Be in the know. 10 key reads for Wednesday…

- Stock-market investors ‘should play offense,’ ignore manufacturing weakness, says Canaccord’s Dwyer (MarketWatch)

- PM Johnson calls for EU to embrace compromise with Britain’s new proposal (Reuters)

- Ray Dalio says U.S. may go for ‘bigger moves’ than limiting capital flows to China (MarketWatch)

- Lennar tops forecasts as builder reports 13% profit rise (MarketWatch)

- Baird Has 3 Top Biotech Picks With Huge Upcoming Potential Catalysts (24/7 Wall Street)

- Stocks Had a Rough Start to the Fourth Quarter. But It May Not Mean Much. (Barron’s)

- Facebook stock is way up this year. How to win from its next big move. (Barron’s)

- Schwab Cuts Fees on Online Stock Trades to Zero, Rattling Rivals (Wall Street Journal)

- Meat Strikes Back as Diet Wars Rage On (Wall Street Journal)

- The Japanese Stock Market Is Cheap if You’re Cheerful (Wall Street Journal)

Unusual Options Activity – Freeport-McMoRan Inc. (FCX)

Today some institution/fund purchased 27,138 contracts of Dec $11 strike calls (or the right to buy 2,713,800 shares of Freeport-McMoRan Inc. (FCX) at $11). The open interest was just 1,760 prior to this purchase. Continue reading “Unusual Options Activity – Freeport-McMoRan Inc. (FCX)”

Where is money flowing today?

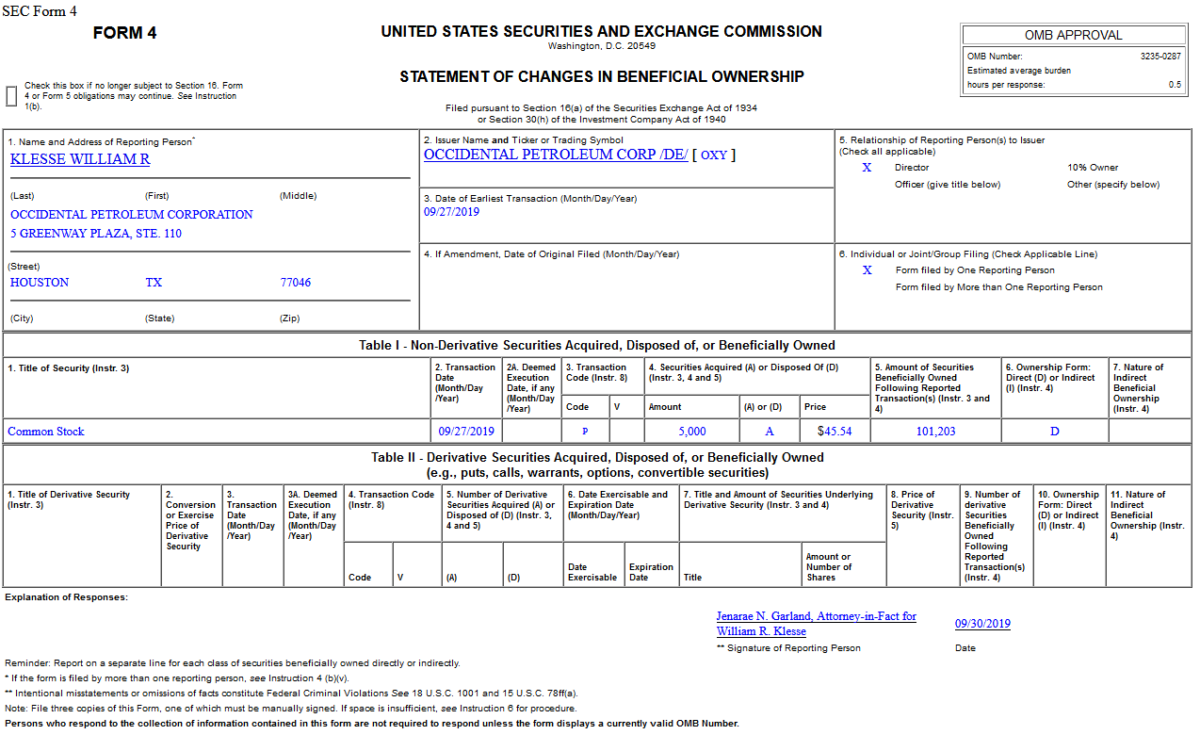

Insider Buying in Occidental Petroleum Corporation (OXY)

