I will be on Yahoo! Finance TV with Scott Gamm on Thursday at 1:55pm live from the NYSE.

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Christmas Eve…

- What the Stock Market Did Under Every President in the Last 100 Years (24/7 Wall Street) Â

- The Grinch is Dead! (YouTube)Â

- Berkshire Hathaway Is a Top Stock for 2020. Here’s Why. (Barron’s) Â

- 7 Internet Stocks To Buy For 2020, According to a Veteran Tech Analyst (Barron’s) Â

- The Top Biopharma Calendar Events to Watch Going Into 2020 () Â

- Why Boris Johnson will not go for a ‘hard’ Brexit, but a slow Brexit (FN London)Â

- China to take measures to support jobs amid economic slowdown (Reuters) Â

- Funding Secured for Tesla Shareholders (Wasll Street Journal)

- Bet on These 16 Value Stocks in 2020, Goldman Sachs Says (Yahoo! Finance) Â

- Warren Buffett’s likely successor will be Geico’s next CEO — here’s how he prepared Todd Combs for the role (Business Insider) Â

Fox Business Appearance on Monday (video)

Where is money flowing today?

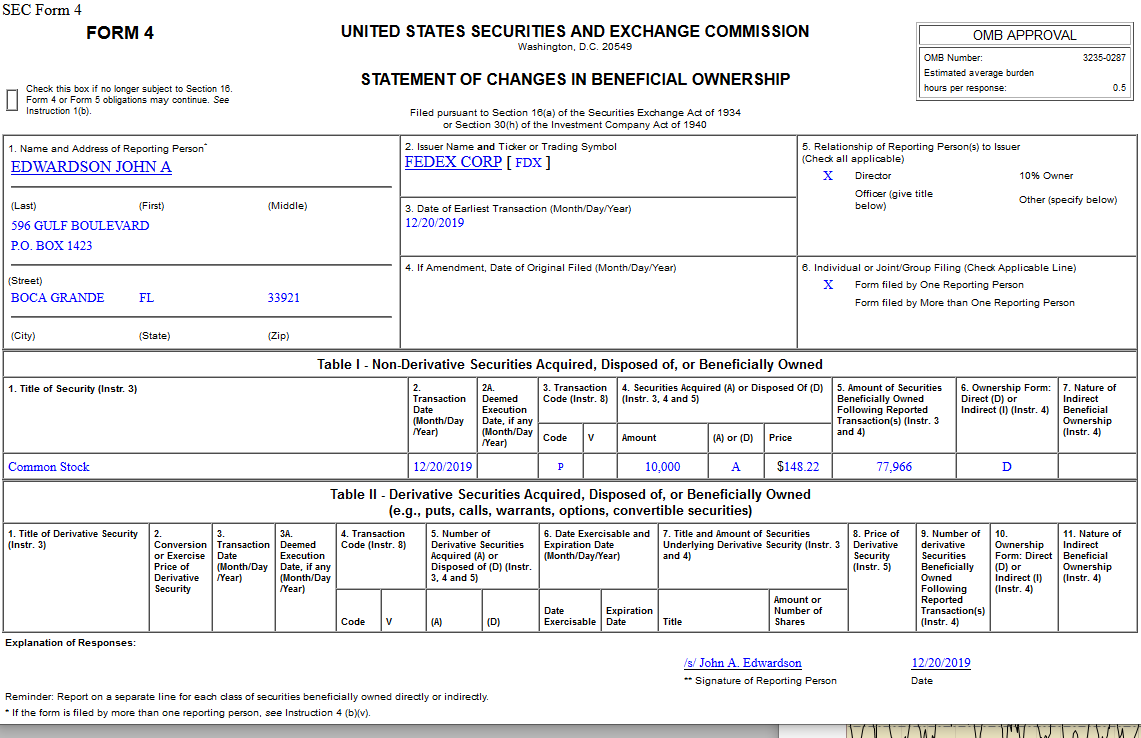

Insider Buying in FedEx Corporation (FDX)

Quote of the Day…

Be in the know. 8 key reads for Monday…

- Banks Get Tough on Shale Loans as Fracking Forecasts Flop (Wall Street Journal)

- This strategist picked two blockbuster stocks in 2019 — here’s what he likes for 2020 (MarketWatch)

- China to Cut Tariffs on Range of Goods Amid Push for Trade Deal (Wall Street Journal)

- What is the Santa Claus Rally? (USA Today)

- China Vows More Support for Private Sector to Stabilize Growth (Bloomberg)

- Robert Shiller: A Trump effect could drive the record market rally through 2020 (CNBC)

- No. 1 Stock Market in Americas Forecast to Climb 15% Next Year (Yahoo! Finance)

- Oil billionaire schools Elizabeth Warren on energy industry (Fox Business)