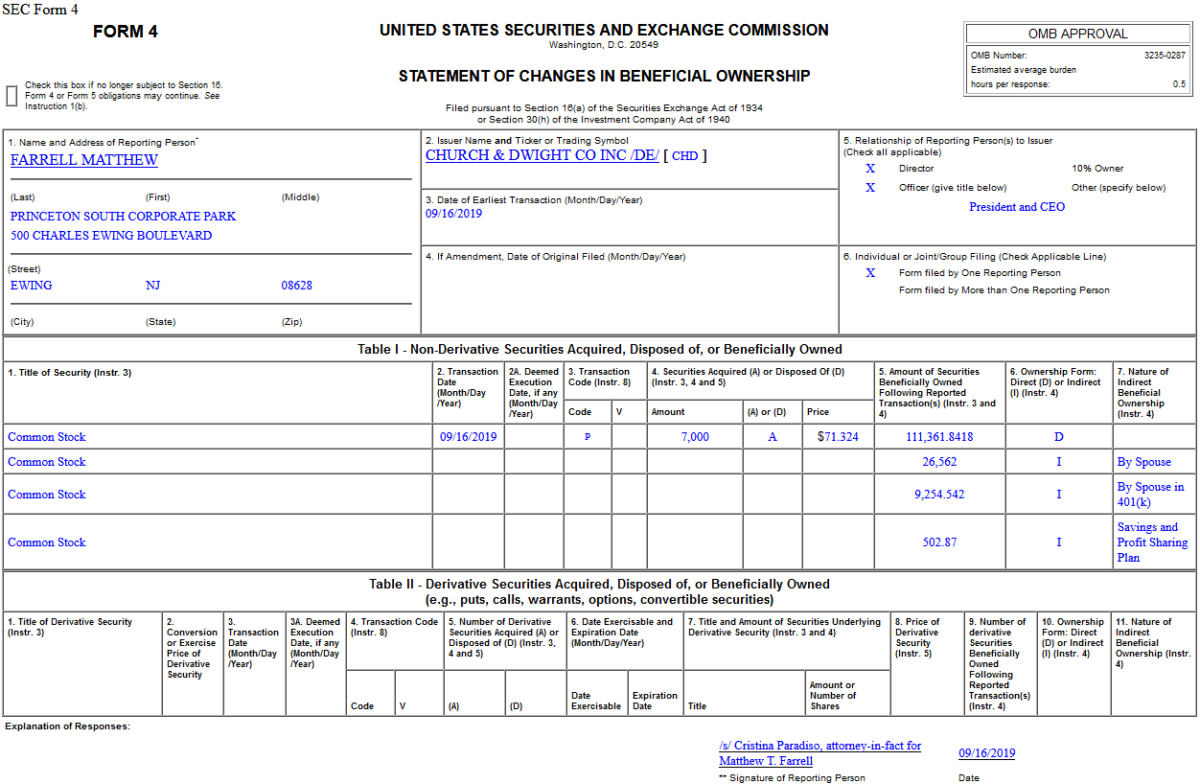

On Sept 16, 2019, Matthew Farrell – President and CEO of Church & Dwight Co., Inc. (CHD) – purchased 7,000 shares of CHD at $71.32. His out of pocket cost was $499,268.

Where is money flowing today?

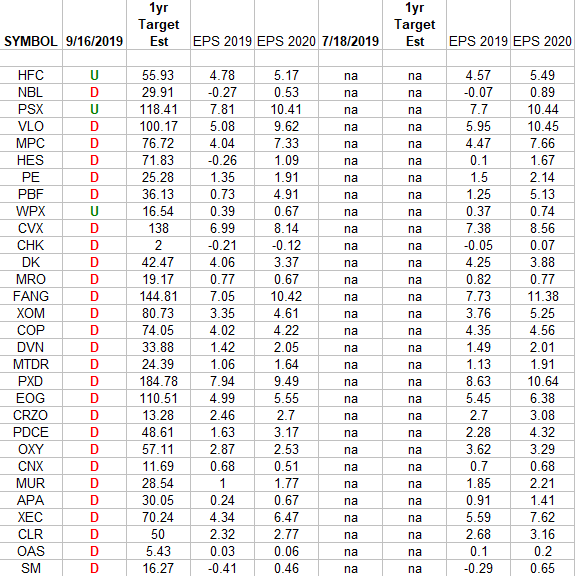

Exploration & Production Sector (XOP) – Earnings Estimates/Revisions

In the spreadsheet above I have tracked the earnings estimates for the Exploration & Production Sector (XOP). I have columns for what the 2019 and 2020 estimates were: 7/18/2019 and today. Continue reading “Exploration & Production Sector (XOP) – Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 5 key reads for Monday…

- Oil Spike, Auto Strike Won’t Derail U.S. Economy (Barron’s)

- Chicago School Professor Fights ‘Chicago School’ Beliefs That Abet Big Tech (New York Times)

- British Prime Minister Boris Johnson is set to explore a Brexit deal with the President of the European Commission Jean-Claude Juncker over lunch of snails and salmon. (Business Insider)

- The 2019 McLaren 720S Spider is a $315,000 supercar with mind-bending performance (CNBC)

- Strong U.S. Dollar Prompts Speculation of Trump Intervention (Wall Street Journal)

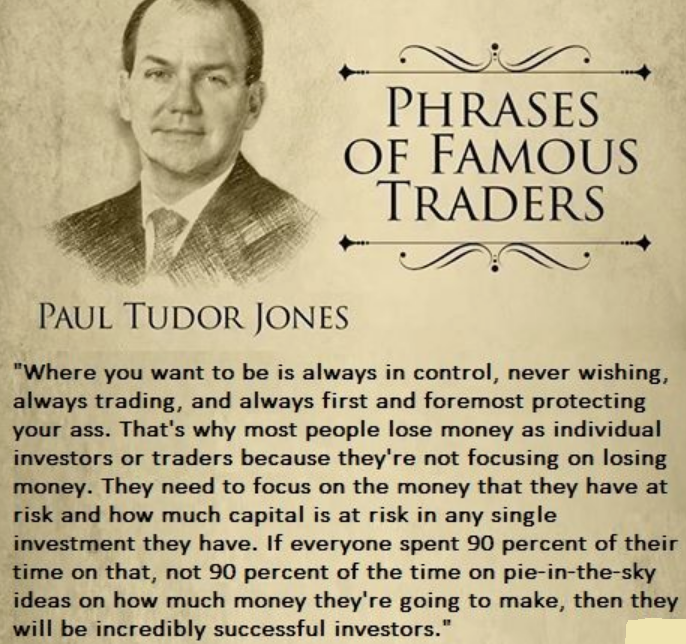

Quote of the Day…

Be in the know. 12 key reads for Sunday…

- Global spare oil capacity in U.S. hands after Saudi outage (Reuters)

- Uber and Lyft say they don’t plan to reclassify their drivers as employees (Vox)

- The Debt That Never Dies: China’s Imperial Bonds (NPR Planet Money)

- VIDEO: Short Selling Stocks Was Invented As Revenge (NPR Planet Money)

- The Third Democratic Debate In 7 Charts (FiveThirtyEight)

- This Guy Grew Up Knowing 2 Things: Hard Work and Hockey. Now He’s Combined Them Into a Hugely Successful Business (Inc.)

- The Co-Founder of Shareholder Activism Is Dead, but His Cause Is Thriving (Cheif Investment Officer)

- Coach Parent Tapestry Could See a Turnaround (Barron’s)

- Saudi Oil Attack: This Is the Big One (Wall Street Journal)

- Surge in Treasury Yields Highlights Easing Economic Worries (Wall Street Journal)

- Stephen Schwarzman’s Lifelong Audacity (Wall Street Journal)

- U.K. Steps Up Efforts Toward a Brexit Deal, Pushing Pound Higher (Wall Street Journal)

Be in the know. 12 key reads for Saturday…

- Souring Bets on Apocalypse Were at Center of Quant Stock Storm (Bloomberg)

- Ken Burns — A Master Filmmaker on Creative Process, the Long Game, and the Noumenal (#386) (Tim Ferriss Show)

- The Faulty Metric at the Center of Private Equity’s Value Proposition (Institutional Investor)

- The Power of Questions (Farnam Street)

- The Great Rotation Continues (Quantifiable Edges)

- Citigroup’s Stock Bear Acquiesces With S&P 500 on Cusp of Record (Bloomberg)

- Billionaire Ken Fisher Wants to Knock Out Wall Street (Bloomberg)

- Value Finally Replaces Growth. But Will This Hate Rotation Last? (Barron’s)

- LEGO Unveils 2,573-Piece Model of New Land Rover Defender (Maxim)

- These Are the Next Wave of Ultra-Luxury Electric Cars Entering the Market—and They Don’t Disappoint (Architectural Digest)

- S&P 500 up 13 of last 16 September option expiration weeks (Almanac Trader)

- Kara Swisher Discusses the Tech Industry (Podcast) (Bloomberg)

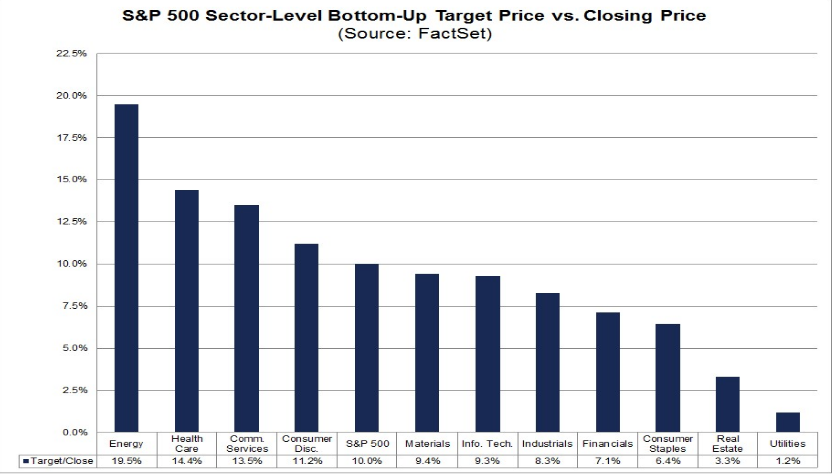

2020 Earnings Estimates Remain at Double Digit Growth

Data Source: Factset

For 2020, analysts are projecting S&P 500 earnings growth of 10.6% and revenue growth of 5.6%. The question is what sectors will lead, and how far are they trading from their bottom-up price targets? Continue reading “2020 Earnings Estimates Remain at Double Digit Growth”