- Hedge Fund and Insider Trading News: T. Boone Pickens, Carl Icahn, Glen Kacher, Camber Capital Management, Elliott Management, Abbvie Inc. (ABBV), Fidelity National Financial Inc (FNF), and More (Insider Monkey)

- Fed officials are studying whether market plumbing issues contributed to a spike in short-term lending rates this week. (Wall Street Journal)

- Paranoia Written All Over S&P 500 in Struggle to Get Back to Record Bloomberg)

- Meet Goldman Sachs’ top quant, Bankers in Portland, Alt data may not be a gold mine (Business Insider)

- The Pentagon will deploy U.S. forces to the Middle East on the heels of the attack on Saudi Arabian oil facilities (CNBC)

- After the Fed’s Second Rate Cut, Hints of Another to Come (New York Times)

- Week in Review: How Trump’s policies moved stocks (TheFly)

- The Stocks Jim Chanos and Leon Cooperman Are Buying — And Shorting (Institutional Investor)

- Why Value Investing Works (Safal Niveshak)

- Why We Love to Call Everything a Bubble (Bloomberg)

- The Evolutionary Benefit of Friendship (Farnam Street)

- How to invest like Warren Buffett (CNBC)

- A World Without Fossil Fuels Is Approaching. But You Might Not Live Long Enough to See It. (Barron’s)

- McLaren GT: Introducing the World’s Most Civilized Supercar (Wall Street Journal)

- How Lil Nas X Inspired a New Cowboy-Hat Craze (Wall Street Journal)

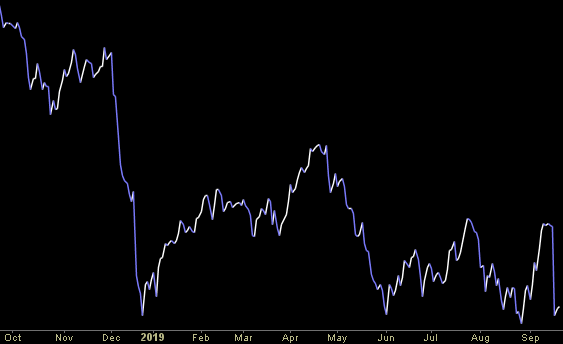

Hedge Fund Trade Tip (PCN) – Position Completion Notification

3 Quarters of Negative Earnings. Bad News?

Data Source: Factset

Factset, “The estimated (year-over-year) earnings decline for Q3 2019 is -3.8%, which is below the 5-year average earnings growth rate of 7.3%. If -3.8% is the actual decline for the quarter, it will mark the first time the index has reported three straight quarters of year-over-year declines in earnings since Q4 2015 through Q2 2016. It will also mark the largest year-over-year decline in earnings reported by the index since Q1 2016 (-6.9%).” Continue reading “3 Quarters of Negative Earnings. Bad News?”

Unusual Options Activity – Wells Fargo & Company (WFC)

Today some institution/fund purchased 1,626 contracts of March $52.5 strike calls (or the right to buy 162,600 shares of Wells Fargo & Company (WFC) at $52.5). The open interest was just 601 prior to this purchase. Continue reading “Unusual Options Activity – Wells Fargo & Company (WFC)”

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 12 key reads for Friday…

- Fed’s Bullard on his rate cut dissent: US manufacturing appears to be ‘in recession’ (CNBC)

- Larry Ellison on Uber, Tesla, AI, and More (Barron’s)

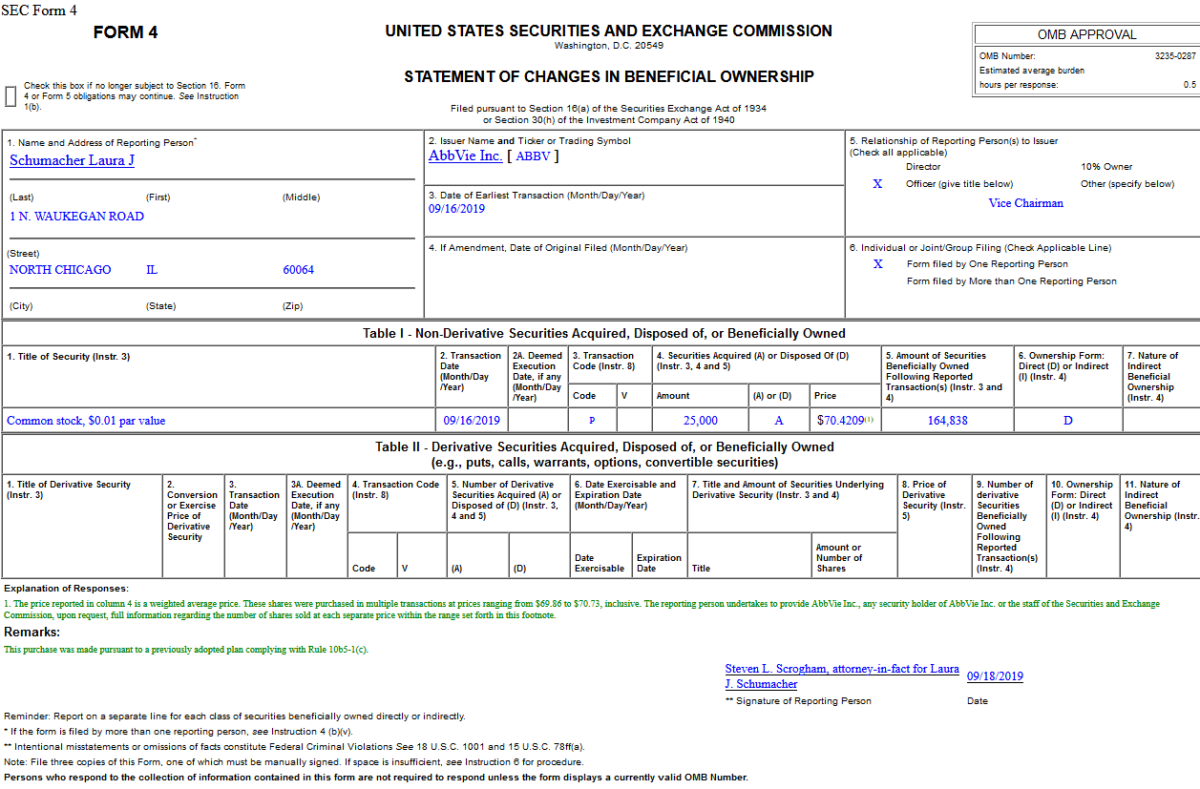

- AbbVie Stock Is Falling Because Investors Hate the Allergan Deal. The Vice Chairman Bought Up Shares. (Barron’s)

- China cuts new loan rate for second month but struggling economy likely needs more (Reuters)

- Activist investor Peltz says GE CEO Culp is doing a good job (Yahoo! Finance)

- U.S. bankers seize on repo-market stress to push for softer liquidity rules (Reuters)

- Light Street’s Glen Kacher: ‘Multiples Should be Higher’ (Institutional Investor)

- Jim Grant, “Nobody’s going to be right all the time. Our job was to make people stop and think.” (Institutional Investor)

- Netflix chief says ‘The Crown’ will look a bargain after streaming explosion (Reuters)

- Hold That Recession: U.S. Indicators Are Trouncing Forecasts (Bloomberg)

- Fed Will Weigh Resuming Balance Sheet Growth at October Meeting (Wall Street Journal)

- Tesla’s Model 3 earns insurance industry’s top safety rating (New York Post)

Unusual Options Activity – Capri Holdings Limited (CPRI)

Today some institution/fund purchased 10,735 contracts of Feb. 2020 $37.5 strike calls (or the right to buy 1,073,500 shares of Capri Holdings Limited (CPRI) at $37.5). The open interest was just 175 prior to this purchase. Continue reading “Unusual Options Activity – Capri Holdings Limited (CPRI)”