Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 7 key reads for Wednesday…

- Global oil market in glut, but not a big enough one for OPEC (Reuters)

- Four reasons why antitrust actions will likely fail to break up Big Tech (MarketWatch)

- Trump Really Might Weaken the Dollar (Wall Street Journal)

- Shopping Mall REIT Stocks Could Benefit Because Growth Expectations Are Low (Barron’s)

- UPS Earnings Top On Strong U.S. Growth; Shipping Giant Raises Guidance (Investor’s Business Daily)

- Value Stocks Haven’t Traded This Low Since the Dot-Com Bubble (Bloomberg)

- Hedge Fund and Insider Trading News: Stanley Druckenmiller, Whitney Tilson, Perceptive Advisors, Bank of New York Mellon Corp (BK), Ionis Pharmaceuticals Inc (IONS), Schlumberger Limited. (SLB), and More ()

Unusual Options Activity – AbbVie Inc. (ABBV)

Today some institution/fund purchased 2,346 contracts of Feb 2020 $70 strike calls (or the right to buy 234,600 shares of AbbVie Inc. (ABBV) at $70). The open interest was just 310 prior to this purchase. Continue reading “Unusual Options Activity – AbbVie Inc. (ABBV)”

Where is money flowing today?

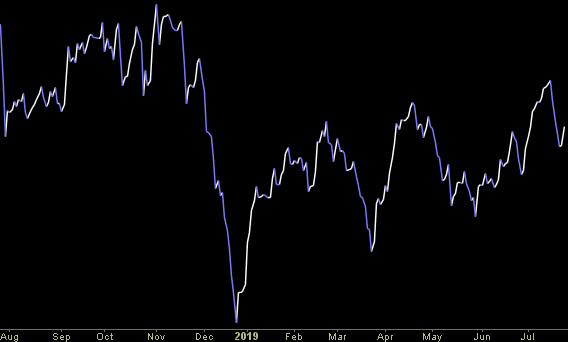

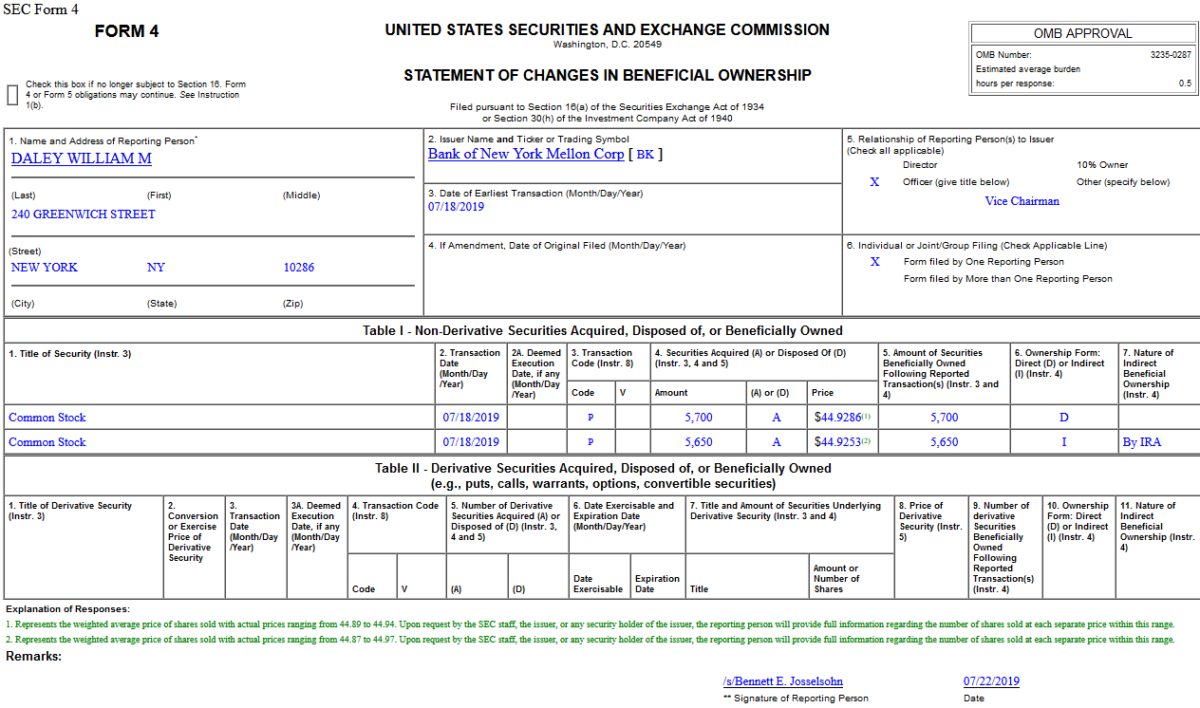

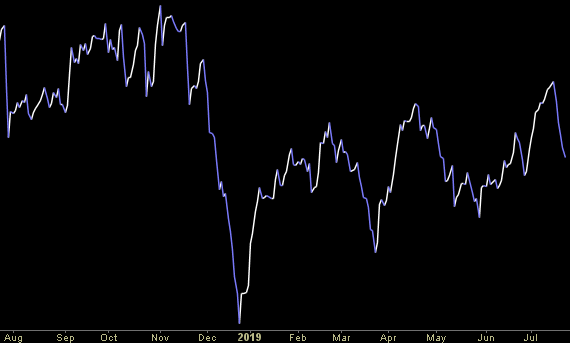

Insider Buying in The Bank of New York Mellon Corporation (BK)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 7 key reads for Tuesday…

- Biogen climbs as profits surge 72%, prompting the firm to boost 2019 guidance (BIIB) (Business Insider)

- U.S. farmers look past trade fears to cash in on China’s hog crisis (Reuters)

- United Technologies’ earnings crush Wall Street forecasts (MarketWatch)

- Warren Buffett took Occidental CEO ‘to the cleaners’: Carl Icahn (New York Post)

- Coca-Cola raises revenue forecast after earnings beat, sending shares higher (CNBC)

- Oil Stocks Could Get a Boost From Lower Interest Rates. Here’s Why. (Barron’s)

- The 35 celebrities and athletes who make the most money per Instagram post, ranked (Business Insider)

Unusual Options Activity – Wells Fargo & Company (WFC)

Today some institution/fund purchased 1,750 contracts of Jan 2021 $25 strike calls (or the right to buy 175,000 shares of Wells Fargo & Company (WFC) at $25). The open interest was just 393 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”