- Why now is the time to buy bank stocks (Yahoo! Finance)

- Fed’s Evans Sees Two Rate Cuts Needed This Year (Wall Street Journal)

- The Hottest Hands in Hedge Funds (Institutional Investor)

- Hedge Fund Investor Letters 2019 Q2 (Insider Monkey)

- This Pharma Company Is Set to Begin HIV Vaccine Trials ()

- Sisters of Swing (Vanity Fair)

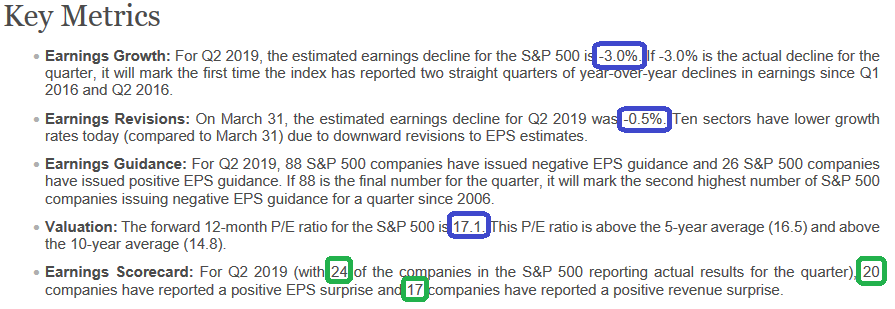

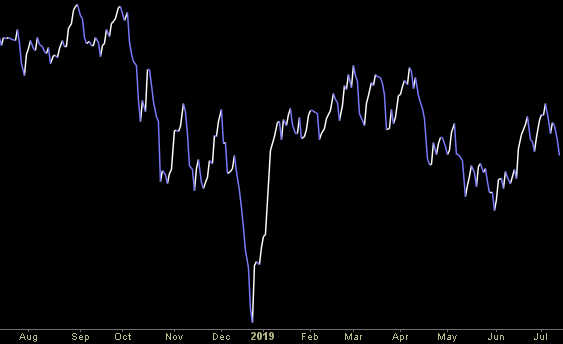

- July Macro Update: Housing Remains The Weakest Link (The Fat Pitch)

- These are the stocks Wall Street analysts believe will lead the Dow to 28,000 (CNBC)

- Fly Intel: What to watch in first round of big bank earnings reports (TheFly)

- 2019 Midyear Roundtable: Where to Find Value Now (Barron’s)

- FTC approves roughly $5B privacy settlement with Facebook (TheFly)

- Mario Gabelli on the Charms of Trucks, Farm Equipment and the Atlanta Braves (Barron’s)

- J&J earnings preview: Wall Street is still optimistic despite company’s legal issues (MarketWatch)

- The Shale Boom in the Permian Is Slowing Down (Bloomberg)

- You Can Now Buy A 2020 Camaro With A Whopping 1,000 Horsepower, But There’s A Catch (Forbes)