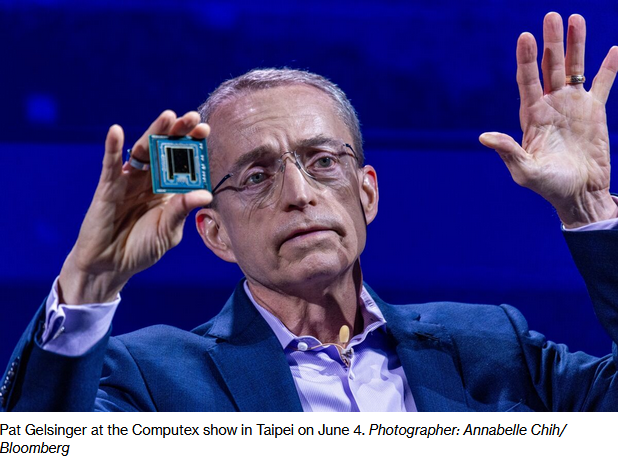

- Both Intel and Advanced Micro Devices are rolling out AI-GPUs designed to target Nvidia’s H100 GPU in high-compute data centers. (fool)

- China sees major rebounds in outbound, inbound tourism (people.cn)

- How a non-profit academy in Beijing is fuelling China’s adoption of AI (scmp)

- Home foreclosures are on the rise again nationwide (foxbusiness)

- Dollar’s Best Streak Since February Threatened as Bulls Retreat (bloomberg)

- Chinese company develops human-like robots that can display complex facial expressions, emotions (nypost)

- 10-year Treasury yield remains at lowest since March on fourth day of bond rally (morningstar)

- “A Major Step To Protect Women’s Sports”: Trans Swimmer Lia Thomas Has Discrimination Case Against World Aquatics Dismissed (zerohedge)

- A Killer Golf Swing Is a Hot Job Skill Now (wsj)

- Inside Callaway’s aerodynamic research area where employees control a ‘ball launcher’ that can project balls at various launch angles, speeds and spin rates. (wsj)

Where is money flowing today?

Quote of the Day…

Be in the know. 20 key reads for Thursday…

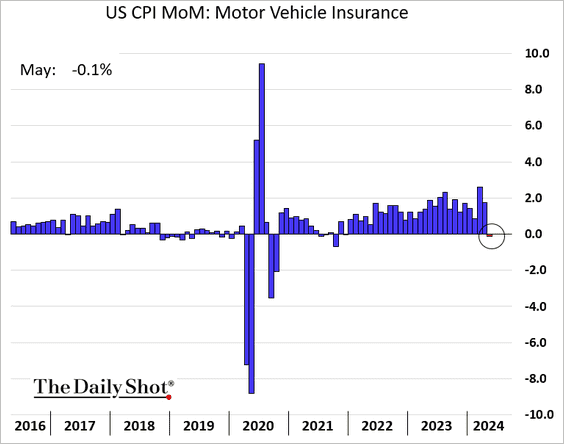

- Fed Projects Just One Cut This Year Despite Mild Inflation Report (wsj)

- Wholesale prices unexpectedly fell 0.2% in May (cnbc)

- Jobless claims jump to highest level in 10 months (marketwatch)

- Why Investors Don’t Believe the Fed (nytimes)

- Bond Market Splits From Fed Again by Betting on 2024 Rate Cuts (bloomberg)

- The Fed isn’t really taking 2 rate cuts off the table (finance.yahoo)

- Fed Signals One Rate Cut This Year, But Keeps Door Open to Two (bloomberg)

- Fed’s $1 trillion pile of paper losses are turning into actual losses — with more in sight (marketwatch)

- Large-Cap Value Stocks Will Power the Market Rally From Here, This Strategist Says (barrons)

- Airline Stocks Are Soaring on Lower Fares. Here’s Why. (barrons)

- Small-Cap Stocks Are Finally Ready to Run With the Bulls (barrons)

- The Bank of Japan Faces an Impossible Challenge (barrons)

- U.S. Travelers Can Renew Their Passports Online Starting Today (wsj)

- Amazon to Invest Billions in Taiwan Cloud Infrastructure (wsj)

- Stung by Past Mistakes, a Wary Fed Takes Its Time (wsj)

- Why Big US Banks Are Resisting Bigger ‘Capital Cushions’ (bloomberg)

- Odd Lots: Elon Musk Dominates Space Like Nobody Has Before (bloomberg)

- ‘The White Lotus’ Gives Thailand a Tourism Boost Ahead of Third Season (bloomberg)

- Dividend stocks can help lower your risk. Many are bargains right now. (marketwatch)

- Wholesale prices decline and add to evidence of easing U.S. inflation (marketwatch)

Indicator of the Day (video): Nasdaq Issues Unchanged

Quote of the Day…

Be in the know. 9 key reads for Wednesday…

- Fed’s rate-cut path in 2024 is a ‘very close call’ as market awaits Powell’s guidance (marketwatch)

- Chinese AI social media apps see demand rise in overseas markets amid slow mainland adoption (scmp)

- Stocks used to rise ahead of Fed meetings. Not anymore. (marketwatch)

- How the stock market performs when a CPI report and a Fed decision happen the same day (marketwatch)

- Opinion: Buffett partner Charlie Munger kept these rules about investing and life that you can use too (marketwatch)

- Natural gas surges over 7% to end at 5-month high on forecasts for extreme heat (marketwatch)

- Snowflake’s Ex-CEO Snaps Up Cheap Stock. He Had Been a Big Seller. (barrons)

- Fed Faces Dot-Plot Cliffhanger as May Inflation Report Looms (bloomberg)

- Nelson Peltz’s Trian amasses stake in pest control giant Rentokil (cnbc)

What I’m Thinking About Now – Stock Market (and Sentiment Results)…

Each week during earnings season we try to update readers on a few of the positions we have discussed in our weekly notes and podcast|videocast(s). Continue reading “What I’m Thinking About Now – Stock Market (and Sentiment Results)…”