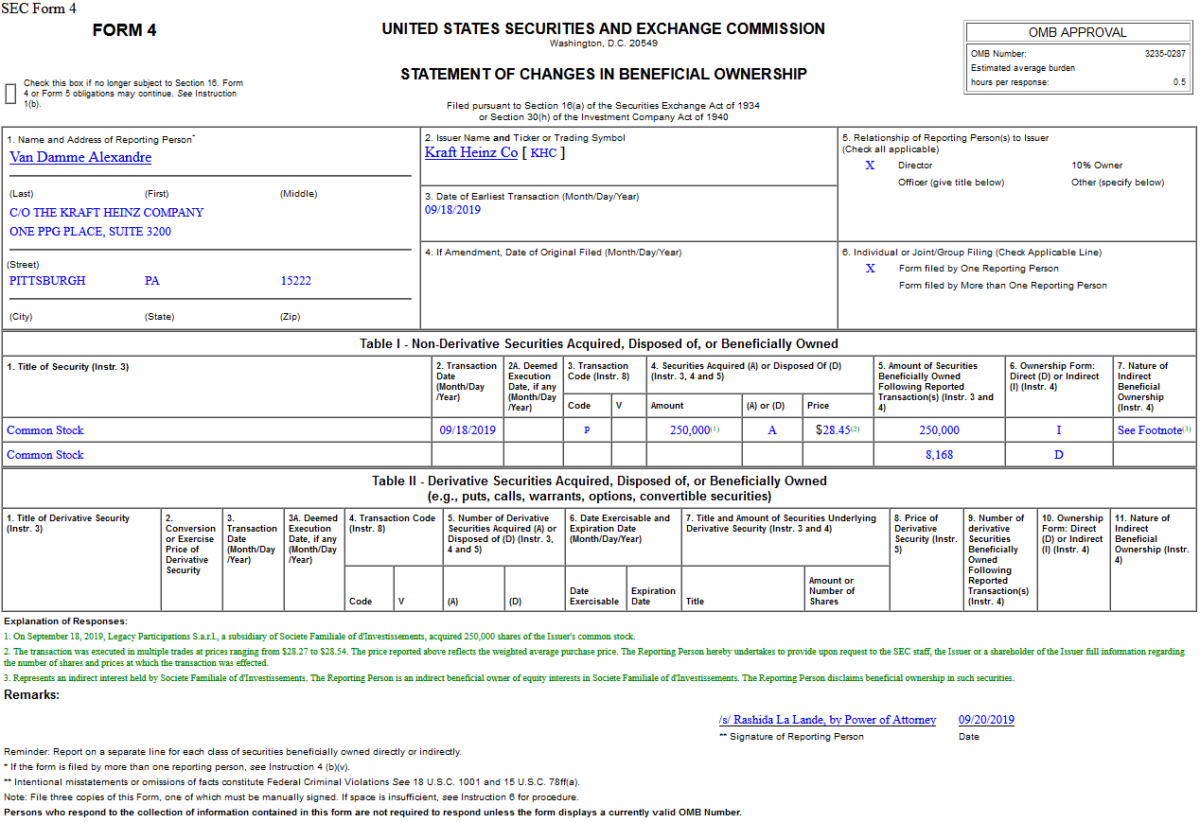

Last week we reported that Jorge Lemann – Brazilian Billionaire – bought ~$100,000,000 of shares in The Kraft Heinz Company (KHC): Continue reading “Another Billionaire Buying Millions of Ketchup”

Where is money flowing today?

Hedge Fund Trade Tip (PIN) – Position Idea Notification

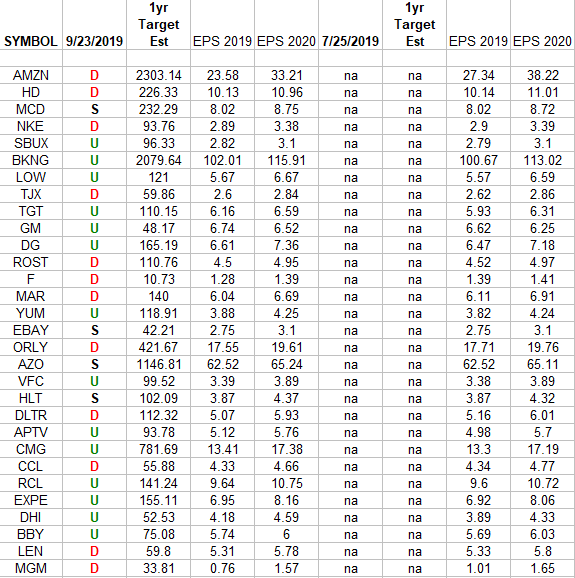

Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Consumer Discretionary Sector ETF (XLY) top 30 weighted stocks. The column under the date 9/23/2019 has a letter that represents the movement Continue reading “Consumer Discretionary (top 30 weights) Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 5 key reads for Monday…

- An Obscure Post Office Fight Has High Stakes for UPS, Amazon, and Holiday Shoppers (Barron’s)

- ‘Money Honey’ Maria Bartiromo on Trump, AI and the future of work (USA Today)

- Chinese Trade Delegation Called Off Farm Visits at U.S. Request (Bloomberg)

- Arthur Cashin, wise to the ways of Wall Street (Washington Post)

- U.K. companies for sale — at a 13% discount (MarketWatch)

Be in the know. 17 key reads for Sunday…

- The weight of evidence is on the side of the ECB’s doves (Financial Times)

- How DJ Khaled Overcame His Fear Of Flying And Earned $67 Million In Two Years (Forbes)

- Watch Brad Pitt and Jimmy Fallon Hilariously One-Up Each Other With Wild Orders (Men’s Journal)

- Sarah Ketterer Discusses Investment Management (Podcast) (Bloomberg)

- Blackstone CEO Steve Schwarzman Says Recession Is ‘Unlikely Now’ (Fortune)

- New land rover defender makes its long-awaited debut (designboom)

- ECRI Weekly Leading Index Update (AdvisorPerspectives)

- Episode 940: Interest Rates… Why So Negative? (NPR)

- Why Netflix’s Founding CEO Always Carries a Notebook (Inc.)

- Google Says It’s Achieved Quantum Supremacy, a World-First: Report (Gizmodo)

- Stitch Fix: Katrina Lake How I Built This with Guy Raz (NPR)

- A Kelley Blue Book for Hospitals? He’s Got a Fix for Surprise Bills (Ozy)

- The Rolling Stone Interview Taylor Swift (Rolling Stone)

- Don’t Stop Believin’, Part 2 – E&Ps Boosting Production Despite Sharp Cuts to Capital Spending (RB Energy)

- The Power 100 2019 (Worth)

- Will Ferrell, Ryan Reynolds to Star in Musical Reimagining of ‘A Christmas Carol’ (Exclusive) (Hollywood Reporter)

- Stocks will soar 17% through next year, market bull Ed Yardeni predicts (CNBC)

Be in the know. 15 key reads for Saturday…

- Hedge Fund and Insider Trading News: T. Boone Pickens, Carl Icahn, Glen Kacher, Camber Capital Management, Elliott Management, Abbvie Inc. (ABBV), Fidelity National Financial Inc (FNF), and More (Insider Monkey)

- Fed officials are studying whether market plumbing issues contributed to a spike in short-term lending rates this week. (Wall Street Journal)

- Paranoia Written All Over S&P 500 in Struggle to Get Back to Record Bloomberg)

- Meet Goldman Sachs’ top quant, Bankers in Portland, Alt data may not be a gold mine (Business Insider)

- The Pentagon will deploy U.S. forces to the Middle East on the heels of the attack on Saudi Arabian oil facilities (CNBC)

- After the Fed’s Second Rate Cut, Hints of Another to Come (New York Times)

- Week in Review: How Trump’s policies moved stocks (TheFly)

- The Stocks Jim Chanos and Leon Cooperman Are Buying — And Shorting (Institutional Investor)

- Why Value Investing Works (Safal Niveshak)

- Why We Love to Call Everything a Bubble (Bloomberg)

- The Evolutionary Benefit of Friendship (Farnam Street)

- How to invest like Warren Buffett (CNBC)

- A World Without Fossil Fuels Is Approaching. But You Might Not Live Long Enough to See It. (Barron’s)

- McLaren GT: Introducing the World’s Most Civilized Supercar (Wall Street Journal)

- How Lil Nas X Inspired a New Cowboy-Hat Craze (Wall Street Journal)

Hedge Fund Trade Tip (PCN) – Position Completion Notification

3 Quarters of Negative Earnings. Bad News?

Data Source: Factset

Factset, “The estimated (year-over-year) earnings decline for Q3 2019 is -3.8%, which is below the 5-year average earnings growth rate of 7.3%. If -3.8% is the actual decline for the quarter, it will mark the first time the index has reported three straight quarters of year-over-year declines in earnings since Q4 2015 through Q2 2016. It will also mark the largest year-over-year decline in earnings reported by the index since Q1 2016 (-6.9%).” Continue reading “3 Quarters of Negative Earnings. Bad News?”