- Global spare oil capacity in U.S. hands after Saudi outage (Reuters)

- Uber and Lyft say they don’t plan to reclassify their drivers as employees (Vox)

- The Debt That Never Dies: China’s Imperial Bonds (NPR Planet Money)

- VIDEO: Short Selling Stocks Was Invented As Revenge (NPR Planet Money)

- The Third Democratic Debate In 7 Charts (FiveThirtyEight)

- This Guy Grew Up Knowing 2 Things: Hard Work and Hockey. Now He’s Combined Them Into a Hugely Successful Business (Inc.)

- The Co-Founder of Shareholder Activism Is Dead, but His Cause Is Thriving (Cheif Investment Officer)

- Coach Parent Tapestry Could See a Turnaround (Barron’s)

- Saudi Oil Attack: This Is the Big One (Wall Street Journal)

- Surge in Treasury Yields Highlights Easing Economic Worries (Wall Street Journal)

- Stephen Schwarzman’s Lifelong Audacity (Wall Street Journal)

- U.K. Steps Up Efforts Toward a Brexit Deal, Pushing Pound Higher (Wall Street Journal)

Be in the know. 12 key reads for Saturday…

- Souring Bets on Apocalypse Were at Center of Quant Stock Storm (Bloomberg)

- Ken Burns — A Master Filmmaker on Creative Process, the Long Game, and the Noumenal (#386) (Tim Ferriss Show)

- The Faulty Metric at the Center of Private Equity’s Value Proposition (Institutional Investor)

- The Power of Questions (Farnam Street)

- The Great Rotation Continues (Quantifiable Edges)

- Citigroup’s Stock Bear Acquiesces With S&P 500 on Cusp of Record (Bloomberg)

- Billionaire Ken Fisher Wants to Knock Out Wall Street (Bloomberg)

- Value Finally Replaces Growth. But Will This Hate Rotation Last? (Barron’s)

- LEGO Unveils 2,573-Piece Model of New Land Rover Defender (Maxim)

- These Are the Next Wave of Ultra-Luxury Electric Cars Entering the Market—and They Don’t Disappoint (Architectural Digest)

- S&P 500 up 13 of last 16 September option expiration weeks (Almanac Trader)

- Kara Swisher Discusses the Tech Industry (Podcast) (Bloomberg)

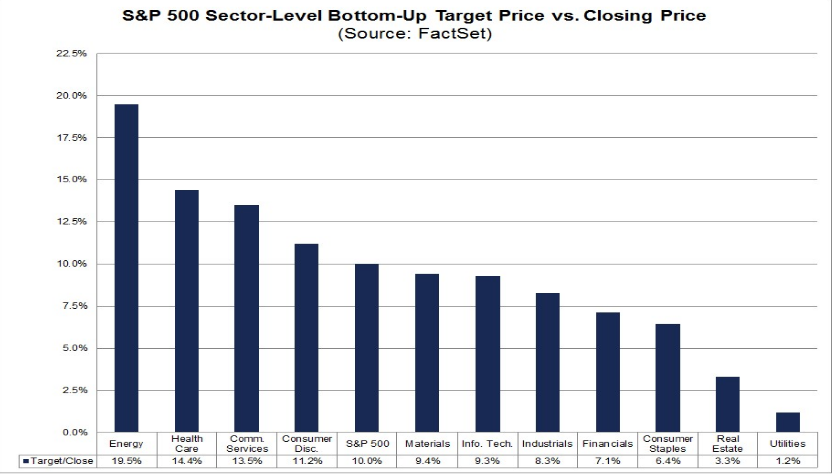

2020 Earnings Estimates Remain at Double Digit Growth

Data Source: Factset

For 2020, analysts are projecting S&P 500 earnings growth of 10.6% and revenue growth of 5.6%. The question is what sectors will lead, and how far are they trading from their bottom-up price targets? Continue reading “2020 Earnings Estimates Remain at Double Digit Growth”

Where is money flowing today?

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Hedge Fund Trade Tip (PCN) – Position Completion Notification

Be in the know. 8 key reads for Friday…

- Euro surges as investors see ECB done with stimulus (StreetInsider)

- China adds US agricultural products to tariff exemptions ahead of trade talks (CNBC)

- Trump says he would consider an interim trade deal with China (CNBC)

- Transformative? New Device Harvests Energy in Darkness (New York Times)

- America’s Billionaire Playgrounds: Rockets, Ranches and Rivers (Bloomberg)

- Shares, bond yields perch at six-week highs (Reuters)

- Pound climbs to nearly two-month high on Brexit report (MarketWatch)

- Old Navy Plans to Open 800 More Stores (Wall Street Journal)

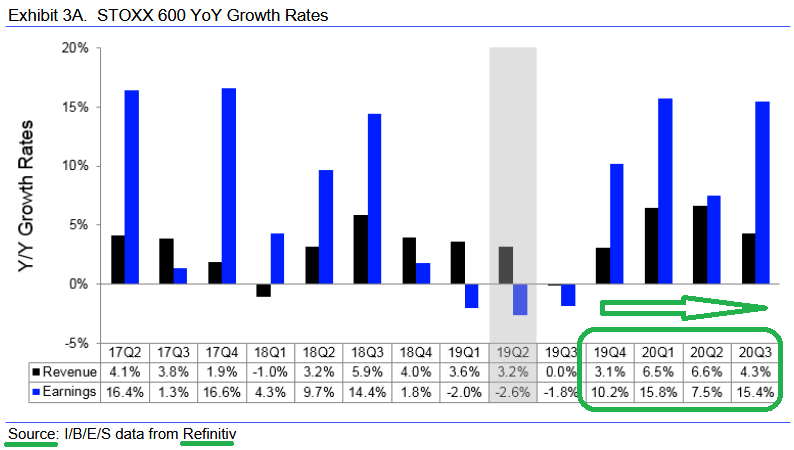

European Earnings Looking for Double Digit Growth…

So the bad news is European (Stoxx 600) earnings estimates came in modestly in the past week. The good news is, they are still holding at double digit growth moving forward: Q4 2019 +10.2%, Q1 2020 +15.8%, Q2 2020 +7.5%, and Q3 2020 +15.4%. Continue reading “European Earnings Looking for Double Digit Growth…”

Unusual Options Activity – BioMarin Pharmaceutical Inc. (BMRN)

Today some institution/fund purchased 679 contracts of Jan 2020 $80 strike calls (or the right to buy 67,900 shares of BioMarin Pharmaceutical Inc. (BMRN) at $80). The open interest was just 137 prior to this purchase. Continue reading “Unusual Options Activity – BioMarin Pharmaceutical Inc. (BMRN)”