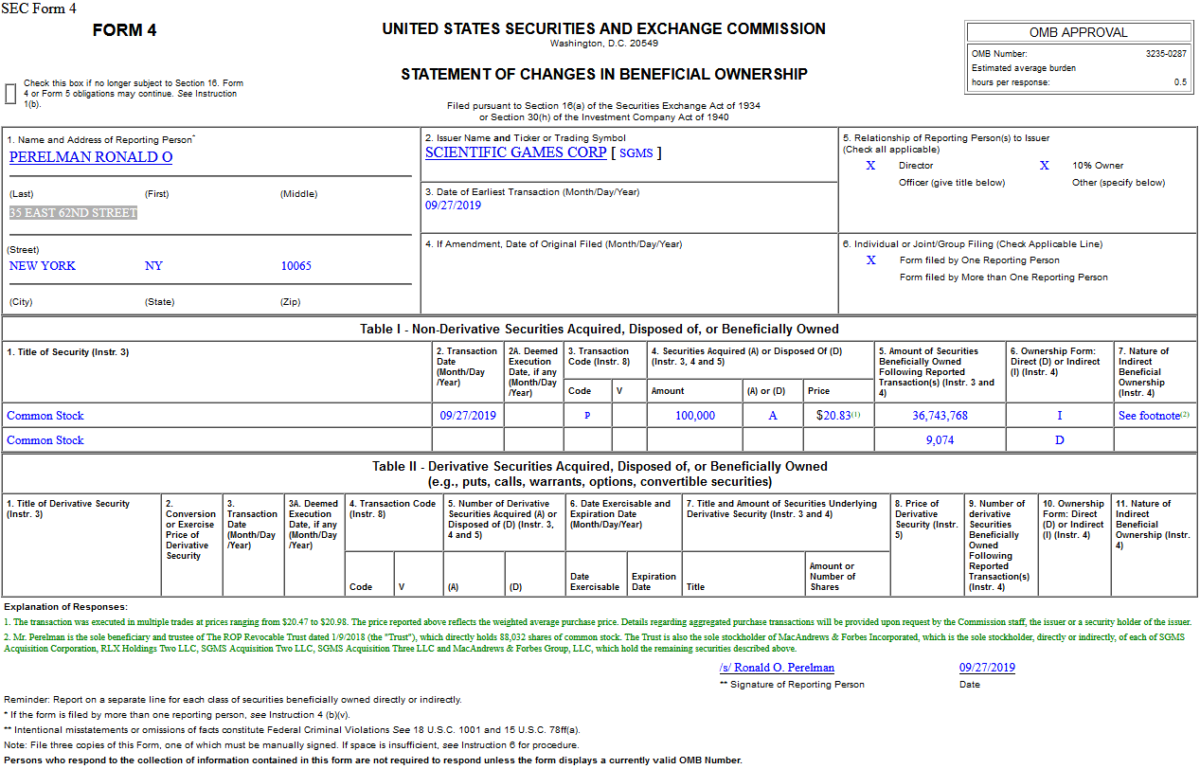

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 5 key reads for Tuesday…

- Stocks Are a Winner in the Fourth Quarter. It’s Time to Buy. (Barron’s)

- Occidental closes $3.9B deal, reveals how much it’s divested since acquiring Anadarko (BizJournals)

- Aramco Steps Up Investor Push With Plans for $75 Billion Yearly Dividend (Wall Street Journal)

- Jeffrey Gundlach: How Trump Will Avoid A Recession To Win Reelection (ZeroHedge)

- U.S. State Department says U.S., North Korean officials plan to meet within week (Reuters)

Unusual Options Activity – Square, Inc. (SQ)

Today some institution/fund purchased 2,295 contracts of June 2020 $90 strike calls (or the right to buy 229,500 shares of Square, Inc. (SQ) at $90). The open interest was just 163 prior to this purchase. Continue reading “Unusual Options Activity – Square, Inc. (SQ)”