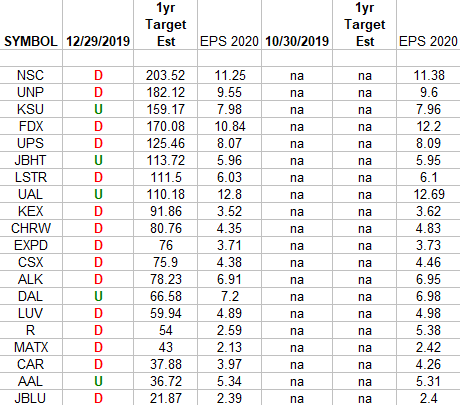

In the spreadsheet above I have tracked the earnings estimates for the Transportation Sector ETF (IYT) holdings. Continue reading “Transports Earnings Estimates/Revisions”

Be in the know. 7 key reads for Sunday…

- For Energy, Poor People Deserve To Be Rich (Forbes)

- These biomedical breakthroughs of the decade saved lives and reduced suffering (CNBC)

- Prescription for Disaster ()

- The Work Week, Episode 4: Is The Unemployment Rate Broken? (NPR Planet Money)

- Why Economists Still Don’t Understand Money (Podcast) (Bloomberg)

- Musk’s Boring Co. Vegas Tunnel ‘Hopefully’ Operational in 2020 (Bloomberg)

- Eddie Murphy’s Return to ‘Saturday Night Live’ Made For the Best Episode in Years (Maxim)

Be in the know. 10 key reads for Saturday…

- Biotech Is Market Front-Runner Heading Into Election Year (Wall Street Journal)

- Hedge Fund and Insider Trading News: Tom Steyer, Daniel Och, Netflix Inc (NFLX), Antares Pharma Inc (ATRS), and More ()

- Oil Posts Longest Run of Weekly Gains Since April on Crude Draw (Bloomberg)

- The best investment of the decade turned $1 into $90,000 ()

- Tech That Will Change Your Life in 2020 (Wall Street Journal)

- Stock Market Forecast 2020: Clear Skies From Fed, China Trade, But Election Clouds Loom (Investor’s Business Daily)

- The 25 Most Popular Robb Report Stories of 2019 (Robb Report)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- 4 Dirty Little Secrets You Need To Know About Successful People (Forbes)

- US Oil Rig Count Falls In Last Week Of 2019 (Yahoo! Finance)

HFT VideoCast – Stock Market Commentary and Weekly Recap – Episode 9

Article referenced in VideoCast above:

The “Fly Me to the Moon” Stock Market (and Sentiment Results)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Unusual Options Activity – Briggs & Stratton Corporation (BGG)

Data Source: barchart

Today some institution/fund purchased 614 contracts of July $7.50 strike calls (or the right to buy 61,400 shares of Briggs & Stratton Corporation (BGG) at $7.50). The open interest was just 231 prior to this purchase.

Continue reading “Unusual Options Activity – Briggs & Stratton Corporation (BGG)”

Where is money flowing today?

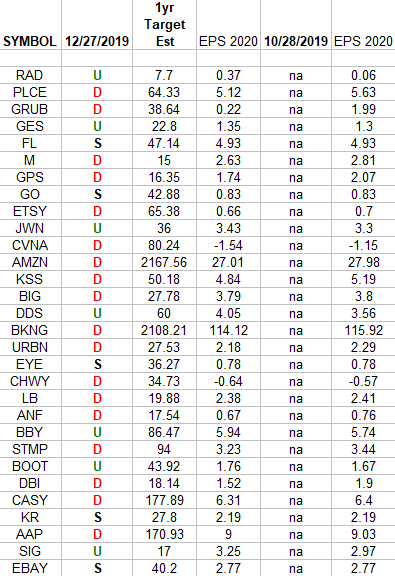

Retail Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Earnings Estimates/Revisions”

Be in the know. 12 key reads for Friday…

- Big Investors Showing Love to Gas Fields Others Shun (Wall Street Journal)

- 3 Losing Sectors That Could Bounce Back in 2020 (Barron’s)

- 36 Corvettes, Hidden for Years in a Garage, Will Be Given Away (New York Times)

- My appearance on Yahoo! Finance TV yesterday (Yahoo! Finance)

- Royal Dutch Shell is a top stock for 2020. This is why. (Barron’s)

- The Future for FedEx, UPS, and Other Shippers Isn’t as Bleak as It Looks (Barron’s)

- Exxon Mobil Stock Was Out of Step With Energy Investors in 2019 (Barron’s)

- Stocks Hit Fresh Highs as Nasdaq Crosses 9000 (Wall Street Journal)

- Charter Schools Keep Tabs on Grads to Keep Them in College (Wall Street Journal)

- The stock market boom may just be getting started — Citi sees 90% odds that equities will rip higher in 2020 (Business Insider)

- Oil Trades Near Three-Month High on Signs of Shrinking Supplies (Bloomberg)

- Why this 10-year-old bull market is actually a one-year-old (Yahoo! Finance)

Yahoo! Finance TV Appearance on Thursday (Video)

Watch it directly on Yahoo! Finance here

Or scroll down to play video (click on “play” button below):

Highlight: “On balance, things do look constructive in 2020,†Great Hill Capital Chairman Thomas Hayes says about the stock market. “You may get some profit taking but overall the table is set.†pic.twitter.com/jIvMM2PRt0

— Yahoo Finance (@YahooFinance) December 26, 2019