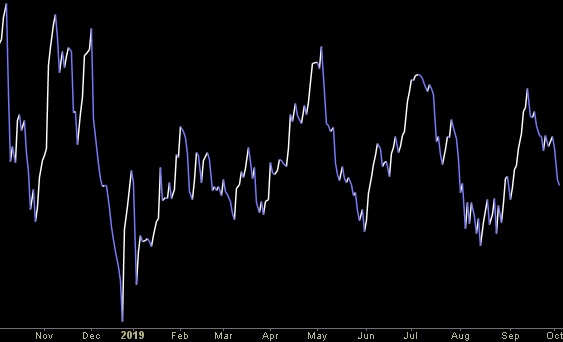

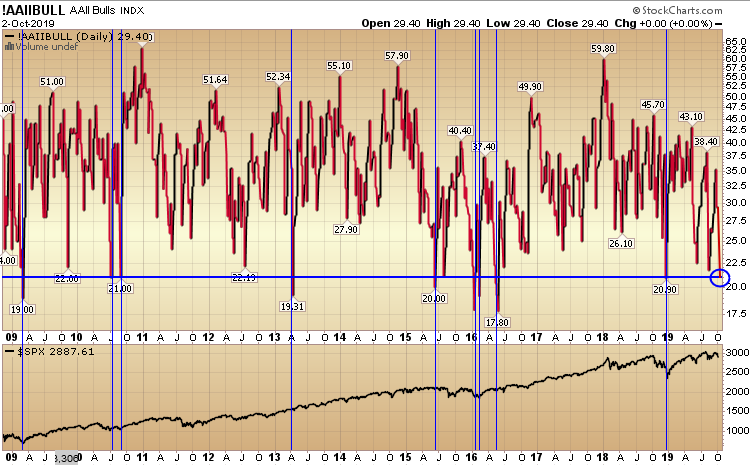

AAII Sentiment Survey: Hurts So Good…

In April 1982, John Cougar Mellencamp released a song entitled, “Hurts So Good.” I was never a huge fan of the song, but in thinking about what to write today, his lyrics came to me: Continue reading “AAII Sentiment Survey: Hurts So Good…”

Be in the know. 11 key reads for Thursday…

- The bull market for stocks may be old, but it’s not dead yet, say Citi strategists (MarketWatch)

- Texture, Flavor, Funk! Six Rules for Building a Better Cheese Board (Bloomberg)

- Microsoft Looks to Rewrite History on Its Phone Business (Bloomberg)

- Here’s why a Houston businessman is betting millions on the Astros winning the World Series (MarketWatch)

- The Curious Case of the Terrible Manufacturing Number (Barron’s)

- Chinese Stocks Are Tumbling. Here’s Why Alibaba and Others Will Bounce Back. (Barron’s)

- Everything Is Private Equity Now (Bloomberg)

- Chicago Fed’s Evans says he’s worried about inflation outlook, open minded on more rate cuts (MarketWatch)

- GE’s Larry Culp Talks About His First Drama-Filled Year as CEO (MarketWatch)

- Slumping Data May Force Powell to Move to Third Cut (Bloomberg)

- A Secretive Committee of Wall Street Insiders Is the Least of the New York Fed’s Concerns. (Institutional Investor)

Unusual Options Activity – Cisco Systems, Inc. (CSCO)

Today some institution/fund purchased 1,147 contracts of March $42.5 strike calls (or the right to buy 114,700 shares of Cisco Systems, Inc. (CSCO) at $42.5). The open interest was just 139 prior to this purchase. Continue reading “Unusual Options Activity – Cisco Systems, Inc. (CSCO)”

