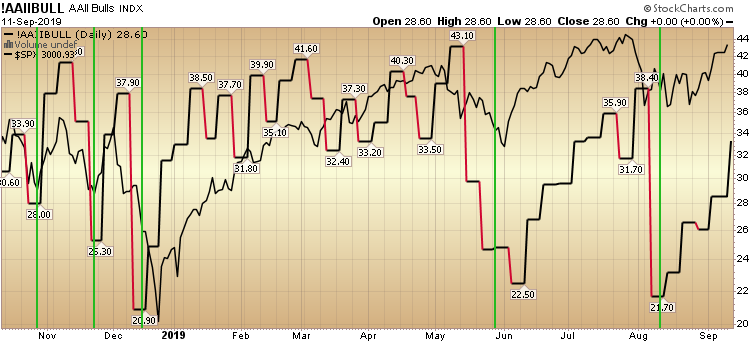

Over the past few weeks we have suggested stepping in as a buyer when everyone else was selling stocks and running into bonds. Continue reading “AAII Sentiment Survey Results: Bulls Awakening from Siesta…”

Unusual Options Activity – Gilead Sciences, Inc. (GILD)

Today some institution/fund purchased 540 contracts of January 2020 $40 strike calls (or the right to buy 54,000 shares of Gilead Sciences, Inc. (GILD) at $40). The open interest was just 128 prior to this purchase. Continue reading “Unusual Options Activity – Gilead Sciences, Inc. (GILD)”

Where is money flowing today?

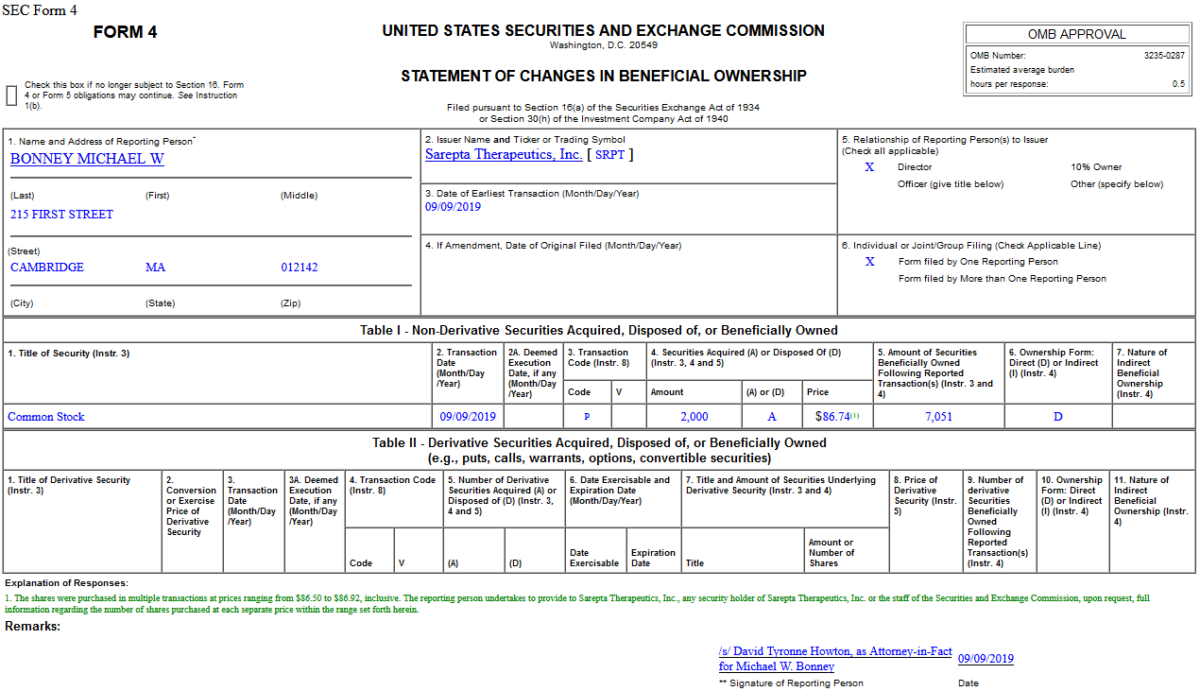

Insider Buying in Sarepta Therapeutics, Inc. (SRPT)

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 10 key reads for Wednesday…

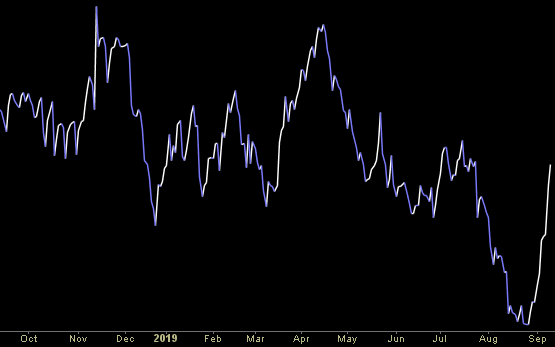

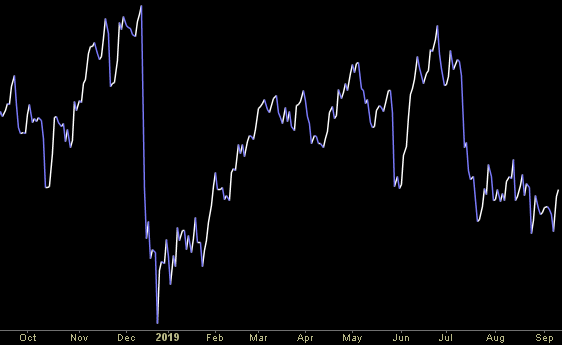

- Biotech EPS UP 8.58%, Price DOWN 9.52% (Hedge Fund Tips)

- Shift into value stocks could fuel a solid rally, says J.P. Morgan (MarketWatch)

- Never Mind Yield Curves. What’s Negative Convexity? (Bloomberg)

- The Frankfurt Auto Show’s Heaviest-Hitting Debuts ()

- Trump calls for zero, negative interest rates to refinance debt (Reuters)

- The economic numbers are continuing to defy the recession hype (CNBC)

- Oil prices gain after U.S. inventories fall (StreetInsider)

- Deere’s Largest Investor, Bill Gates, Bought Up More Stock (Barron’s)

- A Giant Bet Against Natural Gas Is Blowing Up (Wall Street Journal)

- Buy DuPont Stock Because It Could Break Up Again, Citigroup Says (Barron’s)

Unusual Options Activity – Autodesk, Inc. (ADSK)

Today some institution/fund purchased 503 contracts of April 2020 $150 strike calls (or the right to buy 50,300 shares of Autodesk, Inc. (ADSK) at $150). The open interest was 311 prior to this purchase. Continue reading “Unusual Options Activity – Autodesk, Inc. (ADSK)”