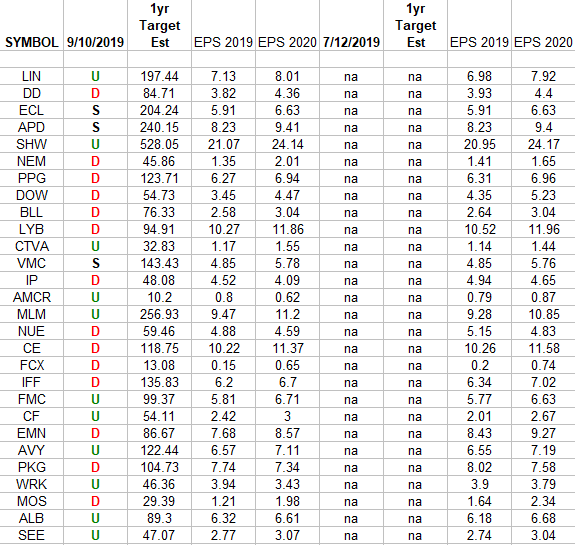

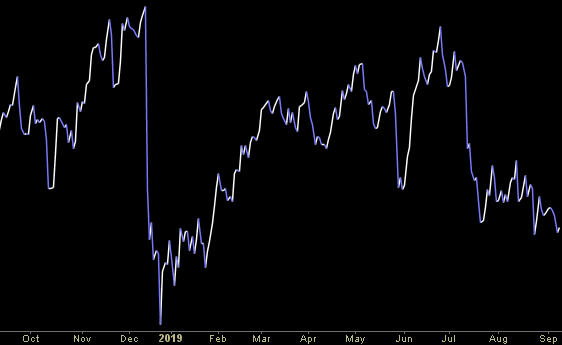

In the spreadsheet above I have tracked the earnings estimates for the Basic Materials Sector ETF (XLB). I have columns for what the 2019 and 2020 estimates were: 7/12/2019 and today 9/10/2019. The column under the date Continue reading “Basic Materials Sector (XLB) – Earnings Estimates/Revisions”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Be in the know. 10 key reads for Tuesday…

- Global growth may soar and investors aren’t ready, says Morgan Stanley (MarketWatch)

- Boris Johnson to Work for Brexit Deal After Losing Six Key Votes (Bloomberg)

- He Paid $1.50 an Acre for Barren Texas Land Now Worth $7 Billion (Bloomberg)

- State Street stock has crumbled. The CEO scooped up shares. (Barron’s)

- Land Rover unveils the all new Defender at Frankfurt Motor Show after 22-year hiatus in US (CNBC)

- Exclusive: Waning confidence over global recovery may nudge BOJ closer to easing – sources (Reuters)

- What Kraft Heinz Can Learn From General Electric’s Quick Actions (Barron’s)

- Hedge Funds Getting Burned as Growth Stocks Trounced by Value (Bloomberg)

- ‘Big Short’ investor Steve Eisman says Trump ‘basically has to give in’ to end the US-China trade war (Business Insider)

- Fracking Buzzwords Evolve, From ‘Ramp Up’ to ‘Capital Discipline’ (Wall Street Journal)

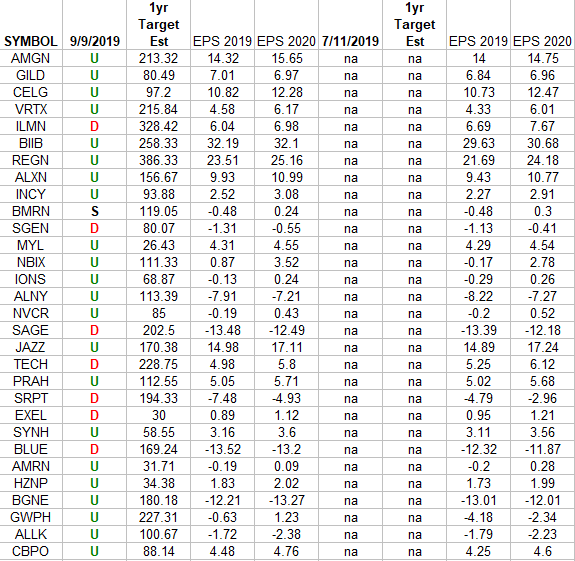

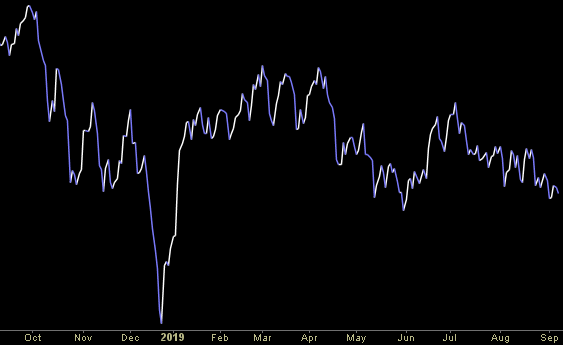

Biotech EPS UP 8.58%, Price DOWN 9.52% (in last 2 months)

In the spreadsheet above I have tracked the earnings estimates for the Nasdaq Biotech ETF (IBB) top 30 weighted stocks. The column under the date 9/9/2019 has a letter that represents the movement in 2019 earnings Continue reading “Biotech EPS UP 8.58%, Price DOWN 9.52% (in last 2 months)”

Hedge Fund Trade Tip (PIN) – Position Idea Notification

Unusual Options Activity – The Williams Companies, Inc. (WMB)

Today some institution/fund purchased 744 contracts of Jan 2020 $28 strike calls (or the right to buy 74,400 shares of The Williams Companies, Inc. (WMB) at $28). The open interest was just 226 prior to this purchase. Continue reading “Unusual Options Activity – The Williams Companies, Inc. (WMB)”