- OPEC set to extend oil supply cut as Iran endorses pact (Reuters)

- Wall St. eyes return to record highs as stocks cheer trade reprieve (Reuters)

- Stifel Has 5 Mid-Cap Energy Stocks to Buy With 100% and More Upside Potential (24/7 Wall Street)

- How Two College Dropouts Built an $860 Million Fortune by Age 23 (Bloomberg)

- The Stock Market Has Been on a Tear. History Says It’s Time to Get Greedy. (Barron’s)

Be in the know. 15 key reads for Sunday…

- China eases foreign investment curbs amid cooling trade tensions (Reuters)

- Trump crosses DMZ to meet with Kim Jong Un in North Korea (New York Post)

- The World’s 50 Best Restaurants: French ‘Mirazur’ At The Top (Forbes)

- Hedge Fund and Insider Trading News: Daniel Loeb, Ray Dalio, Lone Pine Capital, Saba Capital Management, Kingstown Capital Management, Alphabet Inc (GOOGL), AMAG Pharmaceuticals Inc. (AMAG), and a Lot More ()

- American Living (The Irrelevant Investor)

- Why a Strong Dollar Causes the World Major Pain (Podcast) (Bloomberg)

- Mark Cuban Says These 2 Words Separate Those Who Achieve From Those Who Only Dream (Inc.)

- I tried being a lumberjack and it was OK (Economist)

- The 1 Decision That Helped Yeti Move From Cult Brand to Nearly $800 Million in Revenue (Inc.)

- The Rise Of American Oil (NPR)

- Jony Ive made the entire tech world care about design (The Verge)

- How Do You Follow Up ‘Old Town Road?’ If You’re Lil Nas X, You Don’t Try (Rolling Stone)

- Wall Street was ready for the latest twist in the trade war. Here’s how experts think Trump and Xi’s trade truce will play out. (Business Insider)

- What Does Putin Really Want? (New York Times)

- Connecticut billionaire Paul Tudor Jones wants to save Africa with new nonprofit (New York Post)

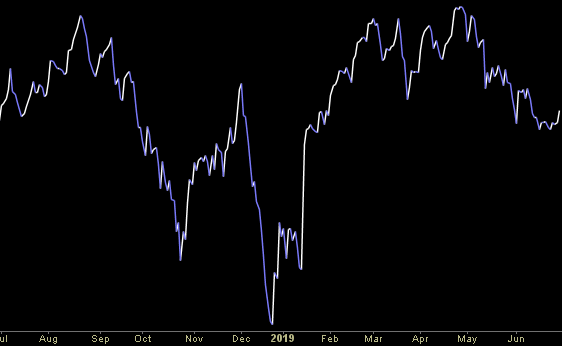

Rear View Mirror: Sideways Earnings = Sideways Price. Windshield View?

Data Source: Factset

Yogi Berra, “If you don’t know where you’re going, you might not get there.”

Not much has changed with Q2 Earnings Estimates in the past week. Factset still has them at -2.6% year on year. This low bar likely implies a slightly positive year on year outcome – similar to the beat rate of Q1. Continue reading “Rear View Mirror: Sideways Earnings = Sideways Price. Windshield View?”

Be in the know. 14 key reads for Saturday…

- The RealReal Is No Pets.com and Today’s IPO Market Is Not the Next Dot-Com Bubble (Barron’s)

- Week in review: How Trump’s policies moved stocks (TheFly)

- Carnival Stock Is Headed for Smoother Sailing (Barron’s)

- Reset of U.S.-China Talks May Boost Risk Appetite, Analysts Say (Bloomberg)

- Trump says he agreed with Xi to hold off on new tariffs and to let Huawei buy US products (CNBC)

- Putin Says Russia and Saudi Arabia Agreed to Maintain Oil Cuts for as Long as 9 Months (Bloomberg)

- Small Caps Are Lagging. Investors Should Be More Concerned When They Lead (The Fat Pitch)

- ‘Charlie’s Angels’ official trailer shows Kristen Stewart and her co-stars getting fierce (USA Today)

- Heat Wave Powers Natural Gas to Best Week Since January (Wall Street Journal)

- The Bold Plan to Reach Mars (Men’s Journal)

- 2020 Dodge Charger SRT Hellcat Widebody Is World’s ‘Fastest and Most Powerful Mass-Produced Sedan’ (Maxim)

- Lotus to Bring 8 Renowned Race Cars and Evora GT4 Concept to the Goodwood Festival of Speed (Robb Roport)

- Step Inside Maria Sharapova’s Sun-Drenched L.A. Home (Architectural Digest)

- July’s First Trading Day—Most Bullish Day, S&P 500 has Advanced 85.7% of the Time (Almanac Trader)

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 7 key reads for Friday…

- Fed Stress Tests Find Top Banks Are Strong, Setting Stage for Wave of Payouts (New York Times)

- What you need to know about Saturday’s highly anticipated Trump-Xi meeting (CNBC)

- G20 meeting may offer more clarity for OPEC, non-OPEC: Russia’s Novak (Reuters)

- Jony Ive, Designer Who Made Apple Look Like Apple, Is Leaving to Start a Firm (New York Times)

- Troubled Boeing Is Still a World-Beater (Wall Street Journal)

- Carnival Stock Is Slumping and the CEO Is Buying Up Shares (MarketWatch)

- Broadcom, FedEx, and 3 Other Stocks That Could Rise on a Huawei Deal (Barron’s)