Data Source: Finviz

Hedge Fund Trade Tip (PIN) – Position Idea Notification

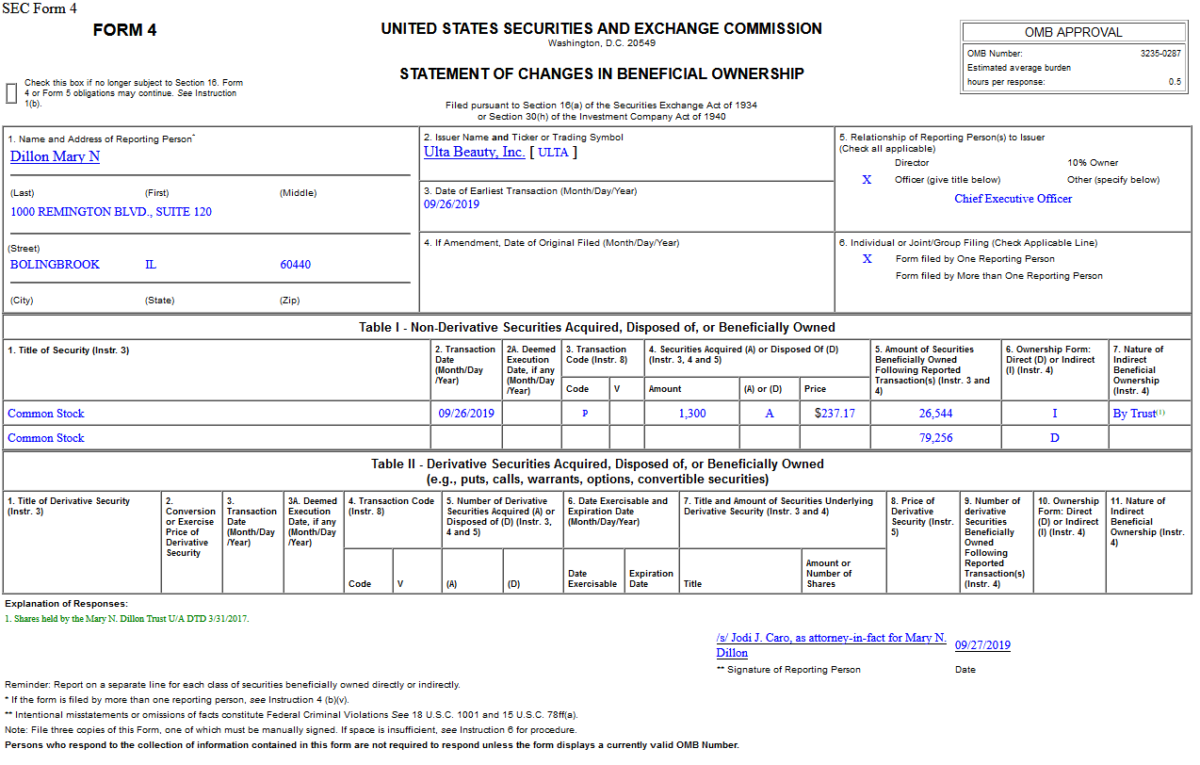

Insider Buying in Ulta Beauty, Inc. (ULTA)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 12 key reads for Friday…

- Wells Fargo names BNY Mellon’s Charles Scharf as CEO (Reuters)

- Baird Says US Banks Still Have Big Value: 4 to Buy Now (24/7 Wall Street)

- What Exxon Mobil and Chevron Could Buy Next, According to Morgan Stanley (Barron’s)

- China trade talks are set to resume on October 10 (CNBC)

- Wall Street Democratic donors warn the party: We’ll sit out, or back Trump, if you nominate Elizabeth Warren (CNBC)

- Hedge Funds Struggle to Replicate Warren Buffett’s Reinsurance Success (Bloomberg)

- Las Vegas Sands (LVS) will replace Nektar Therapeutics (NKTR) in S&P 500 (StreetInsider)

- China’s top diplomat says Beijing willing to buy more U.S. products (Reuters)

- New Kinder Morgan pipeline frees natgas long-trapped in Permian (Yahoo! Finance)

- These three stocks are overlooked and undervalued, says Greenwich Wealth (MarketWatch)

- LNG Buyers Fret Over Feast-or-Famine Forecasts (Wall Street Journal)

- Oil drops after Iran’s president said US offered to remove all sanctions in exchange for talks (CNBC)

Unusual Options Activity – UnitedHealth Group Incorporated (UNH)

Today some institution/fund purchased 637 contracts of May $240 strike calls (or the right to buy 63,700 shares of UnitedHealth Group Incorporated (UNH) at $240). The open interest was just 299 prior to this purchase. Continue reading “Unusual Options Activity – UnitedHealth Group Incorporated (UNH)”