- Alibaba Returns to the Scene of the Crime (stockcharts)

- Alibaba Cloud’s Qwen2 with Enhanced Capabilities Tops LLM Leaderboard (alizila)

- Why the Recession Still Isn’t Here (wsj)

- Freshippo Launches Private Label at North American Supermarkets, Eyes Global Expansion (alizila)

- Hiring and Wages are Up, Reinforcing the Economy’s Resilience (wsj)

- World’s 50 best restaurants for 2024 revealed — and one NYC spot made the list (nypost)

- The Former Amazon Intern Now Running Its Profit Engine (wsj)

- Economic Data Paint a Picture of Two Americas (wsj)

- We’re Spending Billions on This Work-From-Home Indulgence (wsj)

- The Great AI Challenge: We Test Five Top Bots on Useful, Everyday Skills (wsj)

- What to Watch: The Best Movies and TV Shows From April (wsj)

- 11 Fascinating Facts You Didn’t Know About the Record-Busting Rimac Nevera (robbreport)

- Cher’s Ferrari Dino 246 Spider Is Up For Grabs (maxim)

- This Elite Anguilla Beach Resort Just Debuted A New Luxury Villa (maxim)

- Alibaba and JD see performance boost during 618 shopping festival (technode)

- Apple is reportedly ready to announce AI — in the most Apple way possible (mashable)

- How much national debt is too much? (npr)

- The First Ferrari 250 GT SWB California Spider Ever Built Is Going to Auction (roadandtrack)

- Tight money hasn’t hurt corporate profits (scottgrannis)

- Amazon Could Join the $3 Trillion Club. How It Could Happen. (barrons)

Indicator of the Day (video): Real Estate New High New Low %

Quote of the Day…

Be in the know. 5 key reads for Saturday…

- The Jobs Report Is Like a Box of Chocolates. Pick the Data You Like. (barrons)

- SL Green to start deploying $1 billion arsenal for New York real estate this year (marketwatch)

- 3M Stock Is Rising. Wall Street Sentiment Is Turning. (barrons)

- Stock Market Concentration How Much Is Too Much? (morganstanley)

- KraneShares’ Brendan Ahern on China’s Economic Landscape: Is It Still Investable? (mebfaber)

Hedge Fund Tips with Tom Hayes – VideoCast – Episode 242

Hedge Fund Tips with Tom Hayes – Podcast – Episode 242

Where is money flowing today?

Quote of the Day…

Be in the know. 13 key reads for Friday…

- Alibaba says new AI model Qwen2 bests Meta’s Llama 3 in tasks like maths and coding (scmp)

- US Payroll Gains and Unemployment Rate Both Pick Up at Same Time (bloomberg)

- China’s foreign goods trade picks up steam in first 5 months (cn)

- Economists expect realty bounce soon (cn)

- Payrolls Instant Reaction: A Schizophrenic Report (zerohedge)

- Has Lululemon Athletica Turned a Corner? Perhaps Not, Wall Street Says. (barrons)

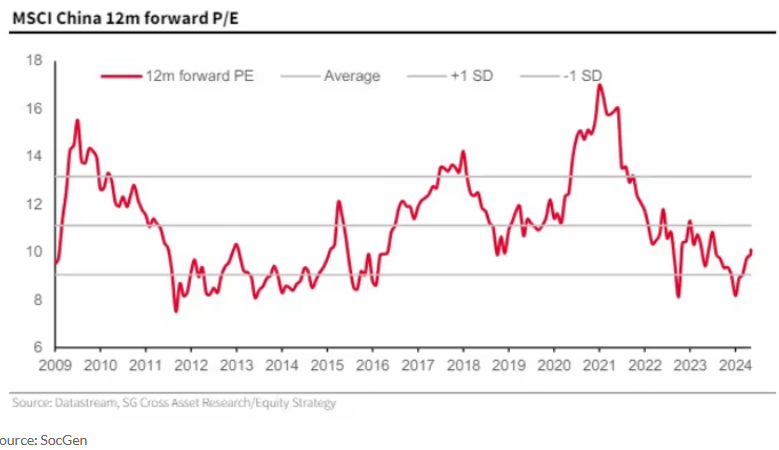

- ‘The China equity trade is back’ and here are the stocks to pick, says SocGen (marketwatch)

- A look inside a $1 billion real-estate bet on the future of San Francisco (marketwatch)

- Three stocks now account for 20% of the S&P 500’s value. That’s making some investors nervous. (marketwatch)

- Opinion: S&P 500 is now giving a ‘buy’ signal and there’s strong support for a summer rally (marketwatch)

- Too soon for small caps? This money manager is picking up bargains. (marketwatch)

- ECB Cuts Interest Rates for First Time Since 2019 (wsj)

- Big US Job Gains Is Out of Sync With Recent Weaker Economic Data (bloomberg)

Tom Hayes – Quoted in Reuters article – 6/6/2024

Thanks to Chibuike Oguh for including me in his article on Reuters today. You can find it here: