- Nothing scares Jeffrey Gundlach more than Bernie Sanders (MarketWatch)

- Starbucks, Lowe’s and 6 Other Consumer Stocks That Could Shine in 2020 (Barron’s)

- 3 Oil Stocks to Buy and 1 to Avoid in 2020, According to an Analyst (Barron’s)

- Iran’s Forewarned Strikes Give Trump a Path to Avert All-Out War (Bloomberg)

- Here’s What Could Take the Dow Up to 32,000 in 2020 (24/7 Wall Street)

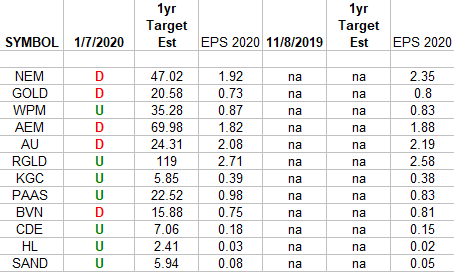

Gold Miners Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Gold Miner Sector ETF (GDX) top US holdings. Continue reading “Gold Miners Earnings Estimates/Revisions”

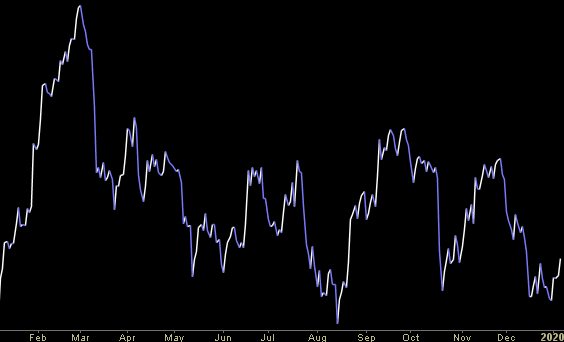

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Tuesday…

- For India’s Battered Small Caps, Patience Is Virtue, ICICI Says (Bloomberg)

- US debt investors seek protection against inflation (Financial Times)

- Expert: These Will Be The Biggest Hedge Funds Trends Of 2020 (Benzinga)

- How 7-Eleven Struck Back Against an Owner Who Took a Day Off (New York Times)

- New cars hit the LA Auto Show (USA Today)

- Byron Wien makes some bold 2020 calls in his widely followed surprises list including 2 rate cuts (CNBC)

- Bet on these big names to use their scale to squeeze out smaller rivals, says Jefferies (MarketWatch)

- US trade deficit plunges to more than 3-year low (Fox Business)

- RBC Capital Markets Out With First Top Picks Equity List for 2020 (24/7 Wall Street)

- Oil tycoon Harold Hamm predicts 19% jump in U.S. oil prices within six months, ‘regardless of what happens’ in the Mideast (MarketWatch)

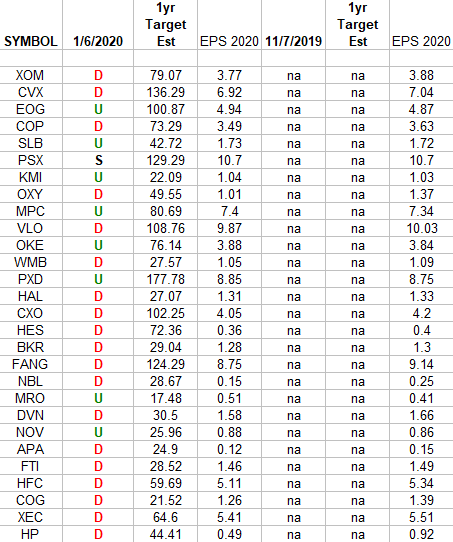

Energy Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Energy Sector ETF (XLE). Continue reading “Energy Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 7 key reads for Monday…

- U.S. Consumer Tech Sales Projected to Increase 4% in 2020. These Trends Will Drive the Growth. (Barron’s)

- ‘Bad’ Manufacturing Data Contained Good News for Industrial Stocks. Here’s Why. (Barron’s)

- UK economy boosted by ‘greater Brexit clarity’ after conservative win (Fox Business)

- Barron’s Picks And Pans: Amazon, Dine Brands, Walgreens And More (Yahoo! Finance)

- Top Energy Stocks for January 2020 (Investopedia)

- Don’t laugh: Here’s why the ‘great rotation’ from bonds to stocks could finally happen in 2020 (MarketWatch)

- Here’s how the Dow and S&P 500 perform in years after they ring up gains of 20% (MarketWatch)