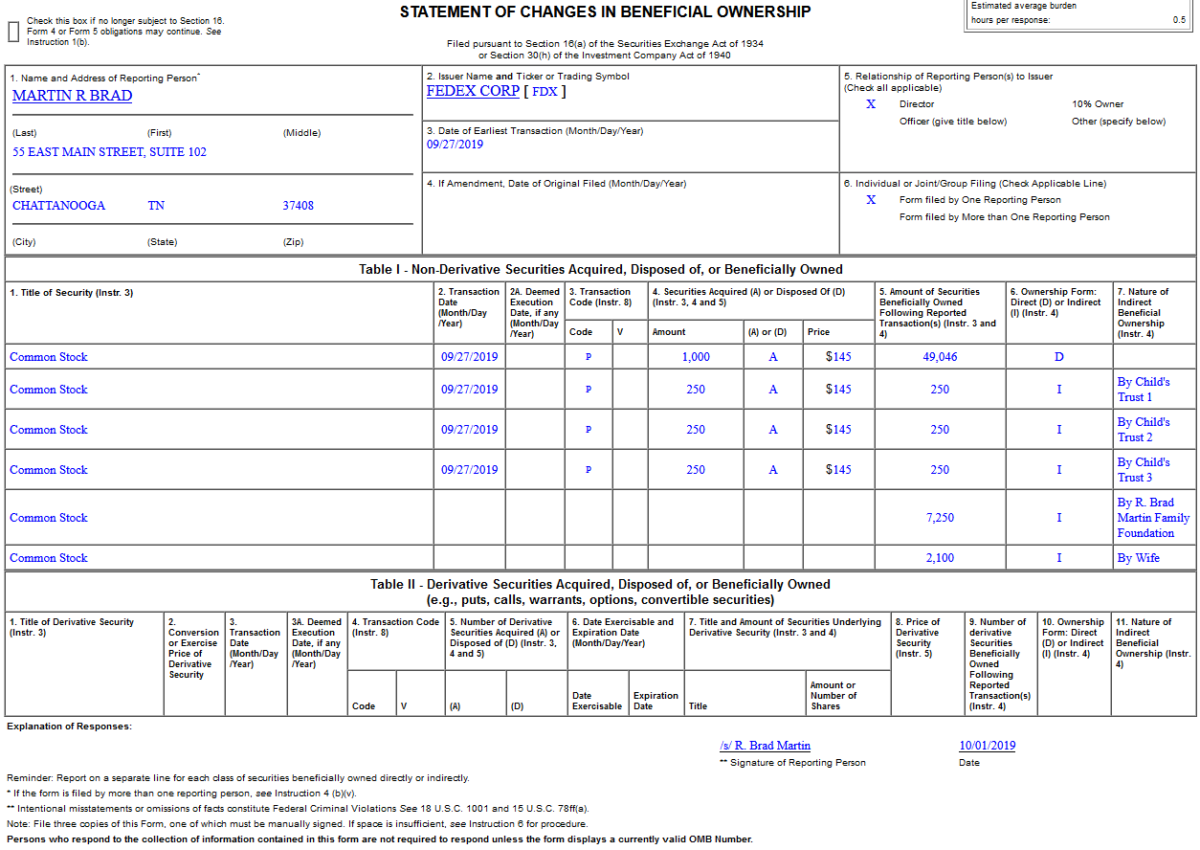

Insider Buying in FedEx Corporation (FDX)

Where is money flowing today?

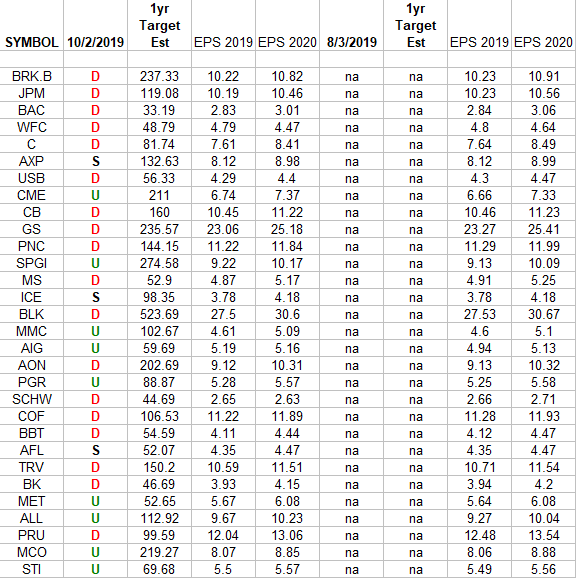

Financials (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Financials Sector ETF (XLF) top 30 weighted stocks. Continue reading “Financials (top 30 weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Wednesday…

- Stock-market investors ‘should play offense,’ ignore manufacturing weakness, says Canaccord’s Dwyer (MarketWatch)

- PM Johnson calls for EU to embrace compromise with Britain’s new proposal (Reuters)

- Ray Dalio says U.S. may go for ‘bigger moves’ than limiting capital flows to China (MarketWatch)

- Lennar tops forecasts as builder reports 13% profit rise (MarketWatch)

- Baird Has 3 Top Biotech Picks With Huge Upcoming Potential Catalysts (24/7 Wall Street)

- Stocks Had a Rough Start to the Fourth Quarter. But It May Not Mean Much. (Barron’s)

- Facebook stock is way up this year. How to win from its next big move. (Barron’s)

- Schwab Cuts Fees on Online Stock Trades to Zero, Rattling Rivals (Wall Street Journal)

- Meat Strikes Back as Diet Wars Rage On (Wall Street Journal)

- The Japanese Stock Market Is Cheap if You’re Cheerful (Wall Street Journal)

Unusual Options Activity – Freeport-McMoRan Inc. (FCX)

Today some institution/fund purchased 27,138 contracts of Dec $11 strike calls (or the right to buy 2,713,800 shares of Freeport-McMoRan Inc. (FCX) at $11). The open interest was just 1,760 prior to this purchase. Continue reading “Unusual Options Activity – Freeport-McMoRan Inc. (FCX)”