Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 7 key reads for Tuesday…

- JPMorgan (JPM) Tops Q3 EPS by 23c, Offers Outlook (Street Insider)

- Fed’s Bullard: Risks remain high and Fed is on a ‘meeting by meeting’ basis (CNBC)

- UnitedHealth Stock Is Up After ‘Medicare for All’ Political Risk Fails to Dent Earnings (Barron’s)

- Industrial Stocks Look Bad but Some See a Return to Growth by Mid-2020 (Barron’s)

- The Biotech Sector Is Lagging. Blame Gene Therapy Stocks, Analysts Say. (Barron’s)

- European stocks nudge higher on Barnier’s Brexit optimism (MarketWatch)

- Prescription drugs boost drives J&J forecasts higher, shares rise (Reuters)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Unusual Options Activity – Dell Technologies Inc. (DELL)

Today some institution/fund purchased 2,811 contracts of Dec $57.5 strike calls (or the right to buy 281,100 shares of Dell Technologies Inc. (DELL) at $57.5). The open interest was just 750 prior to this purchase. Continue reading “Unusual Options Activity – Dell Technologies Inc. (DELL)”

Where is money flowing today?

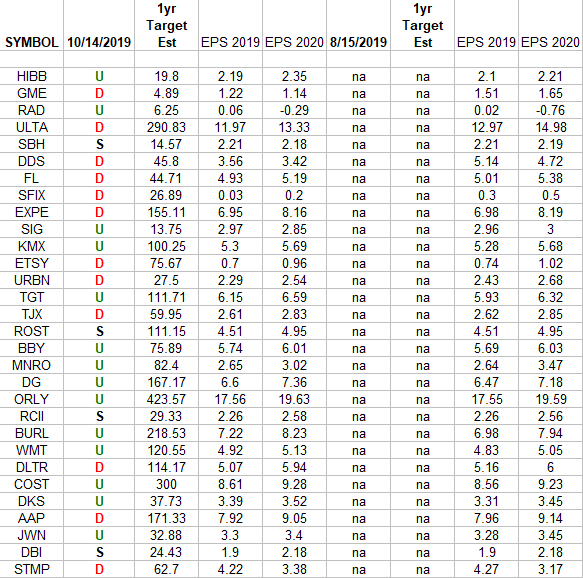

Retail Sector Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Retail Sector ETF (XRT) top 30 weighted stocks. Continue reading “Retail Sector Earnings Estimates/Revisions”

Be in the know. 8 key reads for Monday…

- The S&P 500 Earnings Outlook Is Terrible. It’s Not as Bad as It Looks. (Barron’s)

- China September exports, imports in deeper contraction as tariffs take toll (Reuters)

- Peak Shale: How U.S. Oil Output Went From Explosive to Sluggish (Yahoo! Finance)

- Private-equity deals depress worker wages, study finds (MarketWatch)

- ‘If You Ever Do That to Me Again, I’m Going to Kill You.’ (Institutional Investor)

- Blackstone Talked With Ken Griffin’s Citadel About Buying Stake (Wall Street Journal)

- Apple’s ‘key growth driver’ in 2020 will be a new $399 iPhone, top analyst says CNBC)

- Western Digital upgraded to Buy from Hold at Loop Capital (TheFly)

Be in the know. 10 key reads for Sunday…

- What The %!&# Is The Repo Market? (NPR Planet Money)

- ‘El Camino: A Breaking Bad Movie’ Review: Fan Service Firing on All Cylinders (Rolling Stone)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- The Best of Goethe’s Aphorisms (Farnam Street)

- Is Amazon Unstoppable? (New Yorker)

- How Florida Georgia Line Helped Country Music Reinvigorate Itself (GQ)

- Wells Fargo report: A.I. will cut 200,000 American bank jobs over next decade (Big Think)

- Why Governments Haven’t Learned The Lessons Of Japan (Podcast) (Bloomberg)

- Mini Trade Deal Could Be Huge Catalyst For Oil (Oil Price)

- GE and 4 More Favorite Stocks From a Fan of Disruption (Barron’s)

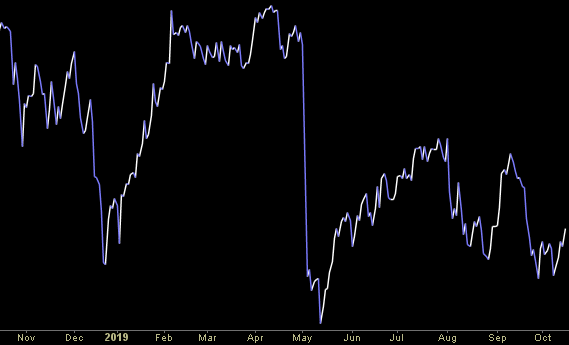

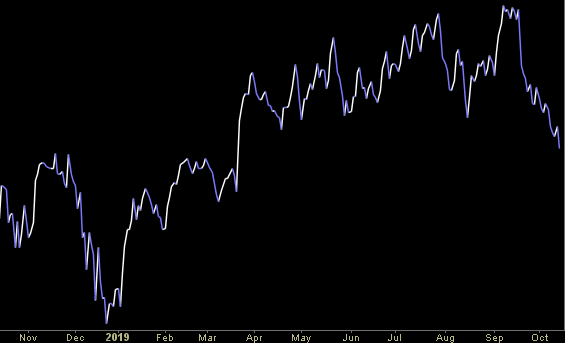

Snake OIL? How Portfolio Managers View Exploration & Production Stocks…

I was doing my normal stock, earnings and sector research over the weekend and I came across this Exploration and Production Sector chart XOP (above). The 2007-2009 financial crisis was a “once in a generation” collapse similar to 1973-1974 and prior to that the Great Depression. The implication of this sector trading at 2009 levels today – is that Oil and Gas Exploration and Production stocks are “snake oil” as defined by Dictionary.com as: a product of little real worth or value that is promoted as the solution to a problem. Continue reading “Snake OIL? How Portfolio Managers View Exploration & Production Stocks…”