- An Investment Tip From Mr. ZIP: Spot a coming trend and buy something close. No one knows exactly what’ll take off. (Wall Street Journal)

- Tepper’s Appaloosa Has Large S&P Call Option Position (Market Realist)

- GE to freeze pensions for about 20,000 employees, stock surges (MarketWatch)

- Barron’s Picks And Pans: Netflix, Raytheon, Spotify, Taiwan Semi And More (Yahoo! Finance)

- Review: The Dodge Challenger SRT Hellcat Redeye is a big, brash, intoxicating supercar (CNBC)

- Netflix has focused on India as a key area for growth. Exclusive data tells the story of its progress. (Business Insider)

- People Who Work from Home Earn $2,000 More a Year (Bloomberg)

- Goldman Says It’s Too Early to Call End to Equity Bull Market (Bloomberg)

- JPMorgan Says Euro Area to Be Key Equities Winner in Brexit Deal (Bloomberg)

- It’s ‘Too Early to Turn Cautious’ on Stocks (Barron’s)

- Fed Confronts Balance-Sheet Decisions to Curb Money-Market Volatility (Wall Street Journal)

Be in the know. 10 key reads for Sunday…

- There’s No Recession Coming. The Fed Will Make Sure of That. (Barron’s)

- ECRI Weekly Leading Index Update (Advisor Perspectives)

- How Iceland’s Tourism Bubble Deflated (NPR Planet Money)

- Externalities: Why We Can Never Do “One Thing” (Farnam Street)

- The Coming Crisis of China’s One-Party Regime (Project Syndicate)

- The Negative Effects of Chinese Financial Repression (Podcast) (Bloomberg)

- 10 Walt Disney Quotes That Could Boost Your Small Business (Entrepreneur)

- Buy Delta stock or sell it? Your time horizon is the key. (Barron’s)

- Odds Apple Buys Netflix Advance (24/7 Wall Street)

- How to Succeed in Business? Major in Liberal Arts (Bloomberg)

Be in the know. 20 key reads for Saturday…

- Charles Schwab, Lennar, Johnson & Johnson: Stocks That Defined the Week (Wall Street Journal)

- Fed Officials Signal Openness to More Easing After Jobs Report (Bloomberg)

- The 2019 S&P 500 Sector Quilt (awealthofcommonsense)

- LEAPS (focusedcompounding)

- Stephen Schwarzman Hung Out a Shingle. Then He Waited (Institutional Investor)

- Google in talks to acquire TikTok rival Firework (New York Post)

- The Fed Will Give the Market What It Wants. Again (Bloomberg)

- Powell Says Economy Faces Some Risks But Still in Good Place (Bloomberg)

- JPMorgan, BlackRock Say Investors Too Cautious on Repeat of 2008 (Bloomberg)

- Banksy’s ‘Devolved Parliament’ painting showing monkeys in House of Commons sold for $12 million (Luxuo)

- I spent the day with a New Jersey commuter who rides a Jet Ski to work, and it changed the way I think about my week (Business Insider)

- The Fed says it will continue overnight repos of at least $75 billion through November 4 (Business Insider)

- Shipping Fuel Is About to Get Cleaner. What It Means for Investors. (Barron’s)

- A GE Stock Bear Trashed the Aviation Unit. Here’s Why Investors Shouldn’t Worry. (Barron’s)

- Banks Expected to Get Break on Postcrisis Rules (Wall Street Journal)

- Opportunity Zones Aren’t a Program—They’re a Market (Fortune)

- Hedge Fund and Insider Trading News: Glenn Dubin, Tiger Global Management, Arrowgrass Capital Partners, Darsana Capital Partners, Apple Inc. (AAPL), PROS Holdings, Inc. (PRO), and More (Insider Monkey)

- Top 20 Best Warren Buffett Quotes On Money, Life And Success (ValueWalk)

- Zuckerberg misunderstands the huge threat of TikTok (TechCrunch)

- The Cheating Scandal Rocking the Poker World (The Ringer)

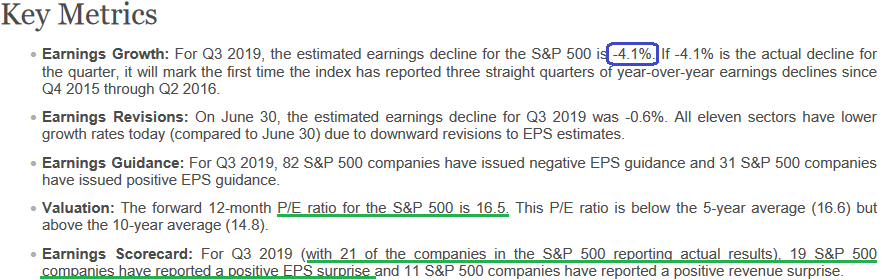

Earnings Estimates Update: Johnny Nash Style…

Data Source: FactSet

Everyone knows the classic song by Johnny Nash, “I Can See Clearly Now”

I can see clearly now the rain is gone

I can see all obstacles in my way

Gone are the dark clouds that had me blind

It’s gonna be a bright (bright)

Bright (bright) sunshiny day

It’s gonna be a bright (bright)

Bright (bright) sunshiny day

I can see all obstacles in my way

Gone are the dark clouds that had me blind

It’s gonna be a bright (bright)

Bright (bright) sunshiny day

It’s gonna be a bright (bright)

Bright (bright) sunshiny day

Continue reading “Earnings Estimates Update: Johnny Nash Style…”

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Unusual Options Activity – Wells Fargo & Company (WFC)

Today some institution/fund purchased 5,002 contracts of June $57.5 strike calls (or the right to buy 500,200 shares of Wells Fargo & Company (WFC) at $57.5). The open interest was 2,815 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”

Where is money flowing today?

Be in the know. 10 key reads for Friday…

- U.S. adds 136,000 jobs in September, unemployment rate hits 50-year low (MarketWatch)

- The Dow Could Rebound in ‘a Matter of Days.’ One Way to Play the Comeback (Barron’s)

- Apple to Increase iPhone 11 Output by Up to 10%, Nikkei Reports (Bloomberg)

- Alphabet (GOOGL) PT Raised to ‘Street High’ $1,600 at Deutsche Bank; ‘Bullish on Google Cloud’ (Street Insider)

- ‘Sahm Rule’ enters Fed lexicon as fast, real-time recession flag (Reuters)

- Eddie Murphy says ‘Dolemite Is My Name’ (and Obama’s urging) spurred his return to stand-up (USA Today)

- The McRib is returning to McDonald’s menus at more than 10,000 locations across America (Business Insider)

- Soybean Futures Bounce Back After China Restarts Purchases (Wall Street Journal)

- The EU signaled it won’t retaliate after Trump said he’d slap Europe with $7.5 billion in tariffs (Business Insider)

- Ray Dalio: ‘I’m going to go quiet in about a year’ (Yahoo! Finance)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Unusual Options Activity – Wells Fargo & Company (WFC)

Today some institution/fund purchased 2,736 contracts of March $50 strike calls (or the right to buy 273,600 shares of Wells Fargo & Company (WFC) at $50). The open interest was 1,741 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”